Nexstar Media Group, Inc. (NASDAQ:NXST) has been generating record year-over-year financial numbers, driven by its attractive business model and growth strategies.

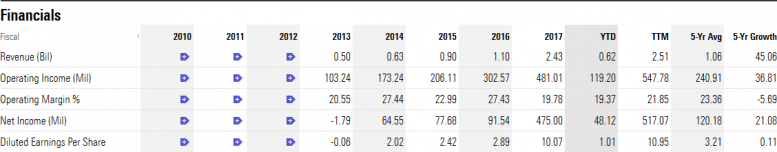

Its revenue jumped from $0.5 billion in 2013 to a record level of $2.43 billion in fiscal 2017; the company claims its strategy of expanding and diversifying its revenue portfolio along with focusing on high growth retransmission and digital opportunities helps in generating substantial revenue growth. Nexstar Media Group has also been acquiring small media outlets that are in line with its future strategies.

The LKQD Technologies acquisition for $90 million is latest on the list. LKQD provides infrastructure for advertisers and publishers reaching about 115M U.S. video viewers last year.

Investors are applauding Nexstar’s business strategies and strong financial numbers. Its share price grew 23% in the last three months, and the stock is up 128% in the previous three years. Its financial numbers are backing its share price gains. This is because its valuations are hovering below industry average despite its robust share price rally.

Its shares are trading at around 7.5 times to earnings compared to the industry average of 22 times to earnings.

>> Staffing 360 Solutions: The New Business Strategy is Optimizing Traders’ Sentiments

Nexstar Media Group Financial Numbers Support Share Price Gains

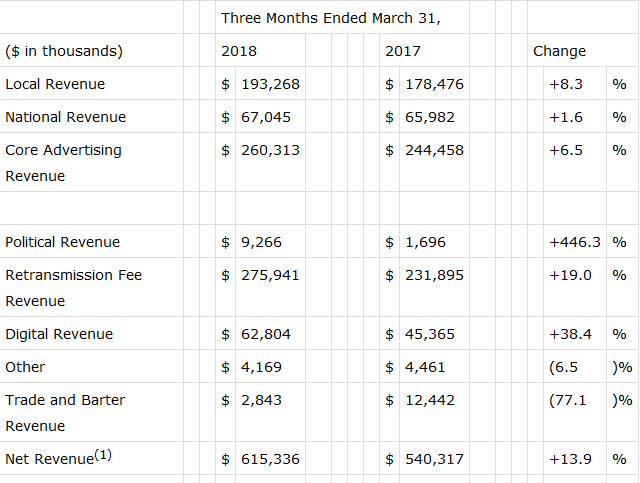

Its first-quarter revenue and earnings for FY2018 hit a new record high. The company generated revenue growth of 13% year-over-year in the first quarter, buoyed by growth from across its business portfolio.

Nexstar CEO says, “The double-digit top-line increase combined with our expense discipline and focus on managing operations for cash flow drove BCF, Adjusted EBITDA, and free cash flow growth.”

Nexstar management expects to sustain double-digit revenue and earnings growth in the following quarters this year.

Share Buybacks and Dividend Optimizes Traders’ Sentiments

Nexstar Media Group has recently increased its quarterly dividend by 25% to $0.35 per share, yielding around 1.9%. The fifth consecutive dividend increase shows the management’s confidence in the company’s future fundamentals and cash generation potential. It has also repurchased $33.8 million of outstanding common stock during the first quarter.

Featured Image: Facebook