TotalEnergies SE

TTE

announced that it has entered into various agreements with Libyan authorities to further expand its presence in Libya’s Energy space and aid in the sustainable development of the country’s natural resources. After political turmoil, the country is presently in the rebuilding phase and TotalEnergies’ investment will assist in the gradual revival of its energy space.

Primarily, TotalEnergies will assist in restoring Libya’s oil production and development of clean energy projects. A Memorandum of Understanding has been signed between TotalEnergies and the General Electricity Company of Libya with the objective of development of solar photovoltaic projects with a total capacity of 500 megawatts designed to supply electricity to the national grid.

TotalEnergies has also agreed to invest in projects for reducing gas flaring in oilfields in order to supply gas to power plants. In addition, TTE will contribute to Libya’s goal of restoring the country’s oil production to 2 million barrels per day and supplying to world markets.

The Council of Ministers of the Government of National Unity approved the joint acquisition by TotalEnergies and ConocoPhillips of an 8.16% interest held by Hessin the Waha concessions. Earlier in 2018, TotalEnergies acquired Marathon Oil Libya Limited, which held a 16.33% interest in the Waha Concessions in Libya. TotalEnergies plans to invest $2 billion in this project to further enhance oil production from this region.

Prospects in Libya

Libya, which is rich in oil reserves, aims to increase oil production to 2.1 million barrels per day and natural gas production to about 4 million cubic feet per day over the next five years. Rich hydrocarbon reserves in Libya are drawing attention from global majors like TotalEnergies and

Eni S.p.A

.

E

, among others.

Eni has already invested more than $10 billion to date in the development and exploration of Libya’s abundant natural resources. Eni will invest more in the Libyan energy space and plans to explore new areas within Libya’s energy sector, primarily offshore regions. Eni will primarily focus on the development of oil and natural gas projects in Libya as well as provide support for developing Libya’s oil and gas assets.

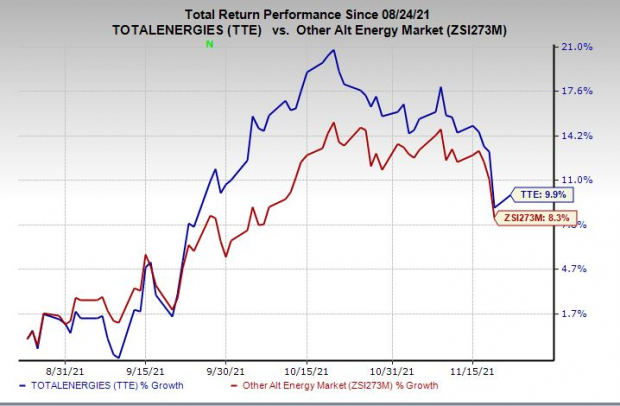

Price Performance

In the past three months, TotalEnergies’ shares have outperformed the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Another Key Pick

TotalEnergies currently sports a Zacks Rank #1 (Strong Buy). Another company worth considering from the same space is

Chesapeake Energy

CHK

, sporting the same rank as TotalEnergies.

You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Chesapeake Energy delivered an average surprise of 23% in the last four quarters. The Zacks Consensus Estimate for 2021 and 2022 earnings for Chesapeake Energy has moved up 11.9% and 31.8%, respectively, in the past 60 days.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report