Recently established mining company Cobalt 27 Capital Corp’s (TSX-V:$KBLT) stocks debuted on Canada’s Venture Exchange on Friday, June 23. In a public offering totalling $200 million, Cobalt 27’s presence on the exchanges gives investors a chance to gain exposure to cobalt either in the physical form or through shares of the company. It also signals the rising cobalt market as electric vehicles begin to gain traction in the automobile industry.

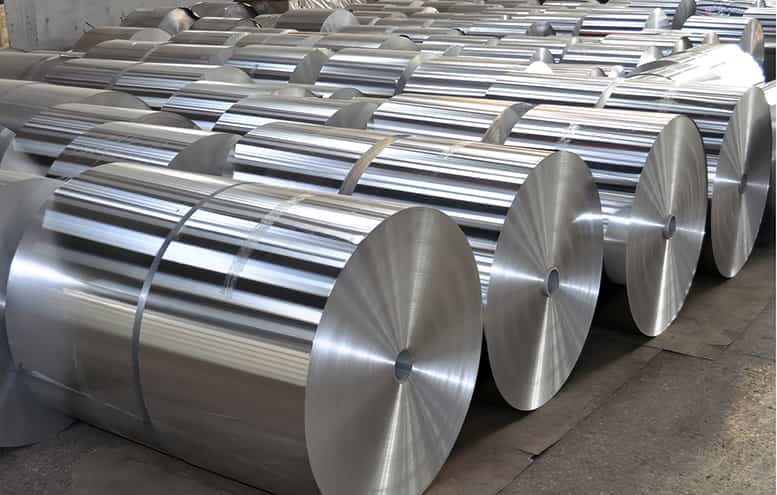

Cobalt 27 currently owns about 2,160 tonnes of physical cobalt, which is worth about US$128 million based on the cobalt prices as of June 28. Most of the metal was obtained as a byproduct of copper and nickel mining by other mining companies like Baar, Switzerland-based Glencore (LON:$GLEN), Toronto-based Sherritt International (TSE:$S), and China Molybdenum (SHA:$603993). All cobalt are stored and insured in warehouses, according to Cobalt 27. The company currently have warehouses located in Baltimore, Antwerp, and Rotterdam.

Cobalt 27, a Toronto-based company, may be just the answer electric vehicle companies like Tesla (NASDAQ:$TSLA) are looking for. CEO Anthony Milewski gave Reuters a small taste of what Cobalt 27 aims to achieve, saying, “We’re a pure play on cobalt and a thematic play on electric vehicles. Our cobalt can be traced back to the producer. It hasn’t been produced by child labor.”

Many tech and automobile companies have been under public scrutiny when it came to where they were extracting their cobalt for lithium-ion battery production. This is because the majority of the world’s cobalt comes from the Democratic Republic of Congo (DRC), where mines make use of child laborers and independent individuals mine under unsafe conditions. Despite having violated a number of human rights conditions and being known as a politically unstable countries, a number of mining companies still invest in mines located in the DRC because of its rich cobalt deposits.

A lot of miners are investing in cobalt, as a number of analysts have projected cobalt’s rise in popularity. This is largely due to a spike in demand of lithium-ion batteries, which cobalt is a key component of. While a lot of personal electronics such as cell phones and laptops make use of lithium-ion batteries, it is the recent trend of electric vehicles that have sent investors and mining companies alike on the search to invest in cobalt. The Union Bank of Switzerland (UBS) (VTX:$UBSG) recently predicted that by 2021, global sales of electric vehicles will reach 3.1 million units, and 14.2 million by 2025. UBS is also expecting electric vehicles to be responsible for about 3.1% of global car sales by 2021, and 13.7% by 2025.

Out of all the commodities that make up the lithium-ion battery supply chain, lithium, cobalt, and graphite in particular will be the most affected by the rapid demand and production of electric vehicles, said UBS analysts recently. However, only cobalt faces the problem of an extremely limited amount of reserves, while other materials’ production capacity are experiencing bottleneck issues.

Given these problems, Cobalt 27 sets itself apart from other junior miners: aiming for pure cobalt production from safe, reliable producers. As such, the company plans to grow through buying other mining companies’ cobalt output at a fixed, predetermined price through royalties and agreements. Cobalt 27 revealed in an investor presentation that it currently has six agreements to obtain the royalties of eight cobalt-containing mines in the exploration stage.

As demand grows — last year, global demand for cobalt was 100,000 tonnes — cobalt will need a pipeline of secure supplies in order to succeed, Frances Hudson, a global thematic strategist at Standard Life Investments (LON:$SL), said. “If the cash flows are there and they can pay a dividend, then this would be a sensible way to do it,” Hudson added.

With cobalt demand increasing and concern over a secure supply chain grows, Cobalt 27 may be worth investing in given their ambitious goals and current amount of cobalt in storage.

Featured Image: Depositphotos/© Afotoeu