RF Industries (NASDAQ:RFIL) is one of the fastest growing micro-small cap companies. Its second-quarter revenue soared 193% year-over-year, which followed a 56% year-over-year increase in the first quarter this year. The stunning sales performance from RF Industries pushed its stock to a new all-time high of $9.35.

RF Industries shares jumped 215% since the beginning of this year, extending its twelve-month rally to 350%. With a 52-week trading range of $1.75 – $9.35, RF Industries’ average trading volume stands at 329,018.0 shares.

Outlook is Bullish

RF Industries is a designer and manufacturer of a wide range of interconnect products for several growing markets, including data communications and wireless/wireline telecom and industrial. Its business strategy of leveraging distribution channels to expand its customer base along with the introduction of the creative solution has been generating substantial sales growth.

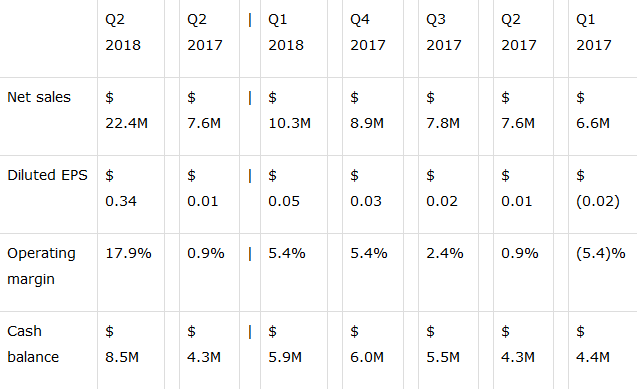

The company’s second-quarter results were terrific from all angles, as shown in the above chart. In addition, the company expects to generate a significant year-over-year growth in the third quarter based on its order backlog of $10 million, which is higher than the $4 million order backlog from this time last year.

“We are positive about the full fiscal year as the Company continues to build momentum. At this time, we expect the Company’s new bookings, in combination with our current backlog, to result in significant growth in net sales and net income for the current fiscal year,“ said Robert Dawson, President and CEO.

Valuations Back Share Price Gains

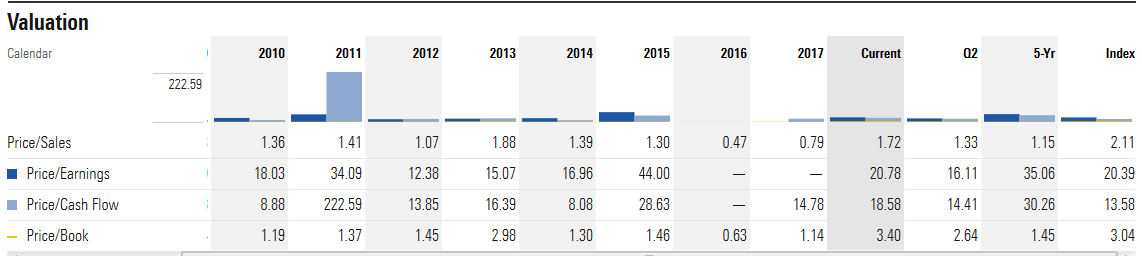

RF Industries’ share price has rallied 350% in the last twelve months, and its stock still looks attractive despite lower than average industry valuations.

RF Industries shares are trading around 16 times to earnings as compared to the industry average of 35 times. Price to sales and price to book ratios are also lower than industry trends—which is an indication that the company’s financial numbers are accelerating at a faster pace than its share price gains.

>> One to Watch: HMS Holdings Corp Hits 52-Week High

Featured Image: Depositphotos/© denisismagilov