Agriculture stocks might not be the pick of the litter amongst income investors, but there are numerous benefits for when it comes to investing in agricultural dividend stocks. For instance, farming companies are working towards tackling one of the biggest challenges in the world: feeding a growing population even as farmable land shrinks. To simplify, one cannot go wrong with investing in stocks that are working towards alleviating a key global challenge.

Here are 3 agriculture dividend stocks that make compelling buys due to their strong dividend history and growth potential.

-

Archer Daniels Midland (NYSE:$ADM)

The majority of investors that are looking for steady and growing dividends will check out the Dividend Aristocrats, which is a list of stocks that have increased their dividends for at least 25 consecutive years. And for those looking to make agricultural investments, guess what? Only one agriculture stock made it to the Dividend Aristocrats list – Archer Daniels Midland.

The Illinois-based company processes agriculture commodities such as corn and oilseeds into food feed, and fuel ingredients and then distributes them to diverse industries. Taking into consideration the commoditized nature of agribusiness, it’s pretty remarkable that ADM has been able to compensate shareholders with annual dividend increases every year for almost three decades. Seeing as ADM’s payout is less than 50%, there is definitely enough room for higher dividends regardless of whether profits were to slow down.

When looking at ADM’s stock, there are certain things investors need to take into consideration. For starters, the company has divested low-margin businesses such as cocoa and Brazilian sugarcane ethanol. It is thought that these moves combined with the company’s targeted capital allocation policy of reinvesting 30% to 40% operating cash flows into its business and returning the rest to shareholders will produce rich rewards for income investors.

-

Terra Nitrogen (NYSE:$TNH)

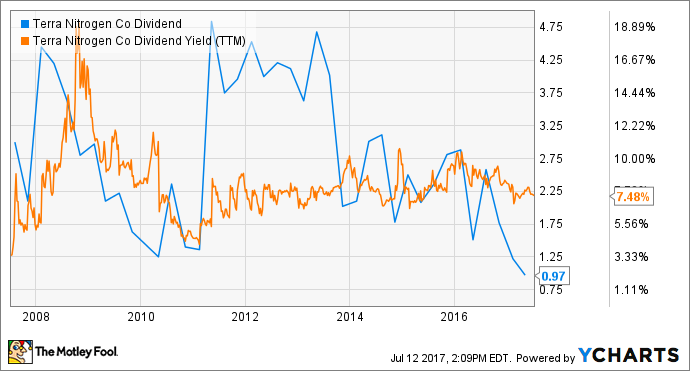

Headquartered in Illinois, Terra Nitrogen is a pure nitrogen fertilizer play that operates one facility in Verdigris, Oklahoma. However, that doesn’t mean that investors should underestimate the stock’s dividend potential. Because TNH is a master limited partnership (MLP), the majority of Terra Nitrogen’s profits are passed on to shareholders in the form of dividends, or distributions in MLP parlance. What does this mean? Well, it means that while Terra’s dividends can fluctuate, the stock has maintained yields above 3% over the past decade.

Of course, like most things, owning an MLP has its fair share of risks and tax complications. That said, Terra Nitrogen has a solid track record of margins and returns on equity to boot. Just keep in mind that if you’re a risk-averse income investor, you might want to opt for CF Industries instead. As of right now, Terra Nitrogen yields almost 7.5% in comparison to CF Industries’ 4.2% yield. While both are strong dividend stocks, one should choose the stock that is best suited to your interests.

-

Agrium Inc (TSE:$AGU) / Potash Corp (TSE:$POT)

PotashCorp and Agrium will soon merge in the coming months. After the merger, the combined entity will be known as Nutrien.

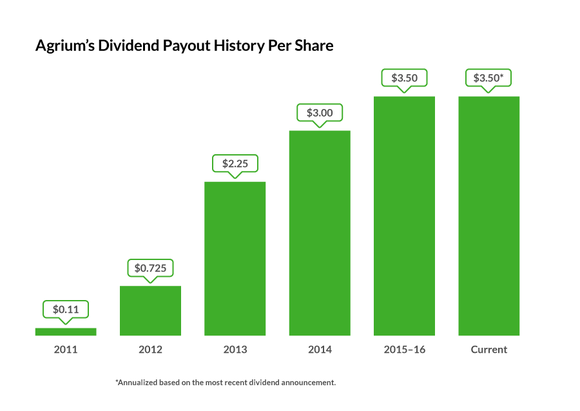

Ever since the initial announcement of the merger, both companies have stuck by their word to aim for a dividend “equal to” Agrium’s current level. As of right now, it is still unclear whether “equal to” means payout ratio, yield, or dividend amount here. Either way, shareholders, particularly in PotashCorp, should benefit given how fast Agrium’s dividends have increased in recent years.

Currently, Agrium pays out 40% to 50% of its cash flow in dividends and yields 3.6%. Over the course of the past three years, Agrium’s stock has yielded more than 2.5%. Seeing as Nutrien will become the largest fertilizer company in the world, there is potential that it could emerge as one of the top dividend stocks in the sector in coming years.

Featured Image: depositphotos/ Greatstock