When thinking about getting into gold investing, it is important to know that the majority of these investments will fall into three sections. These sections include the following; physical gold, gold exchange-traded funds, and gold mining stocks.

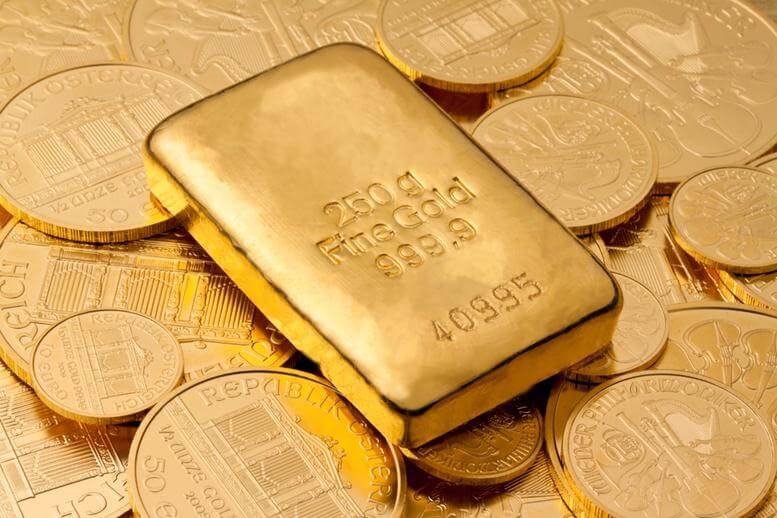

1. Buying Physical Gold

Physical gold can come in the form of bullions, but, they tend to come in the form of gold coins. For instance, the one ounce American Gold Eagle or the one ounce South African Krugerrand. Investors looking to place a gold investment could purchase the Gold Eagle, for instance, from the US mint. Keep in mind, however, that this will be at an increased price in comparison to what gold coin dealers offer. Considering that, when making a gold investment with a gold coin dealer, be sure that it is a credible dealer as there have been numerous cases of counterfeit gold coins.

Looking for gold investing advice in regards to purchasing gold coins? Keep this in mind: gold coins need to be placed in a safe spot, so it is recommended that you keep them in a home safe or a safety deposit box. That said, don’t place your gold coins in a safety deposit box if you are planning to use them in crisis, as they might become inaccessible.

2. Gold Exchange-Traded Funds

Gold ETFs, which are essentially a special kind of mutual fund, invest in a chunk of gold directly. This bullion of gold is often placed in a safe location which is held by an independent accountant. These accountants are required to annually confirm an investor’s ETF gold holdings as a part of their audit. It is worthwhile noting that investors can purchase and sell gold exchange-traded funds through any brokerage company. Anyone who is thinking about making a gold investment and is leaning towards gold ETFs knows that transaction costs through discount brokers are very low and the value of your shares will track any fluctuations in the market price of gold. Additionally, investors can purchase or sell call or put options on gold ETFs. This means that an individual can put into action complex strategies for any market view. Keep in mind that even though gold ETFS are the easiest way to invest in gold, ETF owners do not have physical custody of the gold. If that plays an important role in your decision to start gold investing, consider the option above.

3. Gold Miner Stocks

These stocks are of companies who are involved in gold mining. Typically, gold mining stocks rise and fall at a faster rate than the price of gold. This makes it a high-risk investment with a higher gain/loss rate, so keep this in mind before you start gold investing. Before deciding on a number of gold investing companies that you want to invest in, remember that individual gold mining companies will be subject to political, currency, environmental, and labor relations risks.

Overall, there are a variety of options for people looking to start gold investing. If for example, you want to diversify your portfolio by gold investing, it is recommended that you purchase gold exchange-traded funds. However, if you want to make a gold investment so you are prepared for an end-of-the-world scenario, you would benefit the most from purchasing and holding physical gold.

Featured Image: depositphotos/Baloncici