Abercrombie & Fitch (NYSE: ANF) share price rose sharply higher in the last twelve months, driven by investors confidence in its strategy of focusing on staying closer to its customer and maintaining the disciplined approach to expand profits. ANF share price jumped from the 52-week low of $8 a share at the beginning of the year to $28 a share at present.

The sustainable growth in its financial numbers adds to investor’s confidence and its share price appreciation. Abercrombie & Fitch has topped Q4 revenue and earnings estimates by a wide margin of $30 million and $0.28 per share.

Source Image: finviz.com

Its net sales rose 15% year over year to $1.193 billion, supported by 19% increase in its Hollister brand sales and 9% growth from the Abercrombie brand.

Cost management and operational efficiencies led Abercrombie & Fitch to post adjusted non-GAAP net income per diluted share of $1.38 for the quarter, substantially higher from $0.75 last year period.

Highlighting Q4 results CEO said, “2017 was a year of significant progress. We achieved several important milestones, including Hollister growing to $2 billion in sales, Abercrombie returning to positive comparable sales for the fourth quarter and digital record sales across all brands.”

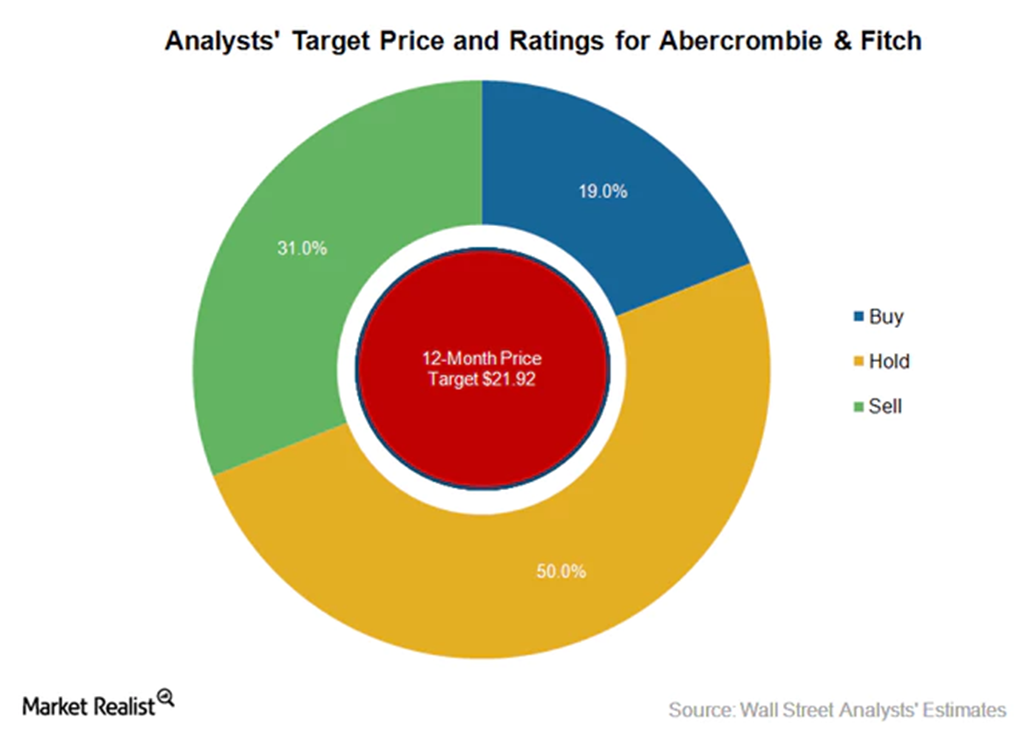

Here’s why Analysts Say “Hold”

Though some analysts believe the recent ANF stock price rally presented a strong selling opportunity for investors, the majority of investors suggest holding the stock amid the potential growth in price.

Source: Market Realist

Analysts believe the company has the potential to expand its financial numbers in the following quarter – which could be the key driver for its share price. Abercrombie & Fitch expects its fiscal 2018 sales to increase at a high mid-single-digit rate, while cost management and gross profit improvement would allow it to post double-digit earnings growth.

>>Supervalu Activists Seek Asset Sale Despite Increasing Revenues

Commenting on future business strategies CEO Fran Horowitz-Bonadies said, “In 2018, we will continue to focus our attention and our investments on engaging our customers with compelling assortments and new experiences, in clearly defined brand voices, positioning our business for sustainable long-term growth.”

Featured Image: Depositphotos/© 78593928