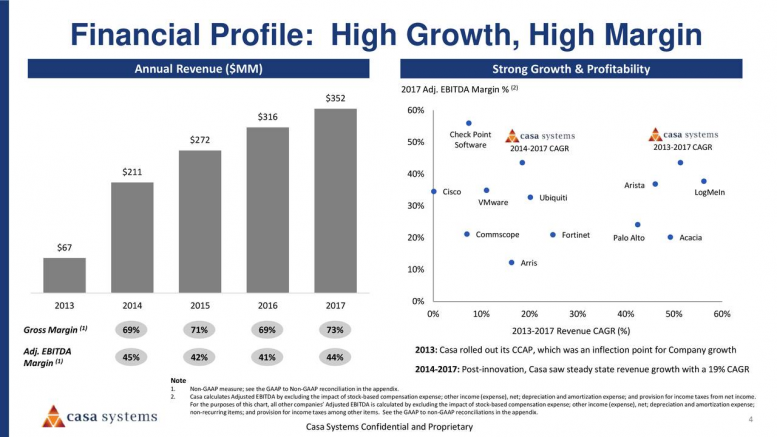

Casa Systems, Inc. (NASDAQ:CASA) is one of the rapidly growing small-cap companies in the tech industry; the company indicates 20% annual CAGR growth through to 2021.

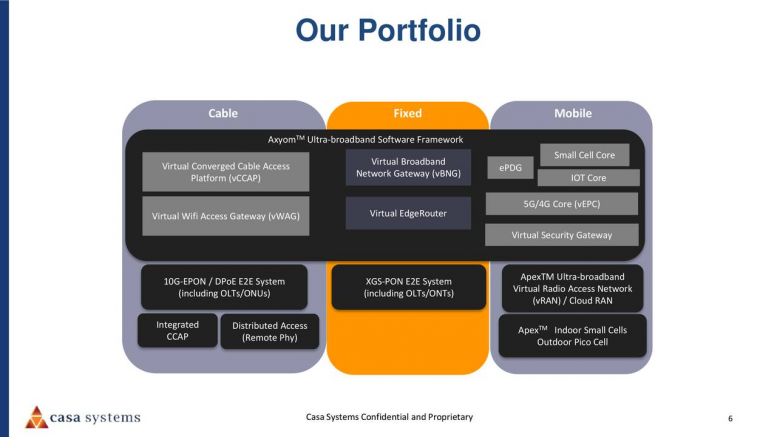

Casa Systems’ business model of providing converged broadband infrastructure technology solutions for cable, mobile, and fixed networks has been generating substantial revenue and earnings growth. The company’s business strategy of targeting high growth, high margin markets are adding to its financial numbers.

Its revenue jumped from $63 million in 2013 to $352 million in fiscal 2017, thanks to their industry-leading solutions, products, and services.

The company generated a year-over-year revenue growth of 22.5% in the first quarter of this year. In addition to substantial revenue growth, Casa Systems has also been generating a robust increase in margins and earnings per share. Its adjusted EBITDA of $29.5 million grew 11.6% compared to the first quarter of 2017.

Gary Hall, Casa’s CFO says, “Our results are driven by the deployment of industry-leading solutions by our customers as they provide additional bandwidth and services to their subscribers. We continue to deliver revenue growth and profitability while continuing to invest in our business.”

The company continues to entice its customers with innovative product launches. Its DOCSIS 3.1 deployments blew up with its MSO customers. Deployments of its small cell solutions have also commenced with mobile customers, and trials for 5G/4G continue to gain momentum with potential mobile customers. The company also expects positive results for its newly launched Virtual Broadband Network Gateway.

>> CLPS Global Expansion: Shares Making Big Moves

Casa Systems Outlook is Rosy

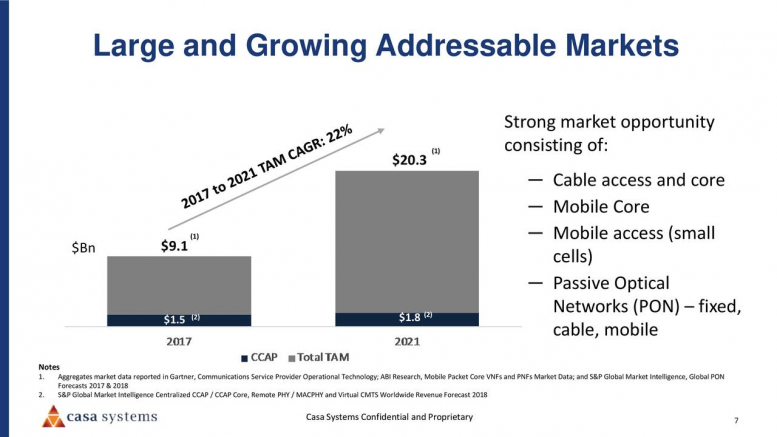

Casa Systems expects its full-year revenue to stand in the range of $395 million compared to its revenue of $353 million last year.

The forecast for the following years also appears rosy. The company expects to generate more than 20% growth through to 2021 – as its total available market is likely to grow at a robust pace in the following years. On the whole, Casa Systems appear to be in a stable position to boost its share price.

Featured Image: Facebook