Turtle Beach Corp (NASDAQ:HEAR) shares rallied more than 1000% in the last three months alone. The higher than expected financial numbers for the first quarter provided support to Turtle Beach’s share price. Analysts’ optimism in its future fundamentals has been adding to its share price momentum over the last couple of months.

Wedbush has issued an ‘Outperform’ rating for Turtle Beach, saying: “Fortnite exposes a large audience to multi-player games, which is greatly enhanced by communication and directional audio cues. This should benefit Turtle Beach for years to come.”

Simultaneously, Oppenheimer (NYSE:OPY) expressed confidence in the company’s balance sheet and increasing market share.

Financial Numbers Optimized Traders’ Confidence

Turtle Beach has generated year-over-year revenue growth of 185% in the first quarter and its gross margin has more than doubled from the previous year. It also reported a positive net income of $2 million compared to the loss of $9.9 million at this time last year. The company says higher market share and increasing volume helped in achieving record financial numbers in the first quarter.

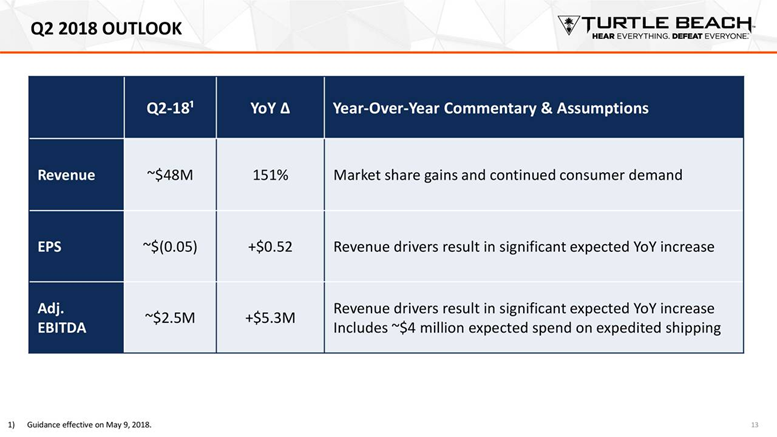

Source: Earnings Presentation

Turtle Beach expects to extend the momentum into the following quarters of this year.

Compared to last year, the company expects to generate revenue growth in the range of 151% in the second quarter and around 37% for the full year. Turtle Beach Corp says, “We believe 2018 is off to a very strong start and better positions us to make selective growth investments and further reduce our debt over time.”

>> Turtle Beach Corp. Shares Skyrocket After Record Q1 Results

Turtle Beach Corp Valuations are Attractive

Although its share price rallied sharply in the last two months, its valuations are trading below the industry average. Turtle Beach shares are trading around 1.56 times to sales compared to the industry average of 2.10 times to sales. The forward price to earnings ratio of 22 also indicates positive momentum in the days to come.

Featured Image: twitter