Amazon

AMZN

, the widely-hailed mega-cap technology giant, shocked the market by announcing a 20-for-1 stock split back in early March. Amazon shares have been in cruise mode over the last few years, soaring as high as $3,750 at all-time highs and significantly raising the barrier of entry for potential investors.

Stock splits have gained popularity recently, with other giants such as Alphabet, Inc.

GOOGL

and Tesla

TSLA

getting in on the action to slash high share prices. Now, after Amazon’s first split since 1999, investors will gain the ability to scoop up shares at a more enticing and affordable price point.

A stock split doesn’t affect a company’s valuation, but it does lower the value of each individual share, making it easier for the stock price to multiply once again and provide considerable gains. The tech giant’s split is slated to take place on June 6th, but there are three reasons why I believe you shouldn’t wait and buy Amazon shares now, pre-split.

Robust Cloud Services

Amazon Web Services (AWS) is the world’s most comprehensive and broadly adopted cloud platform. The service has millions of customers, including fast-growing startups, large enterprises, and leading government agencies. These customers rely on AWS to lower business costs, become more agile in the cloud, and ramp up innovation.

With over 200 fully-featured services from data centers globally, AWS allows customers an effortless, faster, and more cost-effective experience than any other cloud provider. Additionally, AWS has the deepest functionality within its services, offering the widest variety of purpose-built databases for a wide range of applications.

It’s been the company’s fastest-growing source of revenue. From 2020 to 2021, net sales from AWS surged nearly 80%, raking in $62 billion compared to the previous figure of $35 billion. This line of business looks to remain rock-solid, with companies such as Meta Platforms

FB

and Best Buy

BBY

recently selecting AWS as their preferred cloud provider. Furthermore, Nasdaq has shared its multi-year partnership to migrate its markets onto AWS to become the world’s first fully enabled, cloud-based exchange.

Prime Services

Amazon absolutely dominates the e-commerce and entertainment space. With lucrative features and benefits from its flagship Prime service bringing in consistent web traffic, the company has become the gold standard in online shopping and entertainment. Notably, Amazon announced a price hike for Prime subscriptions in its latest quarter.

In 2021, AMZN had its biggest ever Black Friday to Cyber Monday holiday shopping weekend. U.S.-based third-party sellers sold an average of 11,500 products per minute, and more than 130,000 third-party sellers surpassed $100,000 in sales during this time.

To drive my point further home, the company posted record-breaking online sales in 2021 and raked in $222 billion, up almost 13% year-over-year from 2020. As the digital world continues its rapid expansion, demand for online shopping stands to remain strong, and Amazon will be one of the biggest beneficiaries.

It has been adding high-quality digital entertainment to its Prime Video service, and since 2018, the service has tripled the number of Amazon originals. Starting in September of this year, Prime Video will be the exclusive home of Thursday Night Football as part of a historic 11-year deal with the NFL.

Innovative Devices

Amazon’s Alexa is the company’s most widely-known device that’s taken the world by storm over the last several years. However, AMZN’s device catalog branches out much further than that, and the company recently announced several new innovative devices in its latest earnings report.

The company introduced a new in-vehicle experience for passengers to use Alexa or on-screen touch controls to provide access to over one million TV episodes on Fire TV, a device that has been purchased over 150 million times worldwide since 2014.

It launched its Amazon Smart Air Quality Monitor in several countries, a device that allows consumers to monitor the presence of indoor allergens and toxins, making it simpler for customers to check the air quality inside their homes.

Additionally, shipping of the Ring Alarm Glass Break Sensor started, a device that uses artificial intelligence technology to monitor glass windows or doors, alerting customers whenever glass is broken.

Tesla’s Split

Pivoting away from Amazon, Tesla

TSLA

has been a very famous example of a lucrative stock split. TSLA designs, develops, manufactures, and sells electric vehicles and stationary energy storage products.

The company made headlines recently in its annual shareholder meeting in which it intended to seek approval for another split; the previous one happened in 2020. Since then, Tesla shares have surged nearly 130%, benefitting from increased trading volume and higher interest in cheaper shares.

Tesla’s FY21 sales fell just short of $54 billion, notching a 70% increase from 2020, and since 2017, TSLA’s revenue has climbed nearly 360%, or $42 billion. Over the last 60 days, the current year’s earnings estimate for Tesla has increased almost 5% up to $9.73 per share, and next year’s EPS estimate has gained 2.5% up to $12.99 per share. The company has an average EPS surprise of 33% over its last four earnings reports, and in its latest quarter, TSLA beat estimates by 20%.

Tesla is a Zacks Rank #1 (Strong Buy) and has an overall VGM Score of a D. The chart below dates back to August 31st, 2020 – The day that TSLA shares started trading on a stock split adjusted basis.

Conclusion

Before we conclude, let’s look at a few key metrics to solidify confidence in AMZN.

Analysts have been upping their earnings estimates over the last 60 days, boosting the current year’s consensus estimate trend by 7.5% up to $52.22 per share and next year’s by 4% up to $76.02 per share.

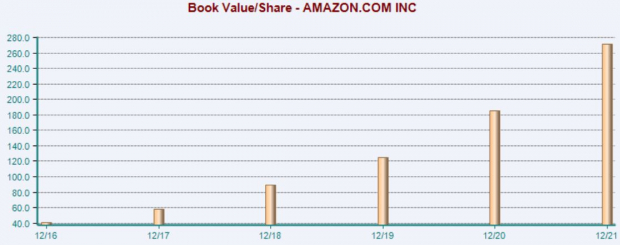

AMZN crushed estimates by an eye-popping 620% in its latest quarter and has a four-quarter trailing average EPS surprise of nearly 170%. A metric that stuck out to me, book value per share, has increased substantially as well since 2016. Additionally, AMZN’s forward-earnings multiple of 62.6X is much lower than its 2022 high of 83.6X. The graph below illustrates the growth of book value per share.

Image Source: Zacks Investment Research

A robust cloud platform, a well-established Prime service, and a dedication to diversifying the company’s product portfolio are why I believe Amazon shares should be purchased pre-split. Additionally, with a much lower price tag, trading volume will come flying in and help propel share price upwards. Amazon is currently a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report