When a business model becomes outdated, it is not unusual for the company to face difficulties when trying to pivot the business in a new direction. However, Chegg (NYSE:$CHGG), an online textbook rental company, has proven to be the exception. Chegg’s management has succeeded in altering its business model and has put itself in a position where it can generate sizeable shareholder value. Over the course of the last few years, management has converted Chegg from an online textbook rental company to a learning platform in an attempt to address a bigger and more attractive market.

Chegg’s New Business Model

Even though GAAP revenue has been declining in recent quarters, this is not a cause for concern. The primary reason for the decline in revenue is because of its transition from owning print textbooks to a more profitable revenue model where its partner, Ingram, will be in charge of owning the print textbook inventory and Chegg will receive roughly a 20% commission from each transaction.

Not only does Chegg’s new business model allow for the company to reduce its risk of holding onto textbooks, it also allows the company to free up capital so it can invest in other growth opportunities. Chegg’s management stated that it successfully completed the textbook transition at the end of last year.

Q3 Release

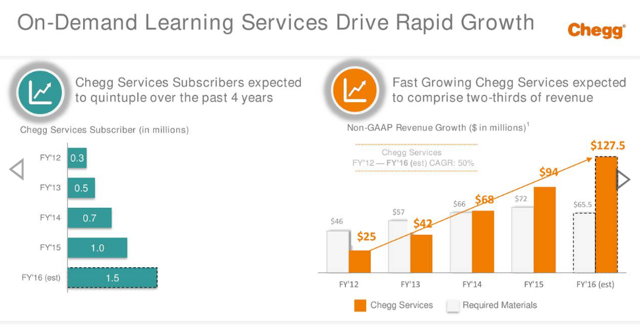

On a year to year basis, the California-based company saw net revenue decrease 12% to $71.3 million. However, as mentioned, this decline is not a cause for concern as it is just a result of its changing business model. Above all, Chegg’s service revenue growth was colossal, expanding 44% y/y to $29.7 million in the quarter, now accounting for 42% of net revenue, in comparison to 25% in the third quarter of 2015.

Yet another positive for CHGG was that it surpassed more than 800,000 Chegg Services subscribers in a quarter for the first time. Dan Rosensweig, the CEO of Chegg Services, elaborated on the subscriber growth in a press release and was very optimistic, saying “this was driven by strong growth across the board in new customers, retention, and engagement.”

In the third quarter of 2016, retention was extremely strong with an 80% renewal rate for Chegg Study subscribers. What does this high retention rate entail? Well, first and foremost, it shows that Chegg’s customers value the service.

Additionally, the management team also discussed a number of other notable positives from the quarter, such as:

- In the third quarter of 2016, over 3.8 million questions were viewed in Chegg Study; and

- There was over 65% growth in tutoring minutes from Q3 2015

Also, management addressed positive guidance for Q4 and fiscal 2017:

Fourth Quarter Guidance

- Total net revenues were in the range of $55 million to $60 million;

- Chegg services revenues were in the range of $41 million to $44 million; and

- The company’s growth margin was between 65% and 67%

Fiscal 2017 Guidance

- There are total net revenues of $230 million;

- Chegg services revenues of $172 million; and

- Adjusted EBITDA of $35 million

Chegg Has Several Platforms

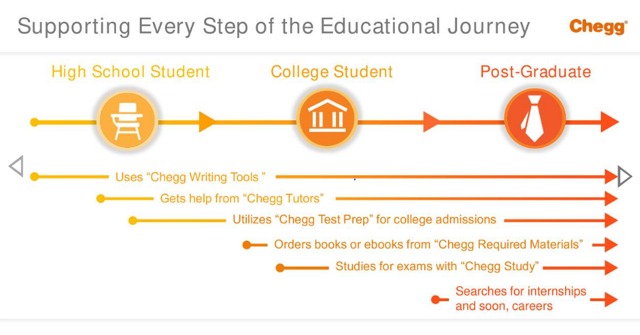

In an attempt to keep customers on its platform, Chegg’s management has carefully been adding several services to its platform over the years.

In their most recent Press Release, Chegg’s management opened up about this goal: “We believe we are building the brand and platform that students from middle school into their early careers will turn to first because we help enable a much broader set of improved outcomes that include accelerated learning, less debt, and of course better jobs.”

As of right now, Chegg’s platforms include the following: supplemental materials, digital textbooks (eTextbooks), multi-platform eTextbook Reader software, Chegg Study, Chegg Tutors, Chegg Test Prep, Chegg Writing Tools, College Admissions and Scholarship Services, purchases of used textbooks, internships, careers, college counseling, enrollment marketing services and brand advertising.

Margin Increase, Acquisition, and Synergies

Since becoming a platform, CHGG is moving in the direction of a less risky market, with upside potential and higher margins. It’s worth noting that since Chegg is now operating a fixed cost platform, the company’s additional sales will not increase its expenses. In a press release, Andy Brown, Chegg’s CFO, elaborated on this phenomenon:

“In fact, our Q3 gross margins were higher than expected at 45.8%, as a result of increased benefits and synergies from our learning services. Notably, much of the incremental revenue goes straight to the gross margin line, as digital services like Chegg Study and our writing tools have a relatively fixed cost structure. In other words, as the services grow and achieve scale, our margins should continue to increase.”

Furthermore, during the Q3 2016 earnings call, CEO Dan Rosensweig explained the other ways in which Chegg’s platform has benefited from an expanded user base:

“ As more students use Chegg more often, we are able to rapidly improve the quality in relevance of each of our service and on a per student basis. This creates a powerful virtuous circle we believe improves each service and helps us introduce new offerings for students at the right time at a very low cost. In addition, about 50% of Chegg Tutors customers are continuing to come directly from Chegg study, which we believe reinforces the fact that each of our services are even more powerful as a platform. Textbooks remain a significant pain point for students and a low-cost customer acquisition channel for Chegg that helps us build our brand, add to our data, and ultimately attach students to Chegg, and with Chegg’s multiple services.”

Thanks to the size of its platform, Chegg is in the midst of developing a competitive edge against its rivals. Essentially Chegg’s network effect will create a trench against competitors entering its markets. Chegg will benefit both from a lower cost of customer acquisition from cross-selling, as well as the self-regulatory mechanism of using ratings which allow for Chegg to filter out and have the top tutors and counselors on its platform.

Acquisition Potential

With Chegg’s new business model, many find it to be attractive as a takeover target. Say a bigger player decides to integrate Chegg’s services into its system, that company could quickly add revenue without having to substantially incur costs to do so. Amazon (NASDAQ:$AMZN), for instance, could do this by integrating Chegg into its platform and leveraging its massive base of Student Prime Members to grow all of Chegg’s different services. Additionally, Amazon might be interested in acquiring Chegg in order to get access to the student demographic and behavioral data that is has stored over the years. This could prove to be advantageous to Amazon by allowing them to learn the ropes of how to sell to this demographic.

Platform Opportunities

If you’re interested in Chegg’s services, it’s important to note that most of these services are relatively low risk/high upside opportunities. To get a better perspective on how these services work, here are four of Chegg’s offerings:

-

Guidance Counseling:

The first of Chegg’s offerings is an economical online college guidance counseling service. The end goal of this offering is to democratize the college counseling industry in order to provide access to all demographics of students. Under the terms of this offering, Chegg will leverage it’s InstaEDU on-demand technology and network of expert counselors to help students find the college best suited to their interests. Though this service tends to be free in public schools, there is a scarcity of counselors in some districts. Plus, private counselors cost roughly $4,000 per child. Therefore, Chegg is filling the hole in the market.

When the service was first launched, it cost $24 per hour, but, now, the lowest pricing offering is $30 per hour. This service marks yet another low downside/high upside initiative. Why? Because Chegg essentially takes on the role of the middleman where it is able to generate revenue simply by linking counselors with students. Of course, like anything, there is a downside which is the initial cost to actually set up the technology behind the service.

Though this project might not be extremely lucrative in itself, it will help Chegg in two ways: 1) it will help the company build a relationship with students entering college, and 2) the service is complementary to its tutoring and career services so it might drive traffic to those sections as well.

-

Chegg Tutor Services:

Similar to the guidance counseling service, the tutoring service runs on a per-hour basis and pays the counselors/tutors the same per-hourly amount. On the website, Chegg advertises that tutors start at a rate of $20 per hour, which implies that $10 per hour goes to CHGG.

It’s important to note that Chegg has a self-regulatory mechanism which filters out bad tutors as students are able to give their tutors reviews.

-

Chegg Career Services Segment:

Yet another one of Chegg’s low-risk, high upside ventures is in the form of a career services segment. In an attempt to encroach on LinkedIn (NYSE:$LNKD), Chegg will leverage its user base and brand awareness. This is will provide Chegg with the opportunity to generate significant revenue by matching employers with prospective employees.

-

Test Prep:

Launched in 2016, Test Prep is a massive market opportunity for Chegg. The test prep software can be as low as $29.95 per month, which reflects a considerable discount from traditional tutors and other test prep offerings.

Featured Image: Chegg