Note: The following is an excerpt from this week’s

Earnings Trends

report. You can access the full report that contains detailed historical actual and estimates for the current and following periods,

please click here>>>

Here are the key points:

-

The picture emerging from the Q2 earnings season is one of all-around strength, with aggregate total quarterly earnings on track to reach a new all-time record and impressive momentum on the revenue side.

-

For the 195 S&P 500 members that have reported Q2 results already, total earnings are up +105.0% on +22.3% higher revenues, with 90.8% beating EPS estimates and 86.2% topping revenue estimates.

-

While the outsized earnings growth pace is mostly due to easy comparisons, primarily in the Finance sector, the performance on the revenue front (growth rate as well as beats percentage) is tracking above what we have been seeing in other recent periods.

-

For the Tech sector, now have Q2 results from 65.8% of the sector’s market capitalization in the S&P 500 index. Total earnings for these Tech companies are up +63.9% from the same period last year on +24.7% higher revenues, with 96.3% beating EPS estimates and 100% beating revenue estimates.

-

For the Finance sector, now have Q2 results from 62.0% of the sector’s market capitalization in the S&P500 index. Total earnings for these Finance companies are up +221.9% from the same period last year on +7.0% higher revenues, with 97.9% beating EPS estimates and 78.7% beating revenue estimates.

-

Excluding the unusually high Finance sector earnings growth, total Q2 earnings growth for the remainder of the index members that have reported results would be up +78.5% on +26.0% higher revenues.

-

Looking at Q2 as a whole, combining the actual results for the 195 index members that have reported with estimates for the still-to-come companies, total S&P 500 earnings are expected to be up +83.9% from the same period last year on +21.3% higher revenues, with the growth rate steadily going up as companies report better-than-expected results.

-

Looking at the calendar-year picture for the S&P 500 index, earnings are projected to climb +39.2% on +11.6% higher revenues in 2021 and increase +9.9% on +6.5% higher revenues in 2022. This would follow a decline of -13.1% in 2020.

-

The implied ‘EPS’ for the S&P 500 index, calculated using the current 2021 P/E of 23.3X and index close, as of July 27th, is $188.64, up from $135.51 in 2020. Using the same methodology, the index ‘EPS’ works out to $207.23 for 2022 (P/E of 21.2X). The multiples have been calculated using the index’s total market cap and aggregate bottom-up earnings for each year.

The market didn’t seem to be overly impressed with the Microsoft

MSFT

earnings report, when it not only beat top- and bottom-line estimates, but came out with earnings and revenue growth of +46.9% and +21.3%, respectively.

To put the year-over-year growth rates in context, please note that while the year-earlier period (2020 Q2) may have depressed overall corporate profitability, Microsoft’s earnings and revenues were actually up from the comparable 2019 period. Just give you a sense of the magnitude of Microsoft’s earnings power, the company earned $14.3 billion in earnings on $44.1 billion in revenues in 2021 Q2.

The market seems to have shrugged off Apple’s

AAPL

report as well, which earned $21.7 billion in earnings on $81.4 billion in revenues in the June quarter. This not only handily beat consensus estimates, but were up +93.2% and +36.4% from the year-earlier levels, respectively.

The market is happier with Alphabet’s

GOOGL

results, which also beat EPS and revenue estimates and whose Q2 earnings and revenues represented year-over-year growth rates of +166.2% and +61.2%, respectively. The actual Q2 dollar amounts for Alphabet are $18.5 billion earnings on $50.9 billion in revenues.

We haven’t seen results from Amazon

AMZN

and Facebook

FB

as we write this, but we all know those companies are as profitable as Microsoft, Alphabet and Apple.

Back in the day, we used to have this magnitude of earnings only from the likes of Exxon

XOM

when it was operating on all cylinders and oil prices were above $100. Exxon is still a very profitable company, but it is expected to earn ‘only’ $4.3 billion when it reports its June-quarter results at the end of the week.

It is no surprise then that each of these companies enjoy market values exceeding a trillion dollars (Apple & Microsoft are over $2 trillion), while Exxon is less than $250 billion. No doubt, these Tech companies have changed the world and dominate the market.

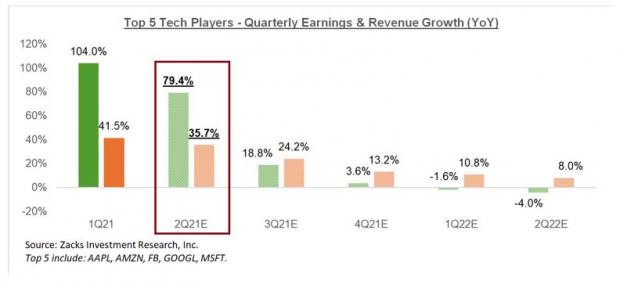

The big 5 Tech companies – Apple, Microsoft, Alphabet, Amazon and Facebook – are combined expected to earn +79.4% more in Q2 on +35.7% higher revenues relative to the same period last year.

The chart below shows this elite group’s Q2 expectations in the context of what it did in the preceding period and what is currently expected in the coming four quarters.

Image Source: Zacks Investment Research

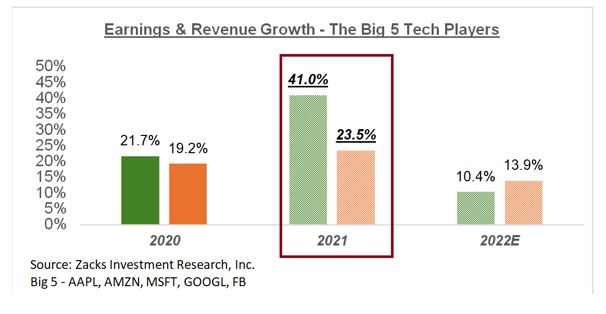

Here is a look at this elite group’s profitability picture on an annual basis.

Image Source: Zacks Investment Research

If one were to look for ‘negatives’ in the above picture, it would probably be the coming period of deceleration in the group trend. But given the very positive revisions trend currently in place, I would hazard that estimates for the coming periods will most likely get revised higher.

These are growth rates typically associated with start-ups and much younger companies, not seasoned operators like Microsoft and Co.

The Earnings Big Picture

The chart below provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the full-year 2021 growth picture steadily improving, with the revisions trend accelerating in the back half of the year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report