Despite being one of the most in demand assets of 2020, there is still a lot of mystery surrounding bitcoin and cryptocurrencies in general.

Rising from US$4,000 in March 2020, to more than US$57,000 in February 2021, bitcoin has soared 1,175 percent, and topped out with a market cap of more than US$1 trillion.

The rapid rally has prompted CitiGroup Bank (NYSE:

C

) to state bitcoin was at a watershed moment that may result in it becoming the currency of global trade.

“There are a host of risks and obstacles that stand in the way of bitcoin progress,” Citi’s analysts

wrote

. “But weighing these potential hurdles against the opportunities leads to the conclusion that bitcoin is at a tipping point.”

In November, the American bank

projected

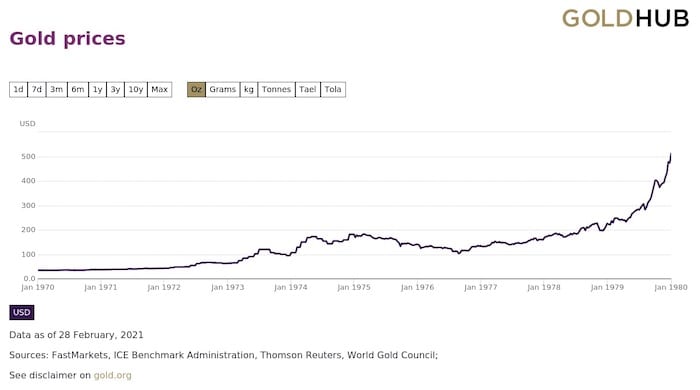

bitcoin could reach US$300,000 by December 2021. The report called the digital cash the “new

gold

,” comparing it to the performance exhibited by the yellow metal in the 1970s.

Between January 1, 1970 and January 1, 1980, the value of gold rocketed 1,326 percent, from US$35.17 to US$512.

Gold price performance, 1970 to 1980. Chart via

World Gold Council

.

With bitcoin mimicking some of the trends that have benefited gold in its ascent to record territory (US$2,063 August 2020), the Investing News Network wanted to look at some of the lesser known things regarding this emerging asset class.

Bitcoin price performance, March 2020 to March 2021. Chart via

CoinDesk

.

1. Bitcoin is not legal tender

One of the hindrances to bitcoin’s early growth was the ability to actually spend it anywhere. While the tech savvy sang the praises of the digital money, most of us were confused as to what we would do with it.

Now the list of companies that are accepting bitcoin as payment is beginning to grow, including the likes of Microsoft (NASDAQ:

MSFT

), Tesla (NASDAQ:

TSLA

), Visa (NYSE:

V

) and MasterCard (NYSE:

MA

). Widespread adoption will be key in moving the value of bitcoin higher; however, the world’s first cryptocurrency is not considered legal tender. Meaning bitcoin is not an acceptable payment method for debt.

“Only the Canadian dollar is considered official currency in Canada,” notes the Government of Canada’s

website

. “Digital currencies are not supported by any government or central authority, such as the Bank of Canada.”

The complexity associated with understanding bitcoin is a factor that may prevent the asset from ever becoming legal tender.

The very nature of bitcoin may also be an obstacle to its growth.

Born out of the 2008 financial crisis

, bitcoin is a response to what was deemed as untrustworthiness in the banking and financial system. The very system that would need to be part of the mainstream adoption needed to help support the case of bitcoin as a currency.

2. Bitcoin might not be as private as it seems

In its early days, bitcoin was often associated with the black marketplace, the Silk Road. The crypto asset, believed to be untraceable, was an ideal way for criminals to move their wares. In late 2020, it was reported that

US$1 billion

worth of bitcoin linked to the dark website had been moved from a bitcoin wallet.

As bitcoin’s image became cleaner the idea morphed into the concept of added security as a result of these untraceable transactions.

However, those private transactions may not be as secure, or untraceable as many believe.

For instance, that US$1 billion from the Silk Road was likely traced using bitcoin’s cornerstone technology,

blockchain

. In the 2008 white paper that introduced bitcoin to the world, creator Satoshi Nakamoto described an immutable, universal ledger that would track and record every bitcoin transaction. The ledger powered through blockchain, would prevent double spending of bitcoin.

Because bitcoin is not a tangible asset, it is stored digitally. Often in bitcoin wallets which can be housed independently on a private USB stick or at a bitcoin wallet firm.

Since its inception, the concept of a bitcoin wallet is for a user to have two access keys. One a public key the owner will use to have other bitcoin users send or make deposits into their wallet.

The other, a private key, only known by the owner allowing them to withdraw and move bitcoin from the wallet.

This globally accessible record would allow anyone with a person’s public key to view every public transaction performed by a person, which is equivalent to having access to every receipt from every purchase you ever made.

In fact, the US$1 billion bitcoin move was traced using the bitcoin address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx.

According to Elliptic

, a company focused on blockchain analytics and compliance for crypto assets, before the November 2020 transaction that account held the fourth largest amount of bitcoin globally.

3. Bitcoin is not insured

Bitcoin, like legal tender cash or gold, is a bearer instrument, meaning whoever possesses it is the owner. However, because bitcoin isn’t government tender or insurable like gold it leaves little recourse if your asset is stolen.

It is estimated that US$1.15 billion in bitcoin has been stolen since 2014. Of that very little of that has been recouped and none was insured. Most notably, was the US$500 million theft from the Japanese exchange, Coincheck, in 2018.

There are rumblings that crypto insurance is on the way, but in the meantime that leaves many bitcoin owners using wallet firms or storage companies out of luck if the system is hacked and the bitcoin stolen. Unless the company has previously agreed to repay any stolen crypto, and also has the financial means.

Add to this, people who are unable to access their own bitcoin due to losing their private key.

“There’s estimates that up till now as much as 20 percent, or more of all the bitcoins that are out there are either lost or inaccessible because people have forgotten passwords,” John Wilson, co-CEO and managing partner of Ninepoint Partners said.

Wilson’s firm recently

launched the Ninepoint Bitcoin Trust

(TSX:

BITC.UN

), in hopes investors who may be confused by the bitcoin market would prefer a simpler, streamlined way to enter the market.

The world’s first two

bitcoin ETFs

, also launched in 2021, with the same goal in mind.

Securing bitcoin wallets and transactions will become increasingly important as widespread adoption of the crypto asset continues. This will also be compounded by the fact that of the

21 million bitcoins

in existence, 18.5 million have already been mined.

Don’t forget to follow us

@INN_Technology

for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.