Gold surged to its highest price since September 2020 after Russian forces attacked targets across Ukraine, further increasing risk sentiment. Spot gold prices have increased roughly 5.6% over the past month to $1,910 per ounce as investors seek to take cover in the safe-haven metal.

The attack on Ukraine is the most significant attack by one state against another in Europe since WW2, with President Putin vowing to “demilitarize” Ukraine. Meanwhile, the EU, U.S., and U.K. have followed through with their promised sanctions, already hitting Russia’s economy and financial sector hard. The Moscow stock exchange had to suspend trading on Thursday as the MOEX index plunged at least 45%, wiping about $70 billion off the value of Russia’s biggest companies.

However, even as numerous investors rush to gold, some argue that the Russia -Ukraine war isn’t the catalyst to drive the precious metal’s long-term price higher. Gold has a history of declining in the wake of geopolitical crises, with the most recent illustration of this being when Russia annexed Crimea.

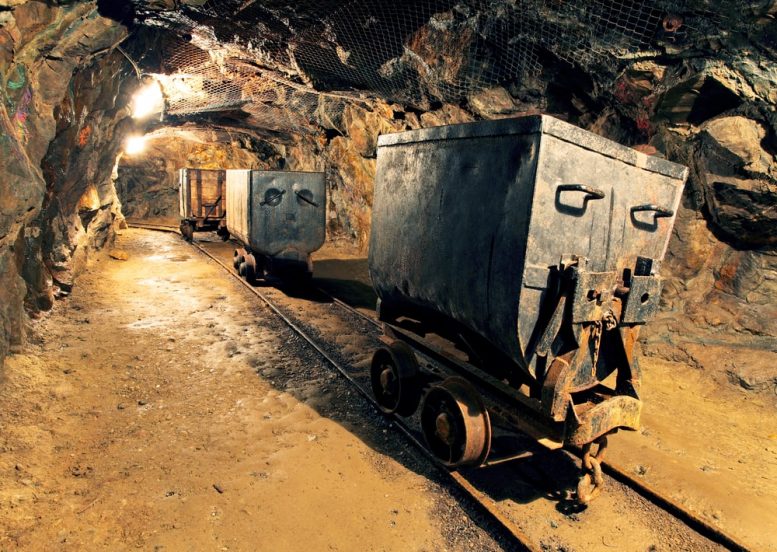

As such, investors looking for above-average returns would be better off considering junior gold miners, as the chart below shows. The VanEck Junior Gold Miners ETF is up 15.1% over the past month, far outpacing gold’s gain over the same time frame.

Gowest Gold (TSXV:GWA), for instance, which has been working on advancing its Bradshaw project in the Timmins mining camp in Ontario, has put out some exciting updates. Since the company got permits to bring the Bradshaw to commercial production in 2020, the company has been looking to secure financing for the project and received a $19 million investment from Greenwater Investment Hong Kong.

Reunion Gold (TSXV:RGD) which has a 50/50 joint project with Barrick Gold in Guyana has seen its share price rise over 65% on a year-to-date basis. This comes on the backdrop of highly encouraging drilling results on its Oko West project, where one hole intersected 3.38 g/t gold over 63 meters. The company also closed an $11.5 million private placement with proceeds expected to further exploration of the project.

Tower Resources (TSXV:TWR) is also up over 80% after announcing the discovery of a new gold zone following its drilling at Rabbit North, which included an intercept of 19.2 meters at 4.21 g/t.