Apogee Enterprises Inc (NASDAQ:APOG): Apogee Enterprises shares hit highest point since the start of this year, buoyed by higher-than-expected results for the first quarter. The company’s strategy of investing in acquisitions, operational improvements, and revenue diversification sets it in a position to generate solid growth in earnings and cash flows.

The APOG stock trading around $48 at present, with a 52-week trading range of $37.24 – $58.30. Apogee Enterprises currently has a market capitalization of $1.3 billion.

Apogee Enterprises Shares Hit Highest Point: Business Strategies are Working

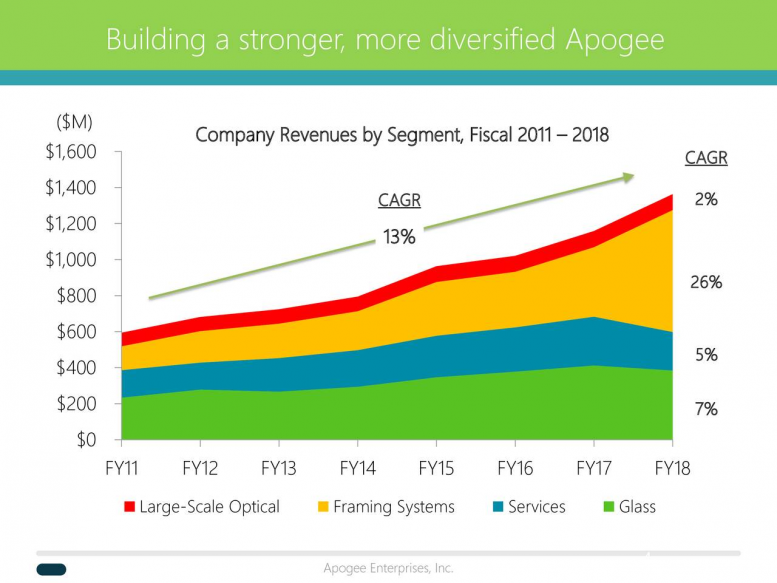

The company’s business strategies are working, considering its robust growth in financial numbers. Apogee Enterprises shares hit highest point with its first-quarter revenue enlarged by 23% since the same time last year. The growth in revenue was due to its investments in organic and inorganic growth opportunities.

Its EFCO acquisition accounted for almost 24% of total revenues; the company claims double digital revenue growth from legacy framing businesses of EFCO in the following quarters.

Apogee Enterprises experienced growth from across all business segments, excluding its architectural glass segment. Its revenues for each segment are as follows: architectural services up 41% Y/Y, architectural glass declined 21% Y/Y, architectural framing systems up 63% Y/Y, and large-scale optical jumped 12% Y/Y.

>> Helix Energy Solutions is Enjoying Improving Dynamics in Energy Sector

“In the first quarter, we executed our plan for a solid start to fiscal 2019: revenues rose significantly, backlogs continued to grow across the business, we saw on-going productivity gains and excellent cash conversion,” said Joe Puishys, Apogee’s Chief Executive Officer.

Cash Flows Offers Room for Dividend Growth

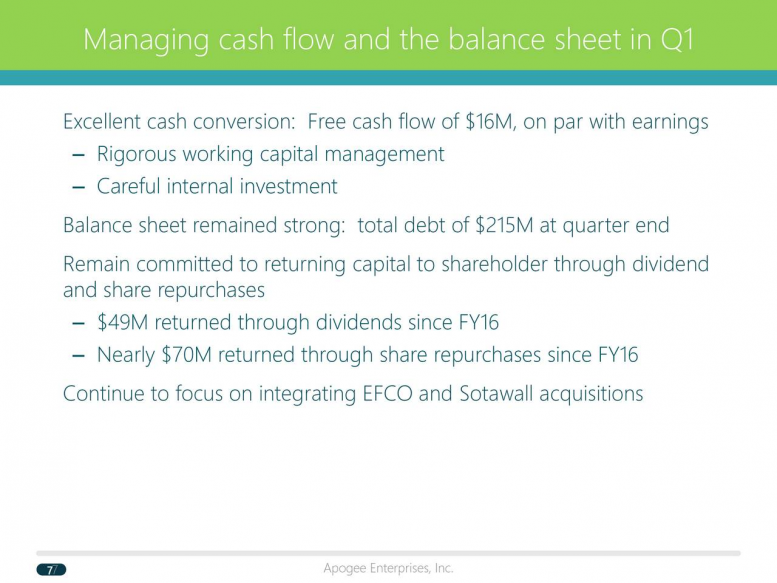

Apogee Enterprises currently offers a quarterly dividend of $0.15 per share, yielding around 1.29%. Its free cash flows, however, are offering room for dividend increase potential. Its free cash flow in the first quarter was standing at around $16.0 million compared to dividend payments of $4.4 million. On top of that, the company expects its full-year revenue and earnings to increase at a double-digit rate – which would offer additional support to its dividend payments.

Featured Image: Depositphotos/© Ai825