With a market capitalization of $1.5 billion, Sangamo Therapeutics (NASDAQ:SGMO) continues to impress investors with its expansion strategies. Sangamo recently announced its partnership with Pfizer (NYSE:PFE), with an aim to develop a gene therapy to treat frontotemporal lobar degeneration (FTLD) and amyotrophic lateral sclerosis (ALS) connected to mutations of the C90RF72 gene.

According to the collaboration terms, Sangamo is likely getting $12M in upfront payments and close to $150 million in milestones and royalties on net sales. Moreover, its SB-913 and SB-318 orphan drugs were selected by The European Medicines Agency’s Committee for the treatment of Mucopolysaccharidosis Type I and Type II.

Investors are cheering the company’s strong performance. Analyst Charles Duncan increased the price target for SGMO stock to $19 a share from the earlier target of $8 a share. He says, “things are ‘reinvigorated’ after the new dosing of patients in the ‘Champions’ study, plans for a new HQ to attract talent, and a possible MPS 1/2 pediatrics plan.”

The Sangamo share price rallied more than 315% in the last twelve months. Its stock is currently trading close to $17 a share, just shy from the 52-week high of $19 a share.

The company plans to expand its manufacturing and production potential. Therefore, in addition to workstations, laboratories, and collaboration spaces, the company is now planning to construct a new manufacturing facility, which will allow it to enhance manufacturing of quickly growing pipeline of genomic therapies.

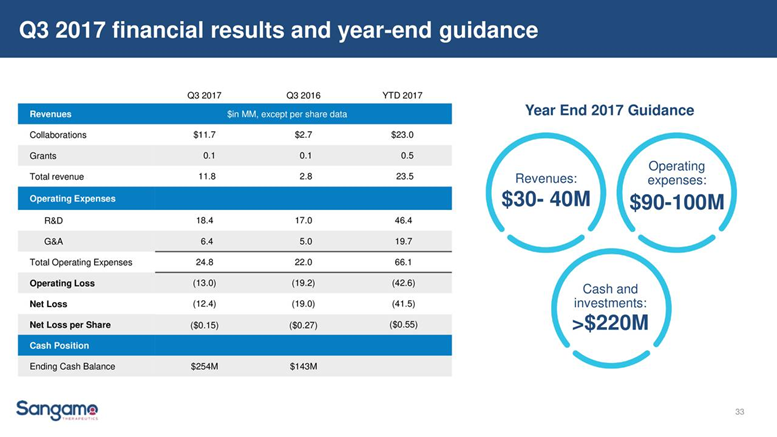

The company’s financial numbers are also impressive and its cash position is sufficient to cover the capital investments. In the latest quarter, its revenue increased almost 300% to $12 million, compared to the same period last year. The company expects its full-year 2017 revenue to stand in the range of $30 to $40 million, sharply higher from past year revenue of $19 million. Moreover, its cash and cash equivalents are likely to surpass $220 million in FY2017. Overall, the company looks in a better position to expand its production and operational capacity in FY2018.

Featured Image: twitter