Shares for Trevali Mining Corp. (TSXV:$TV) are the ones to watch because the Tenkan Line has now moved below the Kijun Line, which indicates negative momentum for the equity. In its most recent session, Trevali moved -0.04 and touched 1.36 on a recent tick.

The Tenkan Line or the Tenkan Sen, Sen meaning “line” in Japanese, is the conversion line, or turning line, similar to a SMA, but different in significant ways. A SMA (simple moving average) smooths out and equalizes the data, whereas the Tenkan Line takes the highest high and lowest low for the last 9 periods. The reason for this is that Hosada thought price action and its extremes were more important than smoothing the data because price action represents where buyers/sellers entered and directed the market. Because the Tenkan Line (TL) uses price rather than averaging or closing prices, it represents price better than a SMA.

The sharper the angle of the Tenkan line, the stronger the trend is; the flatter the TL, the lesser the momentum of the move. It is important not to use the Tenkan Line as a gauge of the trend; instead, use it to see the momentum of the move. It can, however, act as the first line of defense in a trend, and the breaking of it in the opposite direction of the move is often a sign of the defenses weakening.

Beyond its Tenkan Line, Trevali also currently has a 14-day Commodity Channel Index (CCI) of -130.29. The CCI is a technical indicator of stock evaluation that some investors may prefer. Used as a coincident indicator, when the CCI reads above +100, it reflects a strong price action that may signal an uptrend. When the CCI reads below -100, this may be an indication of a downtrend reflecting weak price action. Used as a leading indicator, a CCI reading of +100 is an overbought signal, while a -100 reading is an oversold signal, which suggests a trend reversal.

Which trends will prevail in the second half of the year? Investors are keen to find out. Some investors may be trying to maximize gains, becoming better positioned for success. Technical analysts, on the other hand, maybe studying different historical price and volume data to help them uncover where the momentum might be headed. A solid strategy will be difficult to come up with, but will no doubt be worth it in the long run.

Further analysis of Trevali’s stock may offer some insight. Currently, their 14-day ADX is 15.02. Most technical chart analysts believe an ADX value over 25 suggests a strong trend, while a reading under 20 indicates no trend, and a reading from 20-25 suggests no clear trend signal. The ADX is usually plotted with two other directional movement indicator lines, the Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI), but ADX is believed by some to be the best trend strength indicator.

There is also the Williams Percent Range (Williams %R), which is a popular technical indicator created by Larry Williams to help identify overbought and oversold stock. It is often used with other trend indicators. Trevali has a 14 day Williams %R of -100.00. Generally speaking, a stock is overbought if this indicator is above -20, and the stock is considered oversold when the indicator goes below -80.

By using other technical indicators, Trevali is seen to have a 14-day RSI of 39.28, while the 7-day is 31.09 and the 3-day is 18.98. The Relative Strength Index (RSI) is a momentum oscillator used to measure the speed and change of stock price movements. When charted, the RSI can monitor historical and current strengths or weaknesses in a certain market. The measurement is based on closing prices over a specific period of time. Because the RSI is a momentum oscillator, it operates in a set range, between 0 and 100. Having a RSI closer to 100 indicates a period of stronger momentum while having a RSI closer to 0 could mean a weaker momentum.

Looking at Treali’s moving averages, their 200-day is at 1.32, with the 50-day at 1.46 and the 7-day at 1.42. Moving averages can be used to help filter out unnecessary information from other factors, and can be used to identify uptrends or downtrends. They can be a prominent indicator for detecting a shift in momentum for any particular stock.

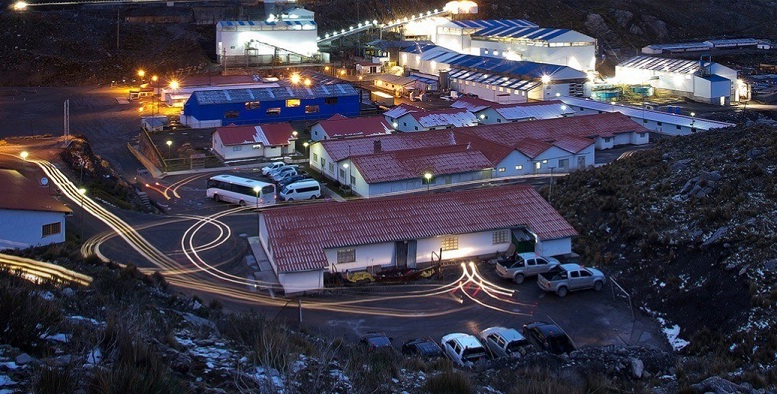

Featured Image: trevali