Over the last few weeks, tech stocks have bounced off of 2022 lows and started their ascent back to levels not seen since early this year. Widely-hailed companies such as Apple

AAPL

, Alphabet Inc.

GOOGL

, and Amazon

AMZN

have all been climbing, but recently, there has been an intriguing development involving these companies that have brought about a heightened level of risk.

Department of Justice Crackdown

The Department of Justice recently endorsed antitrust bills that would prevent tech giants from giving preferential treatment to their products. Essentially, the DOJ believes that big tech firms have unchecked power, vastly influencing other businesses’ success.

Apple is the king of premium phones, watches, laptops, and tablets. The company operates the App Store, the only platform where outside developers can get their apps published on Apple’s devices. It’s accused of taking advantage of the mobile devices market to hurt competition, curb innovation, and inflate prices.

Amazon dominates the e-commerce world with a robust cloud computing business. The DOJ believes that its e-commerce dominance has come at a steep price paid by businesses that continuously rely on its Marketplace platform to sell their products.

Google has stretched itself so far that it’s essentially deemed the portal of the internet. It has a heavy presence within smartphone operating systems, web browsers, e-mail providers, and search engines. The DOJ is accusing the company of abusing its widespread internet power.

Now that we’ve identified and are aware of the risk within these companies, let’s take a deeper look and analyze their performances.

Apple

Apple

AAPL

has cruised in the market over the last year, with shares gaining nearly 50% in value. Shares took a downward trajectory at the beginning of 2022 but have recovered nicely during the recent rally, pushing the company’s YTD return up to a marginal 0.6%.

Revenue from its flagship product, the iPhone, jumped 40% from 2020 to 2021. Net sales of the product grew 9% from the previous year’s quarter, attributed primarily to the high demand for new iPhone models launched in Q4 2021. Overall, the top line has surged by an impressive 33% from 2020 to 2021.

Image Source: Zacks Investment Research

During Q1 2022, the company bolstered its product line, releasing an updated MacBook Pro, the third generation of AirPods, and the Apple Watch Series 7. 2022 Q1 EPS of $2.10 reflected an increase of 25% from the prior year’s quarter, with the company experiencing higher net sales due to increased seasonality demand.

Apple has a four-quarter trailing average EPS surprise of 20%. The current year’s EPS estimate has inched up 0.8% to $6.16 per share, and next year’s earnings estimate has increased slightly by 1% to $6.69 per share. Additionally, the tech giant is forecasting 12% bottom-line growth over the next three to five years.

Apple fears that the recent antitrust bills could undermine its ability to force third-party app developers to obtain permission before collecting data on users. The company is currently a Zacks Rank #2 (Buy) with an overall VGM Score of a B.

Amazon

Amazon

AMZN

shares traded mostly sideways throughout 2021, with a steep drop-off in early January this year. Since then, shares have found a new path upwards, increasing by 0.6% YTD.

Amazon Web Services, a growth driver, saw its net sales jump nearly 80% year-over-year from 2020 to 2021. Nasdaq also shared its multi-year partnership to migrate its markets onto AWS, intending to become the world’s first fully enabled, cloud-based exchange. Additionally, Amazon saw its top line jump by 22% from 2020 to 2021.

Image Source: Zacks Investment Research

The e-commerce giant has recently launched the Amazon Smart Air Quality Monitor in several countries and introduced a new in-vehicle experience that allows passengers to utilize Alexa for streaming purposes in the U.S. Furthermore, a high-traffic e-commerce season allowed AMZN to report a quarterly EPS of $27.75 per share in its latest quarter, smashing estimates by nearly 660%.

Amazon has an average EPS surprise of a whopping 170% over the last four quarters and has seen current and next year’s EPS estimates increase by 7.5% to $52.22 per share and 3.7% to $76.02 per share, respectively. Furthermore, EPS is forecasted to jump by nearly 25% over the next three to five years.

AMZN is concerned that it won’t be able to allow other businesses on its marketplace with the recent antitrust bills brought to light. However, Amazon has created a much more diverse set of business operations than just selling products online and that’s worth noting. The e-commerce giant sports a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

Alphabet

Alphabet Inc.

GOOGL

has seen its shares lose nearly 2% in value in 2022, but shares have gained almost 38% over the last year and have benefitted from the recent rally.

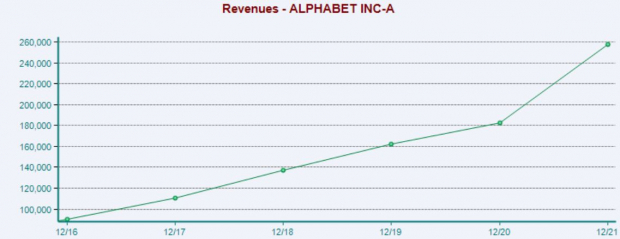

Advertising revenue, Google’s primary source of income, saw a notable 42% increase from 2020 to 2021. In its latest quarterly report, Google said that users are increasingly using more diverse devices to access its products and services, and in turn, boosting this line of business. Overall, revenue surged 42% from 2020 to 2021.

Image Source: Zacks Investment Research

As online behavior evolves, Google expands and evolves its product offerings to serve these changing needs, such as recently giving an increased focus on YouTube and Google Play ads due to their increased profitability. A rapidly growing digital landscape propelled the latest quarter’s results, with the company beating estimates by nearly 15% and reporting EPS of $30.69.

The company has an average EPS surprise of 35% over its last four quarters, and the current and next year’s consensus estimate trend has increased by 4% to $117.70 per share and 3.5% to $137.06 per share, respectively. Additionally, earnings are expected to grow by 20% over the next three to five years.

Google is concerned over the antitrust bills, citing its potential inability to feature Google Maps in search results. Considering how tightly woven Google is within the internet, it seems that these pushes may pan out to be futile. The company is currently a Zacks Rank #3 (Hold) with an overall VGM Score of a B.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report