Cloud computing is one of the most exciting industries that has rapidly gained traction over the last several years. It’s undoubtedly a significant highlight of modern technology and has allowed companies and consumers to achieve digital feats that otherwise felt impossible.

For a quick, somewhat simplistic definition, cloud computing is the delivery of computing services – including servers, storage, databases, networking, software, analytics, and intelligence – over the internet to offer accelerated innovation, flexible resources, and economies of scale.

The “cloud” is super secure, blazingly fast, and very reliable. In addition, it eliminates the need to buy expensive hardware and run those expensive on-site data centers.

It’s fascinating to see what companies have achieved with this technology, and it turns out that it’s a very robust industry as well; cloud computing lines of businesses have primarily enjoyed stellar performances and strong revenue growth.

Three big players in the cloud computing realm include Amazon

AMZN

, Salesforce

CRM

, and Microsoft

MSFT

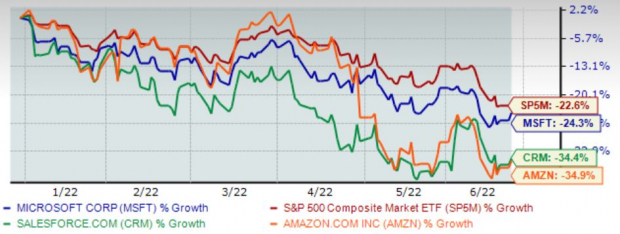

. The year-to-date chart below illustrates the performance of all three companies while blending in the S&P 500 as a benchmark.

Image Source: Zacks Investment Research

As we can see, it’s been a tough stretch for all three companies throughout 2022. Soaring energy costs, supply chain bottlenecks, and most importantly, rising borrowing rates have all played spoilsport for the companies throughout the year.

Let’s dig deeper into each company’s cloud computing segment and analyze how much it has aided top and bottom line results.

Microsoft

Microsoft

MSFT

Azure is the company’s cloud computing service. It’s the only consistent hybrid cloud, delivering unparalleled developer productivity and comprehensive, multilayered security. Azure is available in more than 60 regions globally.

In its latest quarterly release, the company’s Azure cloud platform posted robust results. It reported better-than-expected commercial booking growth of 28%, and Azure Cloud revenue was $23.4 billion, up 32% year-over-year.

Additionally, MSFT believes that cloud technology will be a critical growth driver of the world’s economic output and will further boost its top line in the future.

Since 2017, MSFT’s cloud revenue has grown substantially, up a triple-digit 119%.

Amazon

Amazon Web Services (AWS), Amazon’s

AMZN

cloud service, is the world’s most comprehensive and broadly adopted cloud platform. The service has millions of customers, including fast-growing startups, large enterprises, and leading government agencies. Customers rely on AWS services to lower business costs, become more agile in the cloud, and ramp up innovation.

With over 200 fully-featured services from data centers globally, AWS allows customers an effortless, faster, and more cost-effective experience than any other cloud provider.

Additionally, AWS has the deepest functionality within its services, offering the widest variety of purpose-built databases for various applications.

It’s been the company’s fastest-growing source of revenue. From 2020 to 2021, net sales from AWS surged nearly 80%, raking in $62 billion compared to the previous figure of $35 billion.

This line of business looks to remain rock-solid, with companies such as Meta Platforms

META

and Best Buy

BBY

recently selecting AWS as their preferred cloud provider.

Furthermore, Nasdaq has shared its multi-year partnership to migrate its markets onto AWS to become the world’s first fully enabled, cloud-based exchange – undoubtedly a major positive.

Salesforce

A giant in the cloud space, Salesforce

CRM

, reported strong quarterly results in its latest earnings release. Following the report, shares surged nearly 10%.

Cloud results were robust. The company’s Sales Cloud continued to accelerate, surpassing $1.6 billion in the reported quarter, an 18% year-over-year increase.

CRM’s Service Cloud grew 17% year-over-year to $1.8 billion in revenue in the quarter. Together, Commerce Cloud and Marketing Cloud grew 22% year-over-year for the reported quarter.

Revenue of $7.4 billion pegged a 24% increase in the top-line from the year-ago quarter, and CRM initiated Q2 FY23 revenue guidance of $7.69 – $7.70 billion. In addition, operating cash flow came in at $3.7 billion, a sizable 14% year-over-year increase.

Bottom Line

Cloud computing is a fascinating yet lucrative industry that a few major tech players have recently started to dip their toes into. It’s no surprise why – it’s been one of the fastest-growing and most sought-after technologies in recent times.

Moving forward, the cloud is expected to continue aiding top and bottom line growth. All three companies above would be great places to start for investors seeking exposure to the rapidly growing industry.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report