Turtle Beach Corporation (NASDAQ:HEAR) shares rallied at a robust pace since the start of this year, the result of traders’ confidence in its future fundamentals. Turtle Beach shares rose more than 1000% at the beginning of the year to the highest level in the last three years.

Its shares are currently trading around $21, just shy from the three-year high of $24 it achieved a few days ago. Bullish remarks from market analysts regarding its future fundamentals contributed to the massive rally in its share price.

Analysts from Oppenheimer and Wedbush are showing confidence in Turtle Beach’s balance sheet, as well as its market position in console headsets and product quality. Both firms have set an ‘Outperform’ rating for Turtle Beach shares.

Recent Financial Numbers Pushed Turtle Beach Shares Higher

Turtle Beach Corp, the leading gaming headset and audio accessory brand, generated year-over-year revenue growth of 185% in the first quarter, supported by the increase in its market share along with higher volumes from high-performing game releases.

The company claims the successes of Fortnite and PlayerUnknown’s Battlegrounds have attracted new gamers into the market – which has generated a strong demand for its headsets.

>> These Small-cap Stocks Are Worth Considering

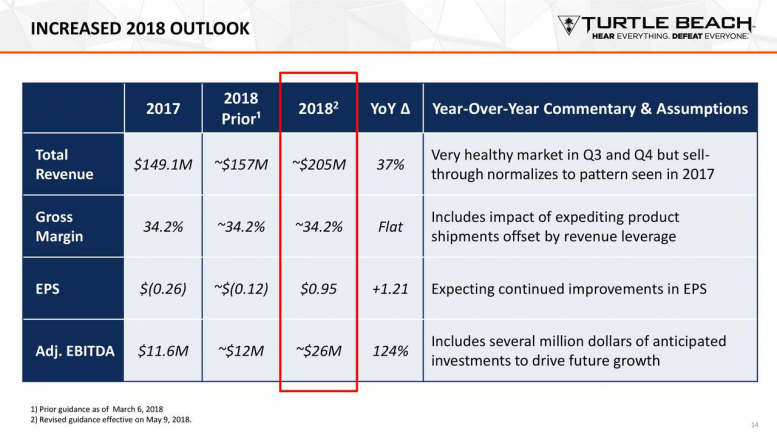

On top of its substantial revenue growth, the company’s margins and earnings also grew significantly when compared to the previous quarters. Turtle Beach’s gross margin of 36.8% in the first quarter doubled from the same period last year, while its adjusted EBITDA increased $11 million year-over-year in the first quarter.

Full-year Outlook Supports Potential Gains

Turtle Beach Corp expects to extend the momentum to the following quarters this year. The company now expects its second-quarter revenue to increase 165% from the same time last year. Full-year revenue outlook is likely to stand in the range of $205 million, substantially higher than previous estimates for $149 million. Overall, Turtle Beach Corp has been experiencing a strong demand for its gaming headset and audio accessory products – which would most likely continue to contribute to its share price performance.

Featured Image: Twitter