Acquisitions are always an exciting announcement that investors can receive. It’s generally a good sign whenever a company has enough capital to acquire a company and transform it into a significant part of its underlying business.

Primarily, throughout time, industries change. If companies don’t jump on board with these innovative changes, things can go south quickly. Acquisitions allow companies to get their hands on more expertise and, of course, technology – providing them with the flexibility needed to innovate continuously.

Through acquisitions, companies become much more extensive – and bigger is better. Primarily, larger companies benefit from additional cost savings and other advantages that smaller companies don’t yet possess.

There have been some exciting acquisitions so far throughout 2022, and three of them have involved significant tech giants, including Microsoft

MSFT

, Advanced Micro Devices

AMD

, and Alphabet

GOOGL

.

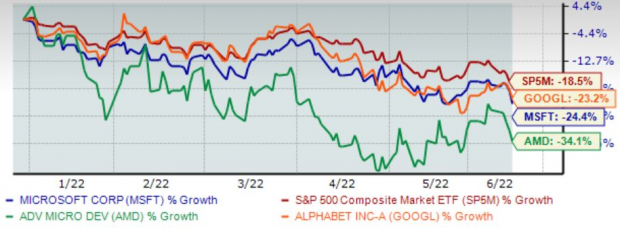

The year-to-date chart below shows the share performance of all three companies while blending in the S&P 500 for a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each acquisition and analyze how these tech giants stand to benefit from the moves.

Microsoft

Microsoft

MSFT

acquired Activision Blizzard

ATVI

for $68.7 billion in January to bolster its stance in the video game industry across all platforms. Activision Blizzard is a leader in video game development and an interactive entertainment content publisher.

ATVI is a giant within console gaming and has some of the most highly-respected franchises of all time, including

Call of Duty

,

Crash Bandicoot

,

World of Warcraft

,

Diablo

,

Overwatch

, and

Spyro

.

It was the largest acquisition deal in the video game industry’s history – a fascinating development.

Microsoft intends to publish all Activision Blizzard titles onto their Xbox Game Pass, a service that gamers have widely accepted and has been a major success.

Xbox’s Game Pass allows gamers unlimited access to a library stacked full of games for a low flat rate of $9.99 each month and is the first of its kind.

Xbox’s Game Pass subscriber count exceeded 25 million in January 2022, and Activision Blizzard titles currently have around 400 million monthly active players – providing a significant source of recurring, sticky revenue.

Providing higher ease of access to the most iconic gaming franchises in history at a low price will significantly propel Microsoft’s growth within gaming and further boost the top line.

Advanced Micro Devices

Looking to expand its Data Center Solution capabilities, Advanced Micro Devices

AMD

acquired Pensando, a developer of new edge services and programmable processors for enterprise and cloud computing. The acquisition is valued at $1.9 billion and is expected to close in 2022.

Pensando’s products have already been deployed at scale across cloud and enterprise customers, an absolutely stacked list including Goldman Sachs

GS

, IBM Cloud

IBM

, Microsoft Azure

MSFT

, and Oracle Cloud

ORCL

.

Pensando states that its robust programmable packet processor provides between 8x and 13x better performance than its rivals’ similar products.

Its processor controls how workloads move through hardware infrastructure, bouncing tasks off the CPU whenever able, considerably increasing efficiency.

The acquisition comes at a time when Intel

INTC

and Nvidia

NVDA

have both expanded their portfolios; Intel has its infrastructure processing unit (IPU) and SmartNICs (network interface cards), and Nvidia has Bluefield DPUs (data processing units) and DPU-based SmartNics.

However, these two companies don’t have the system software Pensando provides, giving AMD an edge over two of its largest competitors – an angle that AMD likely saw.

Alphabet

In early March of this year, Alphabet

GOOGL

announced plans to acquire Mandiant

MNDT

for a price tag of $5.4 billion. Mandiant is a dynamic cyber defense and response solutions provider, utilizing its Mandiant Advantage software as a service cloud-based platform.

The company will join forces with Google’s Cloud business – an obvious attempt to capitalize on the booming cloud computing market.

GOOGL states that organizations face cybersecurity challenges that have accelerated in frequency, severity, and diversity, creating a global security imperative.

To the company, the cloud represents “a new way to change the security paradigm by helping organizations address and protect themselves against entire classes of cyber threats, while also rapidly accelerating digital transformation.”

The acquisition is expected to complement Google Cloud’s strengths in security. GOOGL plans to enhance its security offerings with the deal, delivering an end-to-end security operations suite with more excellent capabilities to support cloud customers.

Combining Mandiant’s robust security with GOOGL’s cloud business will assist enterprises across the globe in staying protected throughout all stages of the security’s life cycle.

The company’s cloud computing has already been a significant success – Google Cloud raked in $6.4 billion in revenue in its latest quarter, displaying a sizable 41% growth from the year-ago quarter. Since FY17, Google Cloud revenue has grown by a massive 375%.

Bottom Line

Acquisitions are always a thrilling announcement that investors can get excited over. Generally, acquisitions are made to expand a business and further fuel future growth.

All three companies above have made a big splash within their respective acquisitions and look to turn them into big-time winners moving forward.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report