Lonestar Resources Inc. (NASDAQ:LONE), a U.S.-based exploration and production company, is working to increase its production potential. The Lonestar Resources production expansion plan includes acquisitions of several production companies.

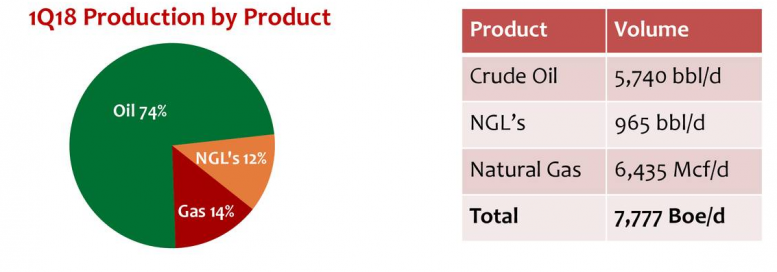

The E&P company’s net oil and gas production jumped 48% year-over-year to 7,777 Boe/d in the latest quarter. The significant increase in production was due to its investments in Eagle Ford Shale and its production associated acquisitions.

Lonestar Resources’ production volumes were standing around 5,740 barrels of oil per day (+43.8% Y/Y), while NGLs production volume was at 965 barrels of NGLs per day (+3.9% Y/Y).

The company continues to see better results from its drilling program in Eagle Ford; they expect second-quarter production to stand around 10,000 to 10,500 Boe/d. This represents a 32% increase over the first quarter and would be up 82% from the same period last year. Lonestar management is bullish in the future fundamentals of oil markets. The company expects its full-year production guidance to be in the range of 10,300 to 11,000 Boe/d.

The company has set its EBITDA guidance for this year at $110 to $125 million. The CEO Frank D. Bracken says, “The source of higher EBITDAX guidance is a result of the outstanding performance of our 2018 drilling program, more lateral length, higher WTI crude oil prices, and sustained positive basis realizations of our Eagle Ford Shale crude oil.”

>> SharpSpring Shares Jump 170% YTD, Here’s Why

Lonestar Resources Production Expansion: LONE Shares Rising

LONE shares are riding an upside momentum since the start of this year, thanks to the Lonestar Resources production expansion strategy.

The company’s share price rose 94% since the start of this year, and the stock price grew 143% in the last twelve months. Its shares are currently trading around the highest level since the beginning of fiscal 2017. The company’s market fundamentals are also supporting its share price gains.

Oil prices are currently trading around $70 a barrel. Analysts like Morgan Stanley expect oil price to hit $85 a barrel in the second half of this year.

Featured Image: Facebook