Warren Buffett is one of the most widely-followed individuals in the financial world. Known for amassing a fortune within the stock market with a unique approach, it’s easy to see why some call him the most successful investor of all time and why eyes are constantly fixated on him.

Buffett is a philanthropist and businessman. He’s the CEO of Berkshire Hathaway, a diversified holding company whose subsidiaries engage in insurance, freight rail transportation, energy generation and distribution, manufacturing, and many others.

He’s had stellar returns in the market, and investors are always looking to see his next move. Simply put, he has been excellent in picking stocks – and that’s what we’re here to look at today.

In 2022, three stocks that Buffett has increased his position size in are Activision Blizzard

ATVI

, Apple

AAPL

, and Chevron

CVX

. Generally, it’s a good sign to see him start a new position, as he rarely does it, but it instills even more confidence in the company moving forward when he adds to a position.

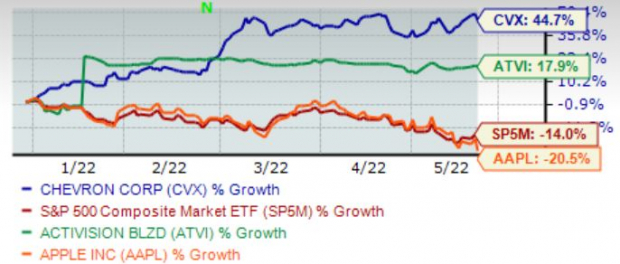

The chart below illustrates the year-to-date share performance of all three companies while blending in the S&P 500 for a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into these companies to understand why he has increased his position on them.

Activision Blizzard

Activision Blizzard (ATVI) is a leader in video game development and an interactive entertainment content publisher. Currently, the company operates five business units: Activision Publishing, Blizzard Entertainment, Major League Gaming, King, and Activision Blizzard Studios.

Microsoft

MSFT

acquired ATVI to bolster its stance in a booming gaming industry in January. Berkshire has been adding to its position within ATVI in a merger arbitrage play, meaning that he believes the acquisition will go through at the agreed-upon $95 per share price tag.

As of today, ATVI shares are trading at around $78 per share. It’s a speculative play in nature, but Buffett believes the odds of the acquisition completing are in his favor.

ATVI has struggled immensely over its last four quarters, acquiring an average EPS surprise in the negative of -7.7%. The company missed earnings estimates by a double-digit 48% in its latest quarter. Additionally, ATVI is a Zacks Rank #5 (Strong Sell).

Earnings for the current fiscal year are forecasted to shrink nearly 20%, and the top line is penciling in a top-line decrease of 2.2% from FY21. Clearly, Buffett is betting on the value that completing the acquisition carries, not so much on the company’s underlying fundamentals and growth rates.

Apple

We all know Apple (AAPL), the creator of the legendary iPhone, Mac computers, AirPods, and the Apple Smartwatch, to name a few. The company has completely shifted the mobile phone landscape over the last decade, and it’s been one of the best places for investors to park their cash.

Buffett has said numerous times that he like Apple because of how strong the company’s brand loyalty is. That means that Apple customers have a high tendency to trade in their old Apple products for new ones, helping it establish an extremely loyal customer base. Additionally, he believes that the services and products that the company provides are very beneficial and crucial to society.

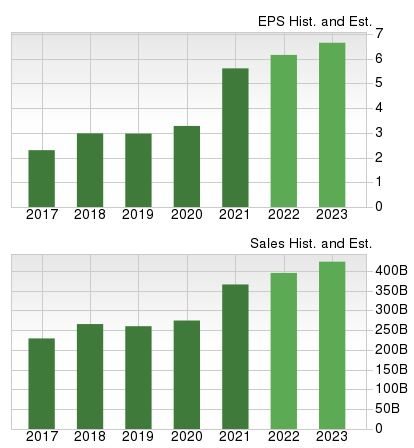

Apple has performed very well over the last four quarters, acquiring an average EPS surprise in the double-digits of 12%, and in its latest quarter, in the face of adverse market conditions, the company still managed to exceed EPS expectations by a notable 6.3%. Apple is currently a Zacks Rank #3 (Hold).

For the current fiscal year, earnings are expected to climb 9% from 2021, and sales estimates have Apple raking in a mighty $395 billion, an 8% year-over-year expansion of the top line. It’s easy to see why the company is currently Buffett’s biggest hold, and I doubt that will change anytime soon, especially since he just reloaded.

Image Source: Zacks Investment Research

Chevron

Chevron (CVX) is one of the world’s largest publicly traded oil and gas companies, with operations that span nearly all corners of the globe. The stock has been a gold mine for investors throughout 2022, gaining almost 46% in value.

Berkshire Hathaway significantly raised its stake in the oil giant, becoming the fourth largest hold in the portfolio. It represents a huge bet on the oil industry, a primary focus of attention within the market throughout 2022.

When asked about the initial purchase of CVX shares last year, Buffett said, “I think Chevron’s benefited society in all kinds of ways, and I think it continues to do so, and I think we’re going to need a lot of hydrocarbons for a long time and we’ll be very glad we’ve got them, but I do think that the world’s moving away from them, too, and that could change.”

Over the oil giant’s last four quarters, the company has acquired an average EPS surprise of a respectable 6.3%, but it missed earnings expectations by 2.3% in its latest report. Looking forward, growth rates look immaculate. Earnings are expected to climb a triple-digit 173% for the current fiscal year. Additionally, revenue for CVX is forecasted to rise a spectacular 35% year-over-year from 2021. CVX is a Zacks Rank #3 (Hold).

Bottom Line

Warren Buffett has become an icon in the investing world. Known for generating consistent, large returns, it’s easy to understand why investors always want to know his next move. After all, many investors in the world simply copycat his holdings in an attempt to reap considerable gains.

Three companies he has increased his position in during 2022 include Activision Blizzard, Apple, and Chevron.

The ATVI addition is a merger arbitrage play, the AAPL addition displays his confidence in the brand loyalty the company has, and the CVX addition indicates a large bet that hydrocarbons will be necessary for some time to come.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report