It’s been a jam-packed earnings season so far, with the action slowly grinding down to a halt. The majority of companies have already reported their quarterly results, and the market reactions we’ve witnessed have been less than ideal for many companies, to say the least.

As the pandemic slowly subsides, some of the trends that came along with the pandemic are slowly changing as well. When the world was under stay-at-home orders, the digital world vastly accelerated in many ways.

People were suddenly shut off from the outside world, causing them to find other sources of entertainment online. In turn, digital ad revenue for companies climbed quite extensively, as more people than ever were flocking to digital entertainment.

Guidance we received earlier in the week from Snapchat

SNAP

caused an extreme level of heightened volatility within the company’s shares. Following the guidance, shares of many fellow digital advertising peers, such as Alphabet

GOOGL

, also experienced volatility.

We’re here to look at why the volatility within Alphabet shares was a bit of an overreaction from the market.

Snapchat

Snapchat’s

SNAP

primary source of revenue comes from advertisements. The company has a unique competitive advantage against Meta Platforms

FB

and Alphabet in this space, as SNAP has had more success in capturing the millennial and Gen Z audience, who are much more active on social media platforms.

In fact, Snapchat has become the most preferred social media platform among the two demographics, a highlight of their immersive platform. SNAP has stated that it reaches an eye-opening 75% of 13 – 34 year-olds within the United States, making it a larger platform than Facebook, Instagram, and Twitter

TWTR

among this demographic.

SNAP Guidance

Not all things have been positive for SNAP, however.

In guidance released earlier this week, it was revealed that the company had been facing an extremely tough macroenvironment. The company also revealed that it would miss its second-quarter revenue guidance, citing yet again macroeconomic concerns.

Revenue of the company came in at $1.1 billion in Q1, a nasty 18% decline from the previous quarter’s revenue of $1.3 billion.

The market didn’t take this guidance well, as SNAP shares plummeted 43% following the guidance – quite the nasty valuation slash.

Alphabet’s Diverse Operations

In result, another highly-regarded tech giant with digital advertising operations, Alphabet

GOOGL

, saw its shares face some turbulence as well, undoubtedly a sign that the market believes that digital advertisement revenue issues will leak over from SNAP and impact the company.

Simply put, the knee-jerk reaction in GOOGL shares is an overreaction by the market.

Firstly, SNAP and Alphabet are not the same type of company – Google has much more diverse operations than digital advertisements. It seems that the reaction we saw within GOOGL shares was an “act now, think later” type of move.

The company sports a robust cloud computing segment, which is aiding substantial revenue growth and has been a major key catalyst. In its latest quarter, Google Cloud raked in $6.4 billion in revenue, displaying a sizable 41% growth from the year-ago quarter. Additionally, the company’s growing number of data centers is assisting the company in expanding its cloud footprint.

Google has also been making a splash in the wearables industry, rivaling companies such as Apple

AAPL

. Noticing the immense success of the Apple Watch, GOOGL revealed in a conference earlier this year the new Pixel Watch, a premium smartwatch expected to rival Apple’s product and further propel the company’s growth moving forward.

Additionally, the company has acquired Fitbit – a wearable fitness company that has 28 million users worldwide; the acquisition gives Alphabet a bridge to the multi-trillion healthcare market.

Furthermore, with voice activation rapidly gaining popularity within computer interaction, the company’s Nest products are likely to continue assisting Google in boosting its top line from the scorching hot “smart home” market.

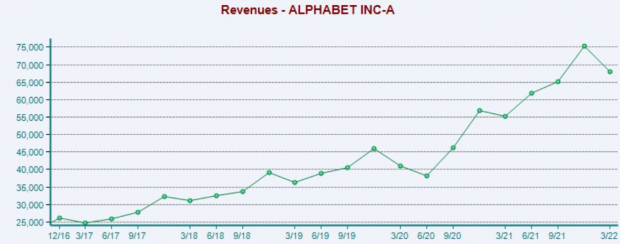

Image Source: Zacks Investment Research

Bottom Line

Alphabet is simply one of the most innovative technology companies in the world, and a growth slowdown within digital advertising is simply a small bump in the road when viewing the long-term picture of the company.

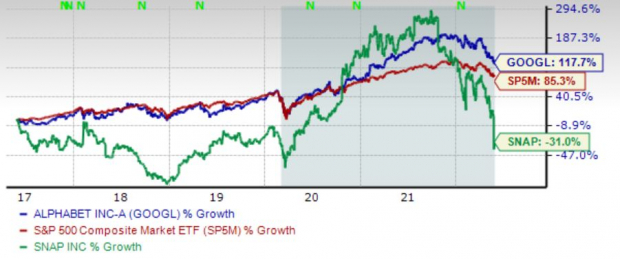

The five-year chart below shows just how well GOOGL shares have performed when compared to SNAP shares and the S&P 500.

Image Source: Zacks Investment Research

As we can see, GOOGL shares are much less volatile than SNAP shares, a development that any investor can’t ignore. Additionally, Alphabet has provided investors with reliable, consistent gains.

All in all, I believe that SNAP’s issues within digital advertising affects the company at a much higher level than it does for Alphabet; GOOGL has much more diverse operations outside of its digital advertising revenue spanning a scorching hot cloud computing industry and recent splashes into the wearables business.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report