When shares carry a steep price tag, the barrier of entry for potential investors is sometimes too steep, causing them to steer away and look elsewhere to park their hard-earned cash.

Fractional shares have gained popularity over the recent term, but not all have access to this accommodating feature. Companies combat this steep barrier of entry via a stock split, one of the more shareholder-friendly and exciting announcements that a company can make.

A stock split doesn’t affect a company’s valuation. However, it does lower the value of each individual share, providing ease for the stock price to multiply once again and provide investors with considerable gains. Simply put, it’s generally a bullish catalyst.

We’ve recently gotten announcements from two giants in the market – Alphabet

GOOGL

and Amazon

AMZN

– that the companies would soon be splitting their stock. Needless to say, it shocked the market, as Amazon hasn’t split shares since 1999, and Alphabet hasn’t split their Class A shares since 2014. Both companies will be performing a 20-for-1 split.

It’s no secret that these two giant companies have skyrocketed in valuation over the last several years due to their popularity with investors, causing the share price to become a significant barrier to entry.

Share Performance Woes

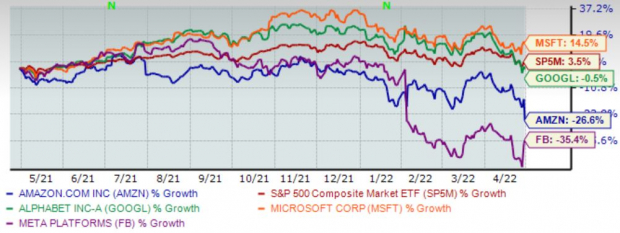

It’s been a tough year-long stretch for AMZN and GOOGL shares. The chart below illustrates the performance of both companies over the last year, along with a few other prominent market names such as Microsoft

MSFT

and Meta Platforms

FB

while comparing the S&P 500 as well.

Image Source: Zacks Investment Research

As we can see, AMZN shares have declined quite drastically and underperformed the general market, but GOOGL shares have managed to show a higher blend of defense. Amazon shares have been negatively affected by supply-chain issues, rising labor costs, and unionization talks. Additionally, in its quarterly report last night, AMZN revealed that expenses had surged and posted less-than-expected revenue growth. A rare EPS miss in Alphabet’s quarterly report earlier this week has recently sent its shares downwards.

Stock Split Success

Tesla

TSLA

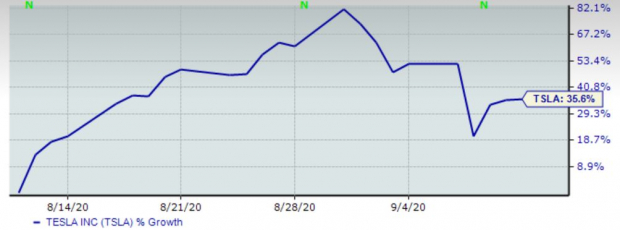

is one of the best examples to analyze whenever gauging how stock splits affect a company’s share price. TSLA last recorded a 5-for-1 split in August 2020, opening the floodgates for many new buyers. The company split its stock for a simple reason – the price tag on shares had increased dramatically following a surge of interest from investors.

The split sent shares flying. The chart below illustrates just how far shares moved in a month following the split announcement on August 11

th

, 2020.

Tesla Share Performance 8/11/20 – 9/11/20

Image Source: Zacks Investment Research

As we can see, TSLA shares no doubt benefited from the split. It’s pretty common for a company’s shares to move upwards following a split, and I see no reason why the same can’t be true for GOOGL and AMZN.

In fact, Alphabet and Amazon simply announcing their plans for a stock split was enough to send both companies’ shares flying. On March 9

th

, when the news first broke that AMZN would be splitting, shares jumped nearly 6% the next day. In Google’s quarterly earnings in February, the company announced the split; shares surged 7.5% the following day.

The splits will also provide a higher level of liquidity; once the share count is increased, the bid-ask becomes tighter and makes it much easier for investors to buy shares.

Bottom Line

With the adverse price action we have witnessed following Amazon’s and Alphabet’s quarterly reports, it feels almost inevitable that rough waters are on the horizon. However, I believe that both companies have at least one major bullish catalyst moving forward – a stock split.

Amazon undoubtedly benefitted immensely from the surge in pandemic-induced online shopping, displayed by its historic increase in revenue and valuation from 2020 to 2021. The trend has recently turned unfavorable for the company, shown in its quarterly revenue.

However, the stock split announcement is still enough for me to have an optimistic outlook for Amazon shares moving forward. The company has also displayed its shareholder-friendly nature via the announcement of a $10 billion share buyback when it revealed its plans to split its stock. The stock split takes place on June 6th.

Like AMZN, Alphabet was able to reap the rewards of the high-traffic online world during the pandemic whenever everybody was locked inside, no doubt fueling the run that shares went on before recently coming to a halt in 2022. Aside from the split, another positive moving forward for GOOGL shares is the announcement of a sizable $70 billion share buyback unveiled this week in its quarterly report. Alphabet’s stock split takes place July 15th.

I believe that it’s vital for investors to realize that these companies can’t stay down forever and that their shares can walk down a more prosperous moving forward, especially after the splits take place. Additionally, a stock split usually indicates that the company is in good health.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report