TotalEnergies SE

TTE

reaffirmed its strategy of producing multiple sources of energy, with a primary focus on cutting carbon emissions. TotalEnergies is on course to meet its target of net-zero carbon emission by 2050 and is implementing steps to achieve the same. The company expects to lower scope 1+2+3 net operated oil & gas emissions worldwide by 30% within 2030 from a 2015 base and contribute to lowering greenhouse gas emissions.

As more and more companies are taking measures to cut emissions, scope 1+2 net operated oil & gas emissions worldwide will decrease 40% between 2015 and 2030, and worldwide absolute scope 3 emissions will be lower in 2030 compared to 2015.

Ways to Achieve Zero Emissions and High Energy Production

An increase in the global population will undoubtedly hike the demand for electricity and the challenge for energy companies in the coming decades will be to increase electricity production without enhancing greenhouse emissions.

TotalEnergies is going to increase its energy production by 30% within 2030 from the current levels, with 50% of the growth coming from electricity, essentially renewables, and the other half from LNG. The acquisition of controlling stakes in

SunPower Corporation

SPWR

in 2021 was a positive step taken by the company to expand the renewable business.

The company is making systematic investments in its operations to achieve clean energy transition goals. The company will invest $13-15 billion per year for the 2022-2025 period and allocate 50% of these investments for growing its activities and the rest for maintaining operations. Out of the planned growth investment, 50% will be dedicated to the development of new energies, mainly renewables and electricity, and the other half to natural gas, essentially LNG.

TotalEnergies is aiming to increase LNG production by 30% and substantially improve biogas production by 2025. The company aims to produce 100 GW of renewable electricity by 2030. Increasing the production of clean sources of fuel and electricity will assist it in lowering global emissions.

The company is also very actively developing electric vehicle charging networks in many countries across the globe, which will also assist it in cutting emission levels from transportation. Since the company is focused on achieving zero emissions by 2050, most of the electricity to be supplied from the charging points will be sourced from renewable power plants. Another energy giant

BP Plc.

BP

is investing in EV charging network development, and has been developing the EV charging network in the United Kingdom and China.

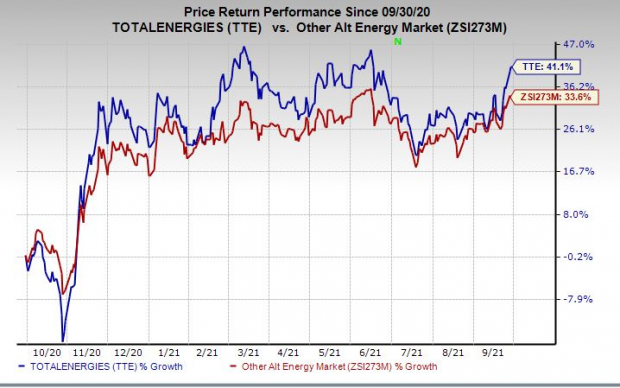

Price Performance

In the past 12 months, TotalEnergies’ shares have outperformed the

industry

.

Image Source: Zacks Investment Research

Zacks Rank and Key Pick

TotalEnergies currently has a Zacks Rank #3 (Hold). A better-ranked stock in the same industry is

Chesapeake Energy Corporation

CHK

, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Chesapeake Energy delivered an average earnings surprise of 13.3% in the last four quarters. The Zacks Consensus Estimate for 2021 earnings has moved up 19% in the past 60 days to $8 per share.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report