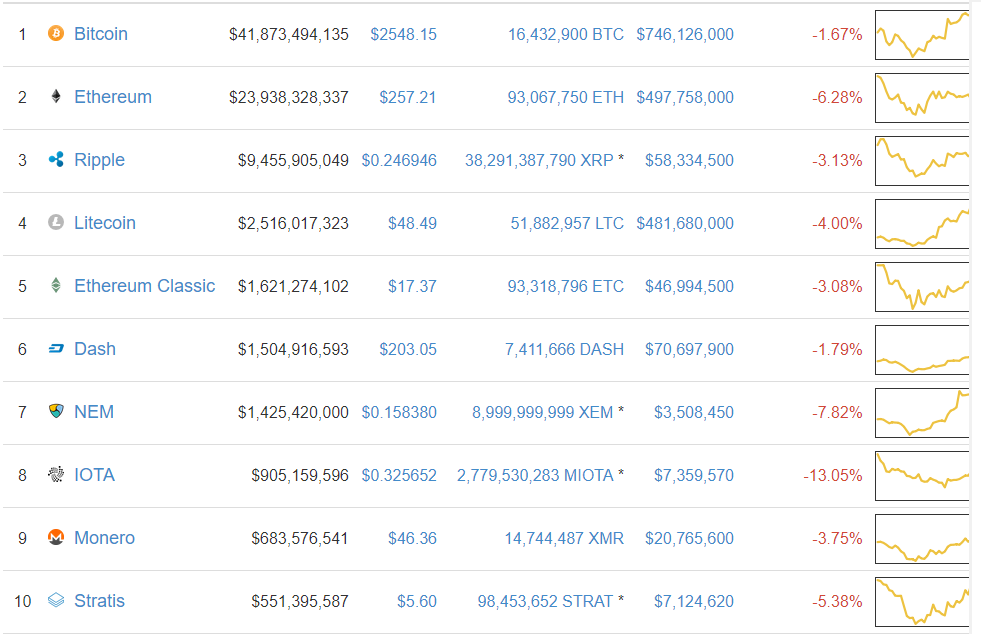

Those that know of cryptocurrency typically associate it with volatility. Although there are periods when volatility seems to smooth out, there are weeks where significant gaps in price fluctuations rattle the community. However, many cryptocurrencies have suffered losses since their all-time highs, with all currencies and assets in the top 10 declining heavily this past week. Of the currencies, IOTA, NEM, and Ethereum have been affected the most.

Cryptocurrency Investors Encounter A Discerning Day of Losses

Those that have shorted cryptocurrencies may be in the money, as these past few weeks have seen all major cryptocurrencies drop harshly in value. Of the top ten currencies, Bitcoin has fared the best relative to its peers, losing just 1.3% of its value. However, other currencies such as IOTA, NEM, and even Ethereum, have recorded massive losses of -11.42%, -6.18%, and -5.51%.

Since the total cryptocurrency market cap broke US $100 billion, the market has seen an oscillating trend of multiple rises as well as multiple dips, leading investors to believe that much of the former market volatility has returned. Although uncertain, it can be inferred from this trend that the US$100 billion mark is simply a psychological factor for traders and speculators, rather than an actual threshold.

It’s helpful to note that as altcoins derive value from Bitcoin, they will drop if the value of Bitcoins drop. However, as evidenced by the varying losses across the board, the volatility is not consistent across all altcoins. With no other currencies keeping their losses to under 2%, Dash is the closest mirror to Bitcoin, losing just 1.46% in this week’s dip. Although timing does not make sense, there could be a possibility that Bitcoin’s value was suspended by investors exchanging altcoins back to Bitcoins.

One thing to take note of, however, is the far more subtle decline in Ethereum Classic when compared to Ether. Even though the latter is far higher in dollar value, it would be assumed that both would experience similar rates of decline. However, with Ethereum Classic and Ether declining 2.04% and 5.51% respectively, their relationship doesn’t seem to hold.

It’s also interesting to see IOTA’s consistent dip in value. Although cryptocurrency debuted trading on major exchanges not too long ago, it caught on quickly and found itself in the top ten in very little time. However, maintaining its position has proven a difficult task, as its market value has fallen below the US $1 billion mark. Depending on how the markets perform in the next couple of weeks, IOTA can easily drop out of the top ten rankings.

With just below US $2.5 billion traded in the past 24 hours, such numbers are low for weekday trading, and are generally expected on weekends. Overall cryptocurrency trading volumes have dipped significantly, and could possibly imply future corrections due to inflated currencies from over purchasing in the past weeks. Currently, the market is dominated by Bitcoin and Ethereum, the only two cryptocurrencies with market caps over US $10 Billion.

Featured Image: Depositphotos/© spaxiax