Amarin Corporation (NASDAQ:AMRN) investors are cheering several impressive reports related to the company’s financial and operational performance, which has led the stock price to rally above 29% in the last month alone. However, traders are questioning whether the rally in its share price offers a selling opportunity, or if the stock has more upside?

Source: finviz.com

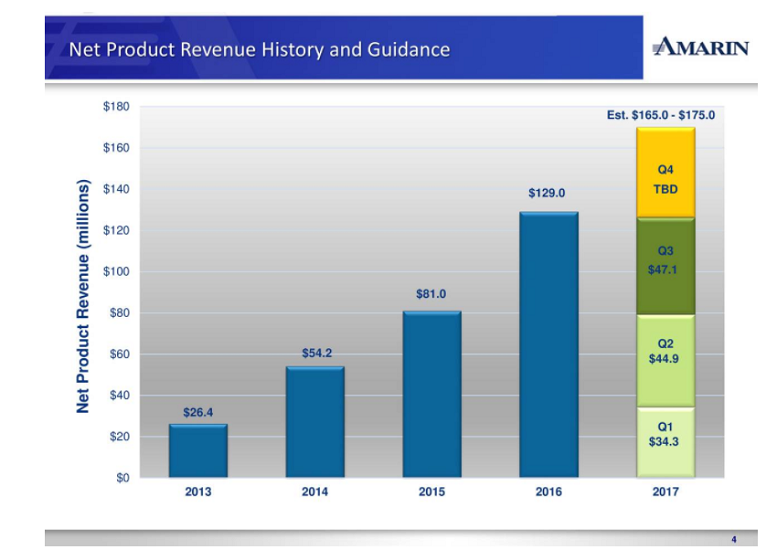

Amarin looks to be in a strong position to generate better results in the days to come. Recently, AMRN increased its outlook for the final quarter and FY2018. The company now expects its fiscal 2017 revenue in the range of $175, while it anticipates Q4 revenue around $51 million to $54 million, mirroring record revenue levels for Q4 and FY2017.

Source: seekingalpha.com

Amarin’s estimated revenue of $175 million for FY2017 indicates a strong growth, compared to the previous year revenue of $129 million. Its average revenue growth in the last three years was standing at 73%, significantly higher from the industry average of 9%.

Although past performance is not a guarantee for a bright future, Amarin’s future fundamentals appear strong enough to analysts to support the stock rally. The company expects its revenue to hit the record level of $230 million in FY2018, representing a staggering 30% growth in each quarter.

The company has been working on a smart strategy, which is based on three key objectives: continue to make an impressive improvement in revenues; complete the REDUCE-IT study on a timely basis; and improve the business performance in a cost-effective way.

On the other hand, Amarin’s multiyear large-scale cardiovascular outcomes study, REDUCE-IT, is nearing its end. Moreover, the Phase 3 ANCHOR study of its post hoc analysis revealed the treatment with its Vascepa (icosapent ethyl) lowered potential artery plaque-forming lipid and inflammatory markers in patients with chronic kidney disease.

The company has also been impressing analysts over the past few quarters, amid its strong financial numbers and reports of advancement in REDUCE-IT and ANCHOR study. Several analysts, including BidaskClub, have upgraded its stock price target. Overall, the company is well-set to generate better financial and operational results in the following quarters.

Featured Image: facebook