Volkswagen

VWAGY

has recently consented to the setting up of a new factory in Wolfsburg-Warmenau, Germany. An investment to the tune of $2.2 billion has been earmarked for the site, from where VWAGY will produce its upcoming all-electric, high-efficiency sports sedan called Trinity. The construction of the facility is scheduled to begin as early as spring of 2023, and the rollout of the assembly line has been slated for 2026.

With Trinity being the central focus of the firm’s electrification strides, Volkswagen plans to expand battery, charging and digitalization activities. Consequently, the project looks to push up employment to robust levels.

The net carbon-neutral Trinity model not only forms an intrinsic part of the auto magnate’s plans to gradually transition to a software-driven mobility provider, but also aims to set high environmental standards. The trailblazing sedan will debut alongside VWAGY’s highly expandable Scalable Systems Platform (“SSP”). The SSP will be a backbone of models for all Volkswagen brands. The company’s new Campus Sandkamp is developing the SSP vehicle platform.

The Trinity Project is a catalyst and springboard in redefining Volkswagen’s potential to compete with manufacturers like

Tesla

TSLA

, a company that has taken the market by storm.

Volkswagen is confident that the Trinity factory will be capable of giving a tough competition to Tesla’s Gigafactory Berlin in Grünheide. Presently, VWAGY is at a production time of 30 hours per car, while Tesla is expected to achieve the mark of 10 hours per car at the Gigafactory Berlin. The Trinity sedan thus looks at a leaner production time with fewer components and a greater degree of automation, and is set for a pompous start.

Driving Electrification Efforts

Volkswagen has been intensively increasing its deliveries of Battery-Electric Vehicles (“BEV”) to mark its spot in the electric vehicle (EV) domain. Its framework of Planning Round 70 focuses on electrifying more European plants to help the company achieve a global leadership position in electric mobility by 2025. Thus, the firm is vigorously driving forward the implementation of its NEW AUTO strategy. The futuristic spending of EUR 89 billion, focused primarily on e-mobility and digitalization, accounts for the largest proportion of the total investment of EUR 159 billion that has been earmarked. The firm expects one in four vehicles sold to have a battery-electric drive system by 2026.

Under the NEW AUTO model, Volkswagen nearly doubled its BEV deliveries year on year to 452,900 units in 2021. This accounts for 5.1% of total deliveries, up from 2.5% in the previous year. The auto bigwig is the European market leader for BEVs and has achieved the second-largest share of the key U.S. market, with about 7.5%. In China, 92,700 BEVs were delivered, increasing four fold from the 2020 level. In total, VWAGY delivered 8,882,000 vehicles worldwide in 2021, down 4.5% year over year amid the global semiconductor shortage. As the company is inching toward a more electrified product portfolio, the investment planning for the years 2022 to 2026 has taken this into account, and these plans provide for an increase in capex and development costs for e-mobility of around 50% compared with the previous planning, which comes to a total of EUR 52 billion.

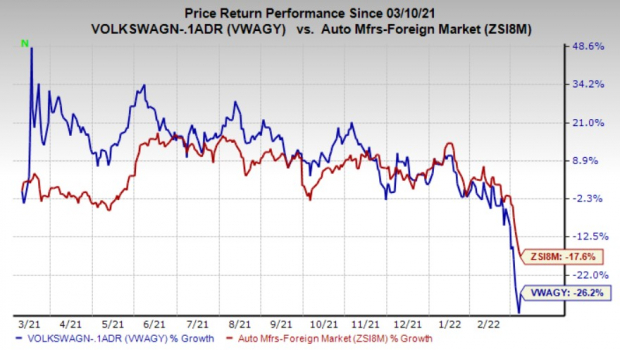

Shares of Volkswagen have declined 26.2% over the past year, underperforming its

industry

’s 17.6% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, VWAGY has a Zacks Rank #3 (Hold).

Better-ranked players in the auto space include

Harley-Davidson

HOG

and

LCI Industries

LCII

, both sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Harley-Davidson has an expected earnings growth rate of 1.9% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 21.7% upward in the past 60 days.

Harley-Davison’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. HOG pulled off a trailing four-quarter earnings surprise of 77.59%, on average. The stock has rallied 2.9% over the past year.

LCI Industries has an expected earnings growth rate of 27.8% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 16% upward in the past 60 days.

LCI Industries’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one. LCII pulled off a trailing four-quarter earnings surprise of 12.86%, on average. The stock has declined 19.5% over the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report