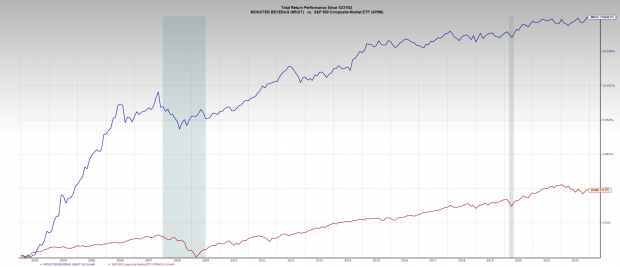

Do you know what the top-performing stock has been over the past 20 years? The probable answers to this question from most investors are probably along the lines of

Apple (AAPL),

Amazon

AMZN

,

or

Alphabet

GOOGL

.

Though thosewould be good guesses, they would be incorrect.

Monster Beverage Corporation

MNST

(formerly known as Hansen Natural, ticker symbol HANS) is the top performer by a long shot. Over the past 20 years, Monster has racked up more than 100,000% in gains, far outpacing any tech stock. To put Monster’s performance in perspective, the second-largest winner over that time is

Tractor Supply Co.

TSCO

,

which has scored gains of more than 40,000%. Below I will discuss where Monster is today, plus two other innovative beverage companies.

Image Source: Zacks Investment Research

Picutred: Monster Beverage’s performance over the past 20 years versus the S&P 500

Monster Beverage: Innovation Leads to Success

Hansen’s, later called Hansen Natural and ultimately Monster Beverage Corp was founded in 1935. For years Hansen existed as a relatively obscure beverage brand that sold juices and “healthy” sodas. That was until 2002, when Hansen decided to diverge from its core business and foray into the energy drink market. Hansen created the Monster Energy Drink, a high-octane carbonated energy drink packed with vitamins. In other words, the company devised a novel way to deliver caffeine, the world’s most popular “drug” to the masses. The rest is history. At this time, Monster accounts for a little less than half of the gargantuan $5.7 billion energy drink market in the U.S.

Monster proves that well-executed innovation and risk-taking can lead to success and massive gains for investors. However, with success, management has yet to rest on its laurels and continues to introduce unique beverages. The Monster brand has more than 30 different drink offerings including energy teas, coffee mixtures, and muscle drinks. Monster’s success has not gone unnoticed. In 2015, the

Coca-Cola Company

KO

,

the king of the beverage market, shelled out more than $2 billion to take a 16% stake in the company. Currently, Coca-Cola is the largest shareholder in the firm and has a stake of just shy of 20%.

Does Monster’s Stock Still Have Energy?

As Monster has grown to be one of the prominent players in the beverage space, the pace of growth has slowed little, with the last eight quarterly reports showing double-digit revenue growth. Last quarter, Monster reported record net sales of $1.62 billion, rising 15% year over year. Despite the impressive sales growth, quarterly EPS fell 5% due to higher input costs, unfavorable foreign exchange rates, and increased co-packaging costs. Nevertheless, management instilled confidence in the company’s prospects by announcing a new share repurchase program of $500 million.

Bottom Line

While Monster does not paint the perfect fundamental picture, there is much to be positive about over the next few years. First, the company has the backing of the most successful beverage company of all time, Coca-Cola. Second, management is buying back shares, a move that will create a floor for shares and increase confidence among investors. Lastly, inflation and the U.S. dollar continue to drop from lofty levels early this year – a tailwind for the company.

Celsius Holdings: Flipping the Narrative on Energy Drinks

Like Monster Beverage,

Celsius Holdings Inc

CELH

has leveraged innovation to achieve massive success in the beverage space. Celsius has taken advantage of the prevailing narrative that most energy drinks are unhealthy and cause late-day crashes and jitters. Rather than create a caffeine-packed unhealthy energy drink, Celsius energy drinks contain no preservatives, high fructose corn syrup, or artificial ingredients. The bet has paid off.

A Healthy Fundamental Picture

Before the last quarter, where the company achieved 98% revenue growth, Celsius had five straight quarters of triple-digit revenue growth. Though last quarter’s earnings saw negative impacts from a one-time sales and marketing termination expense of $155 million, non-GAAP adjusted EBITDA vaulted to $24.8 million compared to the $10.3 million the company earned in the previous year.

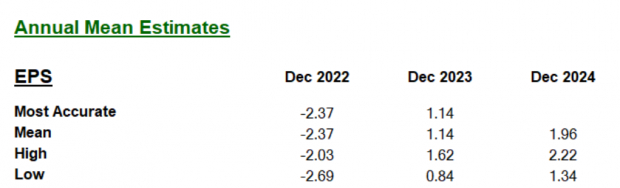

Image Source: Zacks Investment Research

Pictured: Zacks Mean Annual EPS estimates for CELH

What does the future hold for Celsius?

Celsius’s earnings history suggests that healthy energy drinks are here to stay. Zack’s Mean Consensus Estimates suggest that the company will continue to grow rapidly. GAAP estimates move back into positive territory in 2023 and Zacks Consensus Estimates anticipate them to jump drastically in 2024. Like Monster Beverage, Celsius has a big backer in its corner,

PepsiCo

PEP

.

In August, Pepsi inked a $550 million deal that will give Pepsi an 8.5% in stake in the company, a seat on the board of directors, and a long-term distribution agreement. Pepsi’s agreement with Celsius provides investors with a vote of confidence and should help Celsius to continue to its meteoric growth phase and achieve further scale.

Vita Coco: The Newcomer

Vita Coco

COCO

is taking advantage of one of the hottest beverage trends over the past few years, coconut water. Vita Coco came public in October of 2021. Beyond the company’s top-selling coconut water, Vita Coco offers a clean energy drink, enhanced water products, and protein-infused water.

Fundamentals

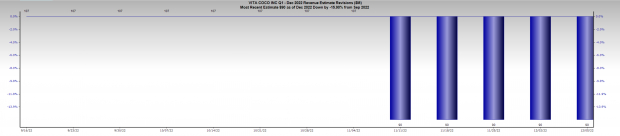

Though Vita Coco is much smaller in market cap than Celsius, the company is growing at a slower pace. Last quarter sales increased a tepid 7% while gross profits decreased $11 million over the previous year to $81 million, driven by higher transportation costs. Recent Zack’s revenue estimates suggest that earnings growth will not turn around soon.

Image Source: Zacks Investment Research

Pictured: Coco’s uninspiring revenue revisions

Takeaway

At this point, Vita Coco is less attractive than its peers. Celsius and Monster boast more impressive fundamentals, higher liquidity, and the backing of industry leaders such as Coca-Cola and PepsiCo. Nevertheless, investors should watch to see if Vita Coco’s brand can catch on in the next few years. If this is the case, we have learned from Monster and Celsius that it can lead to massive performance.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report