It’s time to gain exposure to the skyrocketing cryptocurrency market as a tidal wave of curious individual and institutional investors alike pour into this booming asset class.

Riot Blockchain

RIOT

, now one of the world’s largest public bitcoin miners following its recent acquisition of Whinestone US, is positioned to provide us with the rare and exciting opportunity to profit off the resurging crypto market’s already prolific rally.

Bitcoin

BTC

has rallied north of 50% since the beginning October, notching a fresh all-time high at $69,000 a coin, remaining buoyantly above $60K today. Over $2 trillion in value has being added to this nearly $3 trillion market in 2021 as deep-pocketed institutional investors begin to deploy capital into this ambiguous asset class. The opportunity cost of not being a part of this rapidly appreciating digital currencies is just too great not to have some exposure.

RIOT, which is closely tied to the performance of bitcoin, had initially overshot the crypto rally in the first month and a half of the year as momentum chasing traders such as the (self-proclaimed) “degenerates” on r/WallStreetBets (WSB) drove this leading miner’s shares far above their intrinsic value. RIOT surged as much as 385% at the beginning of 2021, but its momentum-driven valuation bubble has since deflated. The stock is now trading over 50% below its highs to the value opportunity we see today.

At the beginning of the year, euphoric purchases of short-term call options drove RIOT’s moonshot price action, pushing it further out of institutional investors’ scope of investible assets, and giving it the WSB seal of overvaluation. RIOT has fallen so far out of favor with the markets as of late that it has come down to a P/E of less than 20x despite analysts estimating an over 60% increase in 2022 profits (following a 400% earnings jump this year) and a growth outlook that continues to accerlate. This is a highly discounted blockchain innovator that can’t be ignored amid this crypto explosion.

With bitcoin’s ripping rallying staying alive coupled with Riot Blockchain’s continuous operational enhancements as its scales, analysts are getting increasingly bullish on RIOT, inflating EPS estimates across all timelines and propelling the stock into a Zacks Rank #1 (Strong Buy).

All 5 of the covering sell-side analysts call RIOT a strong buy today, with an average price target of $52 a share, with some more bullish analysts giving it targets north of $80 (over 100% upside from here).

The Catalysts

US cryptocurrency miners were given one the greatest gift they could have asked for when China and Xi’s increasingly autocratic regime announced a reinforced ban on crypto mining earlier this year.

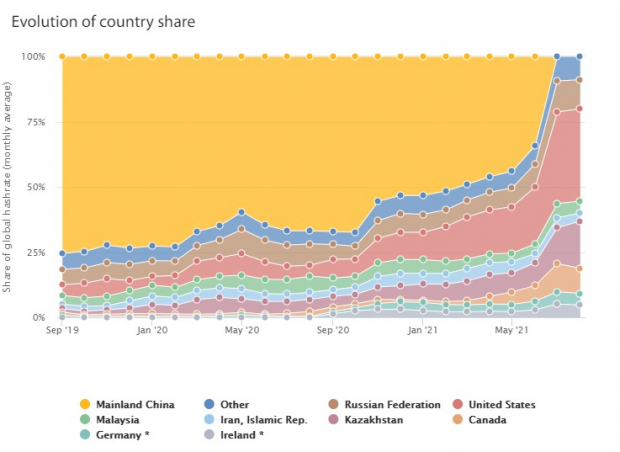

12 months ago, China controlled roughly 70% of the global bitcoin mining market, which is measured using hash rates. Hash rates are the speed at which cryptocurrencies are mined (attained through machine-based problem solving) and represent a measurement of computing power & efficiency (performance) of both individual & total market operations.

The strict crypto mining banned in Asia’s largest economy created a massive market hole, which US miners like Riot Blockchain quickly filled. The US is now the leading bitcoin miner by hash rate, controlling over 35% of this market, according to Cambridge Bitcoin Electricity Consumption Index (CBECI). Below is a graphic from the CBECI breaking down the monthly bitcoin mining market share by country.

Image Source: University of Cambridge

Link:

https://ccaf.io/cbeci/mining_map

Riot blockchain currently controls over 6% of the US’s highly fragmented bitcoin mining market and is taking more share on a seemingly daily basis. This blockchain innovator’s hash rate has more than quadrupled in the past year. Riot’s savvy management team is projecting its hash rate will reach 4.4 EH/s (doubling its rate in September) before this year is up and reach 7.7 EH/s by the end of 2022.

Its recent acquisition of Whinstone (the largest US crypto mining facility in the US) is the primary catalyst for its rapidly improving economies of scale forecast.

First Bitcoin ETF Hits Exchanges

Following SEC Chair Gary Gensler’s landmark approval, the first bitcoin-linked exchange-traded fund (ETF) hit the NYSE last month. Bitcoin soared over $65k for the first time in history following this ETF’s debut as institutional interest was further validated.

ProShares Bitcoin Strategy ETF

BITO

became the first bitcoin futures-backed ETF to trade in the US, and its premiere performance was outstanding, with inflows of nearly $2 billion in its first two days of trading. This was a milestone for the crypto market as its futures ETF approval opens the door for institutional funds and wary investors to obtain exposure to this dubious (yet profitable) crypto market through trusted US government-approved exchanges.

CME bitcoin futures (representing forward-looking derivative of the underlying asset) are the trusted crypto conduit the SEC is comfortable with exposing to the NYSE due to its regulatable nature – something that Defi (decentralized financial exchange) platforms, in which untraceable bitcoin trades, cannot claim.

The one primary issue surrounding this conduit for bitcoin exposure is that futures contracts will need to be continuously rolled over to the front-month contract, which will cost money and cause decay to the ETF’s value regarding bitcoin over time. You see this type of decay with virtually all commodity ETFs, similarly based on futures contracts.

Nevertheless, this SEC approval is a massive step towards legitimizing the crypto space, gaining unprecedented market traction in recent years. Today marked a significant stride towards actual bitcoin-supported ETFs, but Gary Gensler and the rest of the apprehensive SEC will need some convincing before this occurs.

Bitcoin bulls are on the hunt for $70k (trading within 1% of this level), which would mark a fresh all-time high for this currency of the future.

Energy Concerns

There has been growing attention surrounding the excessive use of energy required to power bitcoin mining facilities. Elon Musk is the most notable character voicing concerns about the use of fossil fuels to power digital asset mining operations, deciding to halt Tesla’s

TSLA

bitcoin usage earlier this year because of it. Energy is also the most significant variable cost for blockchain-based enterprises like Riot, so it’s central to assessing an investment in this unique space.

Riot’s primary operations are in Texas, ironically one of the cleanest and cheapest energy states (considering it’s the oil capital of the US). The Electric Reliable Council of Texas (ERCOT) powers one of the few deregulated energy markets with a vast competitive push towards inexpensive and sustainable sources. Wind and solar make up nearly 30% of the ERCOT market’s energy capacity, with relatively lower-carbon natural gas generating just over half.

Free-market energy in Texas provides Riot with relatively inexpensive variable costs from increasingly clean sources.

Final Thoughts

Like it or not, bitcoin is here to stay, and it’s time to get some portfolio exposure, if you haven’t already. RIOT presents us with a unique opportunity to acquire bitcoin exposure at a sizable discount as its underlining profit driver takes flight and its controlling market share proliferates.

RIOT has a significant competitive advantage in a market where scale means everything, with its recent acquisition of Whinstone leapfrogging its hash rate expansion. I would jump on this trade today before the window of opportunity for this rare high-growth value-play disappears.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report