Electric carmaker Tesla Motors

TSLA

is scheduled to report fourth-quarter 2021 results on Jan 25 after market close. Let’s take a closer look at its fundamentals ahead of the earnings release.

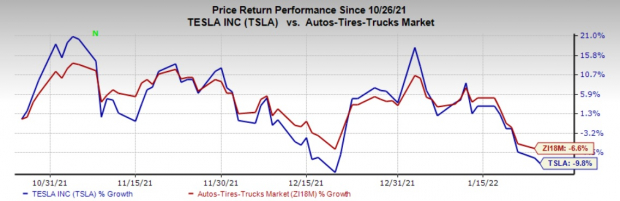

Over the past three months, Tesla has been on a rough ride, plunging 9.8% and underperforming the industry’s average loss of 6.6%. The trend might reverse given the higher chances of earnings beat and positive earnings revisions, which are generally a precursor to an earnings beat ahead of its Q4 report.

Image Source: Zacks Investment Research

This has put focus on ETFs —

Simplify Volt Robocar Disruption and Tech ETF

VCAR

,

Consumer Discretionary Select Sector SPDR Fund

XLY

,

Vanguard Consumer Discretionary ETF

VCR

,

Fidelity MSCI Consumer Discretionary Index ETF

FDIS

and

MicroSectors FANG+ ETN

FNGS

— with a substantial allocation to this luxury carmaker.

Earnings Whispers

Tesla has a Zacks Rank #1 (Strong Buy) and an

Earnings ESP

of +4.69%. According to our methodology, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

The electric carmaker saw a positive earnings estimate revision of 9 cents over the past seven days. Analysts increasing estimates right before earnings — with the most up-to-date information possible — is a good indicator for the stock. The earnings track is robust for the company, which delivered a four-quarter average earnings surprise of 25.38%. Additionally, the Zacks Consensus Estimate for the fourth quarter indicates substantial year-over-year growth of 163.7% for earnings and 49.6% for revenues (see:

all the Alternative Energy ETFs here

).

Tesla has a top Growth Score of A and belongs to a bottom-ranked Zacks industry (in the

bottom 36%

). The Zacks Consensus Estimate for the average target price is $907.55, with nearly 45% of the analysts giving a Strong Buy or a Buy rating ahead of the company’s earnings.

While Tesla is poised for robust growth, its valuation remains high. The stock has a P/E ratio of 107.53 versus the industry average of 11.14. Tesla hit the trillion-dollar market capitalization for the first time in October.

Strong Q4 Production

Earlier this month, Tesla reported another quarter of record deliveries, underscoring its strong growth and defying the global automotive semiconductor shortage that is hampering car production across the globe.

Tesla delivered a record 308,600 (296,850 Model 3 and Y, and 11,750 Model S and X) vehicles in Q4. Deliveries surged 70% from the year-ago levels and 30% from Q3. In fact, Q4 is the sixth consecutive quarter that the world’s most valuable automaker posted record deliveries. With this, annual deliveries surged 87% year over year to 936,172 vehicles, marking the fastest pace of growth in many years (read:

ETFs to Drive Tesla’s Near $1 Million Vehicle Deliveries

).

The electric carmaker produced 305.840 (292,731 Model 3 and Y, and 13,109 Model S and X) vehicles during the quarter.

ETFs to Watch

Simplify Volt Robocar Disruption and Tech ETF (VCAR)

Simplify Volt Robocar Disruption and Tech ETF is an actively managed ETF, seeking concentrated exposure to the leader of autonomous driving technology and then enhancing the concentrated exposure with options. It is heavily exposed to the Tesla stock and Tesla call options at 25% share.

Simplify Volt Robocar Disruption and Tech ETF seeks to boost its performance during extreme moves in Tesla, charging investors 0.95% in annual fees. It has accumulated $8.7 million in its asset base while trading in an average daily volume of 32,000 shares (read:

Best-Performing ETFs of Fourth Quarter

).

Consumer Discretionary Select Sector SPDR Fund (XLY)

Consumer Discretionary Select Sector SPDR Fund offers exposure to the broad consumer discretionary space by tracking the Consumer Discretionary Select Sector Index.

Consumer Discretionary Select Sector SPDR Fund is the largest and the most popular product in this space, with AUM of $21.2 billion and an average daily volume of around 8.2 million shares. Holding 61 securities in its basket, Tesla takes the second spot with 18.2% of assets. Consumer Discretionary Select Sector SPDR Fund charges 12 bps in annual fees and has a Zacks ETF Rank #2 (Buy) with a Medium risk outlook.

Vanguard Consumer Discretionary ETF (VCR)

Vanguard Consumer Discretionary ETF currently follows the MSCI US Investable Market Consumer Discretionary 25/50 Index and holds 304 stocks in its basket. Of these, Tesla occupies the second position with a 13.9% allocation. Internet & direct marketing retail takes the largest share at 24.1%, while automobile manufacturers, home improvement retail and restaurants round off the next two spots.

Vanguard Consumer Discretionary ETF charges investors 10 bps in annual fees, while volume is moderate at nearly 134,000 shares a day. The product has managed about $6.8 billion in its asset base and carries a Zacks ETF Rank #2 with a Medium risk outlook (read:

Forget Amazon, Buy 5 Reopening-Friendly Consumer ETFs Instead

).

Fidelity MSCI Consumer Discretionary Index ETF (FDIS)

Fidelity MSCI Consumer Discretionary Index ETF tracks the MSCI USA IMI Consumer Discretionary Index, holding 329 stocks in its basket. Of these, TSLA takes the second spot with a 13.7% share. Internet & direct marketing retail makes up for the top sector with a 23.9% share, followed by specialty retail (20.5%), automobiles (16.7%) and hotels, restaurants & leisure (16.6%).

Fidelity MSCI Consumer Discretionary Index ETF has amassed $1.6 billion in its asset base while trading in a good volume of around 233,000 shares a day on average. Fidelity MSCI Consumer Discretionary Index ETF charges 8 bps in annual fees from investors and has a Zacks ETF Rank #2 with a Medium risk outlook.

MicroSectors FANG+ ETN (FNGS)

MicroSectors FANG+ ETN is linked to the performance of the NYSE FANG+ Index, which is an equal-dollar weighted index, designed to provide exposure to a group of highly traded growth stocks of next-generation technology and tech-enabled companies. It holds 10 equal-weighted stocks in its basket, with Tesla accounting for a 10% share.

MicroSectors FANG+ ETN has accumulated $73 million in its asset base and charges 58 bps in annual fees. It trades in an average daily volume of 23,000 shares and has a Zacks ETF Rank #3 (Hold).

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report