When thinking of exciting investments, Tesla

TSLA

shares undoubtedly jump to the forefront of many minds. After all, it’s easy to understand why, as the company has entirely changed the way we see the automotive industry.

And it goes without saying that TSLA shares have rewarded investors handsomely over the last decade, up more than a mind-boggling 6000%.

Image Source: Zacks Investment Research

However, over the last month, TSLA shares have significantly lagged behind the general market, down more than 15% vs. the S&P 500’s marginal 0.6% gain.

With shares deep in the red year-to-date, it raises a valid question: how does the company currently stack up? Let’s take a closer look.

Quarterly Performance

Despite the recent poor share performance, Tesla has consistently delivered better-than-expected bottom-line results, exceeding the Zacks Consensus EPS Estimate by more than 10% in its latest print.

In fact, Tesla has exceeded the Zacks Consensus EPS Estimate in seven consecutive quarters, all by double-digit percentages.

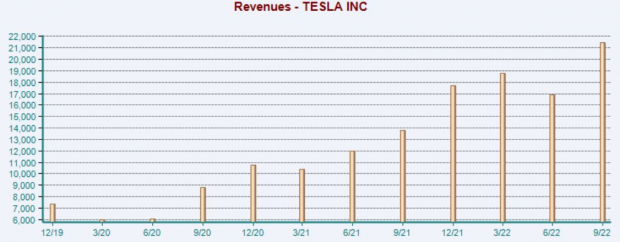

Still, revenue results have come in under expectations as of late, with the company penciling in back-to-back revenue misses. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Growth Outlook

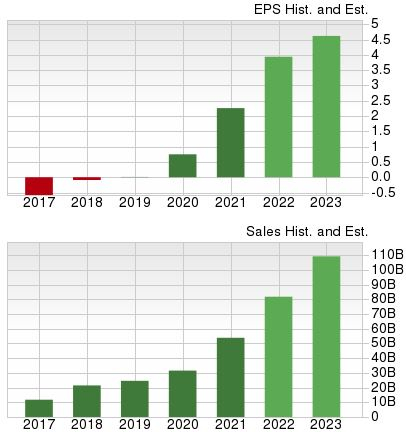

Despite a hawkish Fed and rising logistical costs playing spoilsport for the company, Tesla still boasts an impressive growth profile; earnings are forecasted to soar nearly 80% Y/Y in FY22 and a further 30% in FY23.

The projected growth in earnings comes on top of forecasted Y/Y revenue upticks of 54% in FY22 and 38% in FY23.

Image Source: Zacks Investment Research

Valuation

It’s no secret that Tesla shares are pricey, currently trading at a 6.1X forward price-to-sales ratio. Still, on a relative basis, the value is beneath its 6.5X five-year median value and highs of 23.9X in 2021.

Image Source: Zacks Investment Research

TSLA carries a Style Score of a “D” for Value.

Bottom Line

Tesla

TSLA

shares have displayed a high level of weakness relative to the general market over the last month, indicating that sellers have taken a tight grip.

Still, despite the poor share performance, Tesla has managed to post strong bottom-line results, chaining together a nice streak of positive EPS surprises that are all in the double-digit percentage range.

In addition, investors will have to fork up a hefty premium for the company’s shares, typical within stocks with high-growth profiles.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report