U.S. stock markets witnessed a broad-based decline in September. Although historically September is the worst-performing month on Wall Street, this year it was the most disastrous in a decade.

Nevertheless, market participants have entered October — known for its historically fluctuating trading pattern — with several volatile factors that caused a meltdown on Wall Street last month. However, all is not bleak for investors. September’s mayhem has made some of the factors favorable for investors, the ones that were the cause of market uncertainty last month.

Moreover, a closer look at Wall Street reveals that a small bunch of stocks provided good returns last month defying the market rout. A handful of those are currently Zacks Top-Ranked stocks with strong potential for the near term. At this stage, investment in these stocks should be fruitful.

Stressful September

Last month, the three major stock indexes – the Dow, the S&P 500 and the Nasdaq Composite – plummeted 4.3%, 4.8% and 5.3%, respectively. The Dow registered its worst-monthly performance since October 2020.

Both the S&P 500 and the Nasdaq Composite recorded the worst monthly decline since March 2020. The Dow registered the worst monthly decline since October 2020. All three indexes posted their worst September since 2011. Ten out of 11 broad sectors of the S&P 500 Index ended in the red with the notable exception of energy. The CBOE VIX — popularly known as the market’s fear gauge — soared 40.4% last month.

Volatility inflicted September from several corners. The rapid spread of the Delta variant of coronavirus has compelled a section of economists and financial experts to curtail their forecast for third-quarter U.S. economic growth.

Higher inflationary pressure is likely to persist next year owing to prolonged supply-chain disruptions. Fed Chairman Jerome Powell signaled that the central bank will start tapering its $120 billion per month bond-buy program possibly this year and the first hike in interest rates may happen in the second half of 2022. Consequently, yields on government bonds spiked significantly.

Finally, investors were concerned about overvaluation in U.S. stocks and sought reasons for a market correction.

Near-Term Drivers

Last month’s market mayhem has significantly reduced the overall valuation of U.S. stock markets. The Dow and the S&P 500 are currently down more than 5% from their recent closing highs recorded on Aug 16 and Sep 2, respectively. The Nasdaq Composite slid more than 6% from its recent closing high registered on Sep 7.

In technical analysis, any asset enters correction territory once its value declines 10% or more but not more than 20% from its recent high. Consequently, the three major stock indexes are currently half way down to their correction territory.

This is no doubt a significant correction of stock market valuation. Momentum investing calls for the continued appraisal of stocks, ensuring that an investor does not pick a beaten-down name or overlook a thriving one. Momentum investors buy high on the anticipation that a stock will only rise in the short to intermediate term.

Moreover, a major driver of stock markets in October could be the third-quarter 2021 results. Corporate profits are likely to remain elevated after an impressive performance in the first two quarters of this year.

Rising cost pressure amid supply-chain disruptions along with labor and material shortages will keep the spotlight on margins, which are expected to be up year over year as well as sequentially.

Our current projection shows that total third-quarter earnings for the S&P 500 Index are expected to be up 26.1% from the same period last year on 13.8% higher revenues. Moreover, total earnings of the S&P 500 Index are projected to climb 42.7% on 13.6% higher revenues in 2021 and increase 9.6% on 6.6% higher revenues in 2022.

Our Top Picks

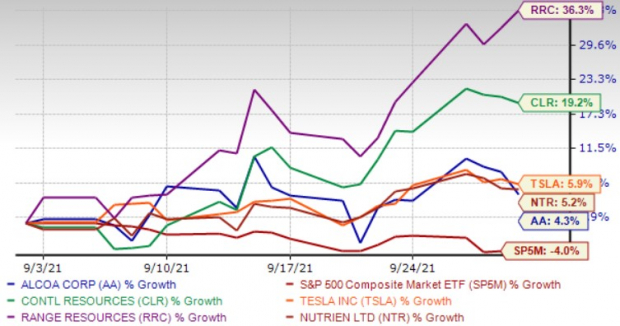

We have narrowed down our search to five momentum stocks that have provided more than 4% in September in contrast to the S&P 500’s decline of more than 4%. These stocks have strong upside left for the rest of 2021.

These stocks have seen positive earnings estimate revisions within the last 30 days, indicating that the market is expecting these companies to do good business this year. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a

Momentum Score

of A. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

Range Resources Corp.

RRC

operates as an independent natural gas, natural gas liquids and oil company in the United States. It is engaged in the exploration, development and acquisition of natural gas and oil properties.

Range Resources has extensive oil and gas resources in key regions like Marcellus Shale & North Louisiana. The company is well-positioned to benefit in the long run from its projects in the Appalachian Basin. Its core operating regions in the basin comprise a huge inventory of low-risk drilling inventories that are likely to fetch incremental natural gas production volumes.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.9% over the past 30 days. The stock price has jumped 36.3% in the past month.

Continental Resources Inc.

CLR

explores, develops and produces crude oil and natural gas primarily in the north, south, and east regions of the United States. It sells crude oil and natural gas production to energy marketing companies, crude oil refining companies, and natural gas gathering and processing companies. Continental Resources has a premier position in the Bakken area.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the past 30 days. The stock price has climbed 19.2% in the past month.

Tesla Inc.

TSLA

has acquired substantial market share within the electric car segment. The strong performance and impressive design of the firm’s products are ramping up sales volumes. Increasing Model 3 delivery, which forms a major chunk of the automaker’s overall deliveries, is aiding the company’s top line. Along with Model 3, Model Y is contributing to its revenues.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the past seven days. The stock price has risen 5.9% in the past month.

Nutrien Ltd.

NTR

provides crop inputs, services, and solutions. It offers potash, nitrogen, phosphate, and sulfate products; and financial solutions. Nutrient distributes crop nutrients, crop protection products, seeds, and merchandise products through approximately 2,000 retail locations in the United States, Canada, South America, and Australia.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.7% over the past 30 days. The stock price has advanced 5.2% in the past month.

Alcoa Corp.

AA

produces and sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Brazil, Canada, and internationally. The company operates through three segments: Bauxite, Alumina, and Aluminum.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 19% over the past 30 days. The stock price has gained 4.3% in the past month.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report