EOG Resources

EOG

reported strong results in the last quarter, with earnings growing 156% from the March quarter of 2021 on sales that grew 68%.

Segmental revenues were ahead of consensus estimates:

Crude Oil and Condensate revenue of $3.889 billion beat estimates by 28.2%; natural gas liquids revenue of $681 million beat by 122.8%; while natural gas revenue of $716 million was more or less in line with estimates. Gathering, processing and marketing revenue of $1.469 billion also beat estimates by 28.0%.

Analyst estimates are generally a good indication of the results a company is likely to report in any given quarter. That is because analysts study various aspects of the business including the major drivers of its growth, the internal strengths and weaknesses, the cost base on which it operates, pricing strength and so forth to arrive at projections of its future performance. Hence, these projections are studied opinions that can be depended upon.

So investors develop a certain expectation about a company’s performance based on the estimates for the concerned period. And when a company significantly underperforms or outperforms estimates, there is usually a reaction from investors that is represented in the share prices. In this case, investors greeted the news with a 6.0% increase in share prices.

Drilling further down into the numbers reveals much more about how the company actually did in the last quarter.

The bulk of

crude oil and condensate

production was in the U.S. where production volumes of 449.4 MBbld missed estimates by a sliver (0.45%). The price of $96.02 a barrel however exceeded the estimate by 29.2%. Trinidad volumes of 0.7 MBbld missed by 69.6% while the price of $83.82 a barrel beat by 25.2%. Total crude oil and condensate production of 450.1 MBbld missed estimates by a sliver and the composite price of $96 a barrel was 13.1% above estimates.

Natural gas liquids

production of 190.3 MBbld was 4.3% above estimates. All of this was in the U.S. and fetched a price of $39.77 a barrel (31.7% above estimates).

Natural gas

production was again mostly in the U.S. Production in the U.S. was 1,249 MMcfd while Trinidad production was 209 MMcfd. The combined production of 1,458 MMcfd missed analyst estimates by 1.4%. The U.S. price of $5.81 per Mcf was 5.5% above estimates. The Trinidad price of $3.36 per Mcf was 12.5% lower than estimated. The composite price of $5.46 was 14.2% above estimates.

Conclusion

From the above it is clear that EOG Resources has slightly lagged in both crude and natural gas production, with natural gas liquids only slightly outperforming. The strong results are therefore attributable to the strong pricing environment.

Zacks Rank

The strong pricing environment has made this industry extremely attractive. This is why there are a large number of Zacks #1 (Strong Buy) stocks to choose from. In addition to EOG, some of the others are Antero Resources

AR

, Chesapeake Energy

CHK

, Civitas Resources

CIVI

and Comstock Resources

CRK

.

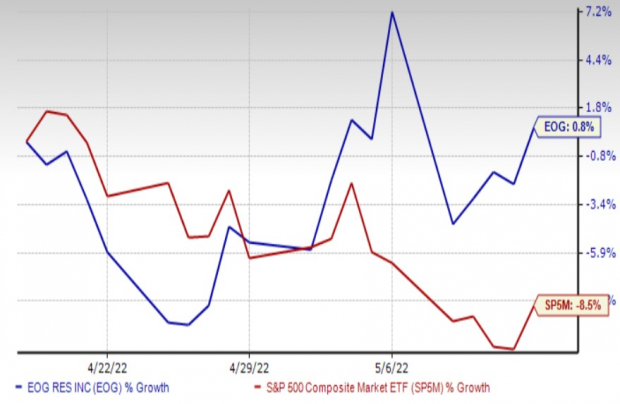

One-Month Price Performance

Image Source: Zacks Investment Research

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report