3 Altcoins That Have Potential To Be The Next Ethereum Or Bitcoin

With the boom of Bitcoin, and subsequently, Etherium, massive increases in value have pampered cryptocurrency investors.

Although Bitcoin reached new peaks in 2017, it took years before it was able to catch such traction. Ethereum, on the other hand, is barely two years old. Trading at just 5% of Bitcoin’s value earlier this year, Ethereum was well on its way to surpass Bitcoin in Market Cap just a few weeks back.

However, like other cryptocurrencies in the market, Ethereum has experienced significant headwind in its growth.

As a result, investors are keen on finding the next cryptocurrency that will provide them with as much excitement and return as Ethereum has.

As a result of the success Ethereum has experienced, there has been increased interest in a number of alt coins.

And when looking at these altcoins, the performance of Ethereum will without a doubt play part in investor speculation.

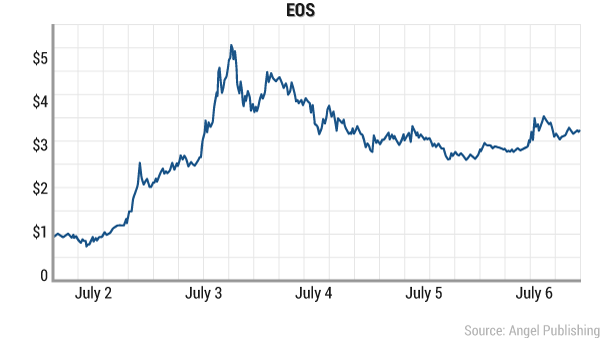

EOS (The Ethereum Killer)

Opening trade on June 26th, EOS is one of the youngest digital currencies on the market.

Because the ICO was incredibly unique and EOS was gaining name across the community, trade volumes spiked immediately.

For the first five days, only 20% of the EOS tokens available would be sold, with the remaining 70% being released over the year, while 10% would be reserved for Block.One, EOS’s founding company.

EOS grew rapidly, with the initial price increasing by 400% from the initial $1 in the first few days alone.

Currently, the token trades just under $3 at about $2.85

But Here’s The Worry:

Being such a new concept, EOS is still in its infancy. EOS is not yet a product you can use, so any investment would be a gamble on whether or not the idea will have any merit to back it up.

But what is so revolutionary about EOS…?

Could EOS Give Ethereum A Run For Its Value?

Also, EOS doesn’t actually stand for anything, the concept generated so much hype that the internet was quick to name it. The most popular, and possibly controversial of the names being: “The Ethereum Killer.”

And if investors read the underlying vision from Block.one, many can see why the nickname might be suitable.

Very much like Ethereum, EOS is a platform that aims to support decentralized applications.

However, Block.one has proposed a much simpler platform than that of Ethereum’s that will feature tools built directly into the program. This will allow businesses to develop their own applications on the decentralized network without a very heavy technical background. This makes EOS an amazing tool for companies that need a simple, but versatile way to monitor their information.

Given that some businesses have already thought of using Ethereum has a platform for corporate tools, Block.one’s proposal for EOS should have Ethereum enthusiasts a little nervous.

Again, as EOS is still a concept, it is an unproven product. Until Block.one is able to deliver its promises, investors should be wary and not too optimistic about what management says.

Want To Invest In EOS?

EOS tokens are currently available for purchase on their website: EOS.io website.

Investors can use Ethereum as well various other cryptos such as Jaxx, Exodus, Poloniex, and Kraken to purchase EOS tokens.

If you are an American trying to purchase, however, you’ll notice that you’re unable to. This is because Block.one has restricted purchase from any computers that display an American IP address. Although it could be understood that Block.one wanted to keep a more stable price during its ICO, limiting the entire American market seems a little excessive.

However, there are very little obstacles that persist in the digital world. For American investors that are genuinely interested, a simple Google search will show you ways to bypass the restrictions.

EOS Key Concepts

To reiterate, an investment in EOS is essentially a gamble. EOS’s potential has already been highlighted by articles from The New York Times and Reuters, so it’s safe to say that EOS’s name has already gained some traction. However, as it’s still unproven, EOS’s product is still under question.

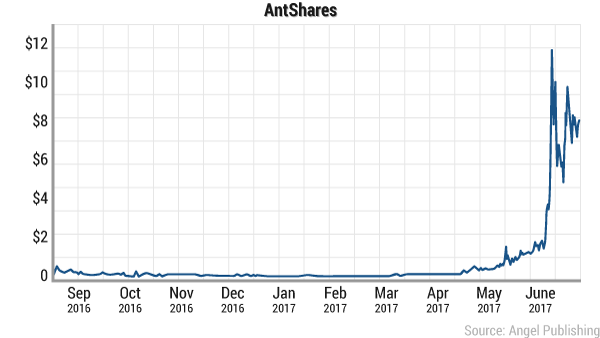

NEO (Antshares) Is Bigger Than You Think

Referred to as the “Ethereum of China”, NEO, previously known as ‘Antshares”, is another concept that has taken the crypto world by storm. Although catering more towards the Chinese market, NEO is picking up traction in the American Markets.

That being said, growth has been fairly exciting, especially with Ethereum’s booming success that spurred a wave of altcoin purchases.

Jumping from a starting price of $0.39 in September of 2016 to a high of $9 in June 2017, NEO shot up more than 2000%. Prices fell in late June however, much like the rest of the crypto economy.

Although a four digit growth is impressive, NEO provides a platform that mirrors Ethereum’s, provoking questions in its recent surge.

Will NEO foster technology that will differentiate itself and ensure its place in the market, or is it simply another “altcoin” riding the success of Ethereum?

Is NEO Worth the Price?

Although it has a very comparable concept to Ethereum, there is still much to be excited about what the team at NEO is working on. Also acting as a decentralized peer-to-peer network, NEO allows people to make decentralized financial transactions, which also allows the use NEO for equity raising or crowdfunding purposes.

Additionally, developers at NEO are keen to correct the faults of its predecessors and are already working on scaling issues that have put distress on Ethereum investors. Signs that the team has the foresight to reprimand any errors should really help NEO garner credibility and interest.

Just like Ethereum and Ripple, who have backing from the Enterprise Ethereum Alliance (a coalition of Fortune 500 companies) and Google respectively, NEO has its own support system as well. As observed in the performance of past cryptocurrencies, strong backing by reputable firms means that there is confidence in the technology as well as the team to bring such technology to market.

Including big tech names such as Wings and Alibaba, NEO has an impressive legion of multimillion-dollar Chinese companies in its backing.

The backing of various firms means promise for crypto currencies like NEO, and is not always the easiest to come by. As a network, significant evidence has surfaced of NEO’s goal to improve the emailing system and tracking for their e-commerce partners.

At this point, investors may wonder why NEO hasn’t yet been adopted for mainstream use. The reason is explained by the lack of solid – western information about the technology: NEO has a language barrier, as most of its discussion has been in Chinese.

With NEO (Antshares) just beginning to make its rounds in the U.S cryptocurrency community, NEO is nowhere near as developed as Ripple or Ethereum. Currently, the only way investors can get a hold of Antshares is by exchanging Bitcoin on Bittrex.

Final Thoughts On Neo

Already with more market exposure than EOS, NEO is a revolutionary new concept. With investor backing, as well as a promising market to lead mass adoption, NEO stands to only gain from exposure to the Western market – a factor that has been growing exponentially. Although already producing technology for Chinese companies, it is still unknown whether traction will be able to persist in the Western market.

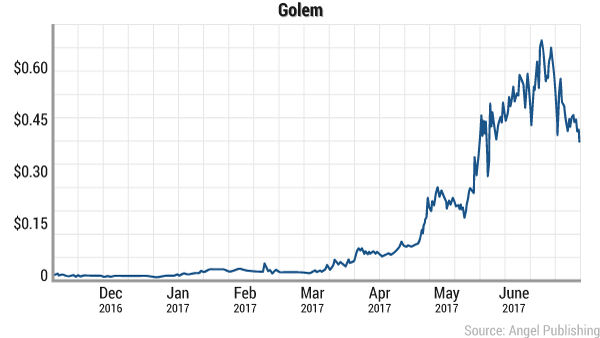

Golem

Much like the rest, the team at Golem is also designing a decentralized platform, albeit in a unique way. Golem, however, will specialize in digital tokens that can be used to fund decentralized internet projects.

Since its ICO in 2016, Golem has skyrocketed more than 4366.67% and has amassed a following that surely benefitted from its rallies.

If word from Golem’s management proves itself, however, then this is just the beginning.

Like EOS however, Golem is still just a concept and is highly susceptible to unforeseen roadblocks. This also means that Golem was caught in the digital bloodbath that saw the decline of many crypto currencies.

Golem is still dropping rapidly as we speak.

Although more established cryptocurrencies such as Bitcoin and Ethereum have already gained back some of their value, Golem hasn’t recovered and has only continued declining in price.

Golem was particularly troubled, however, as the downturn in crypto currencies interfered with a major approaching deadline that is Brass Golem. The combination of these negative events has investors worried.

Although there have been a few setbacks for Golem, the underlying project is still promising, which could represent an opportunity in this dip.

What’s So Special About Golem?

As mentioned earlier, Golem is developing another decentralized network, although they plan to accomplish this in a much different way.

Golem’s method of adoption uses the residual computing power (CPU) from older or current generation electronic devices such as laptops and cell phones. This recycles and maximizes the utility of your devices including laptops and cell phones.

Much like mining, Golem will pay people to share that CPU.

As a result, if Golem’s concept is cleared for the market, then your phone could become an extra source of income.

Additionally, Golem’s decentralized network could drastically improve the current internet.

As the digital age evolves, and people become more dependent on the service it provides, consumers are becoming more cautious about cyber security. That is, there is more worry about their private information than there is of their physical possessions.

To no surprise, firms understand this just as much if not more than individuals. Handling a plethora of consumer and sales data, and sensitive client information, large firms are frequently targeted by Denial Of Service (DDoS) attacks. DDoS attacks are, essentially, attacks that overload a server with commands, thus stalling or even breaking the system.

Companies are vulnerable to such attacks due to the centralization of servers, however, it is nearly impossible to target a decentralized network.

For example, it would be much easier to get rid of one large spider than it would be getting rid of an army of smaller spiders. If something is easily located in one position, rather than spread around, it is much easier to target. It’s this very security issue that led to Golem’s support by many companies.

Although Google’s backing is just rumored, there is proven interest from well-known players such as Reddit’s CEO who expressed his support for Golem over Twitter.

Additionally, as Golem operates and releases projects in stages, they also have a multi-round funding system that nulls any unnecessary ICO hype.

For now, investors can only hope for the success of Brass Golem to alleviate their losses.

An Objective Look At Golem

Much like EOS, Golem is still a concept and may be difficult to justify any investment.

However, the team behind Golem is reputable and transparent and has amassed a following due to their superior communication with investors, and publishing of complete plans to GitHub. With the underlying technology approved by enthusiasts and tech geeks alike, the company is well poised for success.

Additionally, any roadblocks that Golem is going through in its initial stages should not completely sway the confidence of investors. It’s good to note that small development issues early in the project don’t necessarily question the integrity of the project, and could lead to less urgent problems later on.

Featured Image: depositphotos/Violka08