It’s no doubt that Apple

AAPL

and Alphabet

GOOGL

are two of the major winners in the technology realm. Pushing boundaries, spurring innovation, and releasing cutting-edge technology are a few of the reasons why they have been leaders in the market alongside the uprising of tech stocks.

Apple’s product catalog has been continuously expanding and undergoing innovation. The tech giant’s story starts from humble beginnings with its first-ever computer, the Apple 1 – a project in which Steve Jobs had to sell his only mode of transportation to finance.

Since then, it has transformed into a mega-giant that has become the world’s largest company by market capitalization. Simply put, Steve Jobs selling his vehicle could be considered one of the most impactful transactions of all time.

Google’s story picks up in 1995 when the duo of Larry Page and Sergey Brin began working on a search engine initially known as BackRub – the name stems from the algorithm-generated ranking for how many “back-links” a page has. In 1997, the name was changed to Google, drawing inspiration from the mathematical term “googol,” which displays the founders’ goal of collectively organizing an infinite amount of information on the web.

Flip the calendar forward to 2022, and it has become the world’s most widely used search engine and ranks within the top 10 of all companies globally by market capitalization.

Performance

While these companies have been some of the most successful and exciting companies over the last decade with the rise of technology, shares have recently taken a less prosperous path throughout 2022, affected majorly by the current economic situation that COVID-19 and geopolitical issues have brought us to.

Additionally, the high-flying days of stocks following the pandemic crash in early 2020 have come to an abrupt halt, stopping the music that investors once enjoyed.

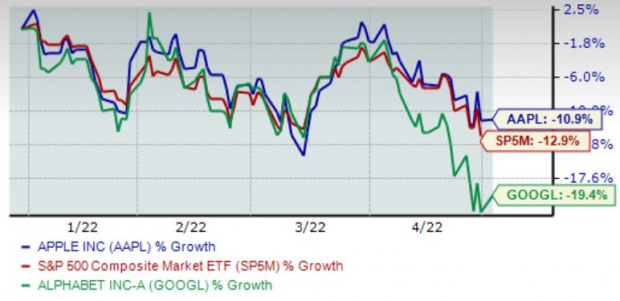

The chart below illustrates the year-to-date performance of GOOGL and AAPL while also comparing the S&P 500.

Image Source: Zacks Investment Research

As we can see, it’s been a brutal start to 2022 for not just the general market but also for AAPL and GOOGL shares. However, Apple shares have been a brighter spot, providing valuable defense and nearly aligning with the S&P 500. Alphabet, though, has nearly lost 20% of its share value year-to-date.

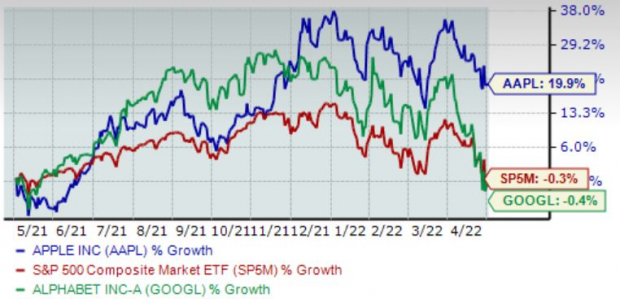

The share performance paints a mildly different story when we stretch out the time frame over the last year. Apple shares have easily outpaced the general market and provided investors with a solid 19% return. On the other hand, GOOGL shares have traded nearly in line with the market.

Image Source: Zacks Investment Research

So, why the disconnect? I believe it stems from Apple’s ability to continuously release and gain ridiculous demand for new models of their products, including the flagship iPhone, AirPods, Mac computers, iPads, AirPods, and the Apple Watch. Additionally, it’s been difficult for tech leaders such as Alphabet to keep pace with the monstrous popularity that Apple devices have gained throughout their lifespans.

Alphabet Joining Apple’s Party

Recently, though, there have been some intriguing rumors going around that Google will be unveiling a brand-new Pixel Watch in an upcoming product showcase. The product creation feels like a direct result of the popularity that smartwatches have received in the recent term, specifically the Apple Watch.

Alphabet is aware of the smartwatch demand, so it only makes sense for the company to release one that can pair with its Pixel smartphones. Additionally, the upcoming May showcase comes at a time that makes sense; GOOGL can roll out the smartwatch alongside its Pixel 7 smartphone, which has already been confirmed to launch in October of this year.

It looks to be a wise business move, as Apple has gained immense success with its similar smartwatch and other “wearables” that the company has been launching over the last several years.

Analyzing Apple’s wearables segment of business, the company reported last week that it raked in $8.8 billion in revenue for the latest quarter – a sizable 12% increase from the year-ago quarter. More specifically, annual revenue from the Apple Watch has surged 70% from $29.8 billion in 2019 to $40.8 billion in 2021.

Clearly, its wearables line of business has gained significant traction. The company dominates the market for these items due to the rapidly growing adoption of the Apple Watch and AirPods, which has also helped strengthen its presence in the personal health monitoring space.

Moving Forward

There is a massive market opportunity for GOOGL within the wearables space. It plans on capitalizing via the release of a new smartwatch that connects with its flagship mobile device, the Google Pixel. The company has undoubtedly realized Apple’s success with its smartwatch, and now it wants a piece of the pie itself.

It bodes well for GOOGL shares moving forward, though a rough 2022 landscape for tech has sent shares plummeting and perhaps finding a recent top. Additionally, 2022 is a brand-new market that has turned many investors’ sentiments sour.

With these two tech giants continuously looking for new products to release and spur innovation, it seems unlikely that any company stands to dethrone Apple or Alphabet anytime soon. If the release of the Pixel Watch comes to be accurate and finds success, GOOGL shares have a very prosperous path ahead of them. Additionally, it’s a new diverse stream of revenue for the company – something that companies look for intensely that provides opportunities to expand further.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report