Zoom Video

ZM

recently announced that the company has entered into a definitive agreement to acquire Karlsruhe Information Technology Solutions – Kites, GmbH, a start-up specializing in real-time machine translation.

Kites leverages self-developed technology and predictive AI that runs in the cloud or on-premises to deliver the highest levels of translation accuracy with low latency. The transcript and translated text are displayed in real time before the speaker completes the sentence, and are autonomously modified if a better interpretation is found by adding context.

Zoom and Kites will work together to advance in machine translations and provide multilingual translation options in order to make meetings more productive and efficient for Zoom users. In addition, Zoom is considering setting up a research and development location in Germany.

Zoom already offers real-time transcriptions but these are limited to people who speak English. There are plans to open a research center in Germany, where the Kites team will be located.

Zoom has been benefiting from an expanding enterprise customer base backed by its cloud-native unified communications platform. Its solutions combine video, audio, phone, screen sharing and chat functionalities and make remote-working and collaboration easy.

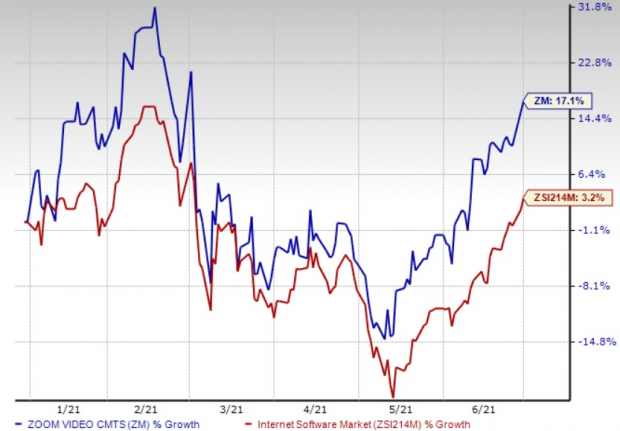

Shares of the company have returned 17.1% in the year-to-date period, outperforming the Zacks

Internet – Software

industry’s rally of 3.2%.

Year to Date Performance

Image Source: Zacks Investment Research

Zoom’s Unified Communications Offerings to Drive User Growth

Zoom’s latest deal is expected to boost the company’s efforts. Kites has its roots in the academic community and strives to apply AI and machine learning to real-time translation.

Machine Translations and AI have been gaining more relevance in virtual communication especially in the post coronavirus remote-working environment. The aim is to translate conferences in real time whether as subtitles or as a spoken word.

With the acquisition of Kites, we expect transcripts to be available in more languages besides English on Zoom’s platform, along with real-time translations. However, the company is facing stiff competition from

Cisco

’s

CSCO

Webex,

Microsoft

MSFT

and

Alphabet

GOOGL

owned Google G Suite.

Cisco has real-time translation based on AI in its Webex conference tool. This allows English conversation to be translated in real time into 100+ other languages as live subtitles. This includes almost all languages that are spoken in Germany’s neighboring countries.

Nonetheless, we believe Zoom’s ability to generate strong cash flows will enable it to make further investments in product development and acquisitions in the future. This Zacks Rank #1 (Strong Buy) company has cash and cash equivalents (including marketable securities) worth $4.7 billion as of Apr 30, 2021. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Recently, Zoom announced the launch of Zoom Phone Appliances, all-in-one desk phones that combine Zoom’s platform with hardware from Yealink and Poly, and are capable of HD video meetings, phone calls and interactive whiteboarding.

Moreover, in May, the company launched Zoom Events, an all-in-one platform with the power to produce interactive and engaging virtual experiences.

User addition and portfolio expansion are being hailed as key catalysts for Zoom to continue on its growth trajectory in 2021. At the end of the fiscal first quarter of 2022, Zoom had roughly 497,100 customers (with more than 10 employees), up 87% year over year.

Moreover, the company had 1,999 customers with more than $100,000 in trailing 12-month revenues, up roughly 160% year over year.

Easy to deploy, use, manage and scalability makes Zoom Video’s software more popular among its customers. For enterprise customers, minimal involvement of IT, lower cost and scalability are major factors behind selecting Zoom Video.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report