Big pharma has made mega billions

failing

to resolve the world’s biggest health problem and the number one cause of disability.

Now, it’s biotech’s turn… at an industry segment marching towards

$16 trillion

.

Backed by what Forbes describes as

Silicon Valley legends, billionaire financiers and patent attorneys

.

All of whom are preparing for a massive reawakening … and it’s all about the brain.

The number one cause of disability in the world?

It’s depression. And it’s costing the economy

$1 trillion

in lost production every single year.

Yet, a classical compound that even the FDA has twice recently designated a “

breakthrough therapy

” is shaping up to potentially be the revolutionary treatment that big pharma has been waiting for.

Scientists say this “miracle compound” can help reset the brain and has huge implications for the treatment of people with…

– Depression and anxiety

– PTSD

– Addiction

– Bipolar Disorder, OCD and Schizophrenia

– Autism

– Alzheimer’s and Parkinson’s

– And many other disabling diseases…

Right on the leading edge of this $16-trillion biotech transformation is Lobe Sciences (

CSE:LOBE

;

OTC:GTSIF

).

The company is working in collaboration with the University of Miami towards a revolutionary treatment for globally crippling depression.

But this is a game of patents, with multi-billion-dollar IP at stake.

With 5 provisional patent applications on their technology already … here are 5 reasons to keep a close eye on

Lobe Sciences

(

CSE:LOBE

;

OTC:GTSIF

):

#1 $16 Trillion in Mental Health Spending Is Demanding Better Treatments

Four classic compounds will “revolutionize the treatment of mental health diseases”, says Lobe’s chief scientist, Maghsoud Dariani, previously vice president of chiral pharmaceuticals at Celgene.

“With just one of these compounds we’re already seeing significant decreases in symptoms and successful outcomes.”

The four compounds are CBD, THC, MDMA and psilocybin.

According to Global Market Insights the CBD market will grow AT 52.7% to $89 billion by 2026.

According to Grand View Research the THC market will grow over 315% to $73.6 billion by 2027.

The first two compounds, CBD and THC already made tons of money for investors in the initial cannabis boom:

– 9,000%

gains on Cronos Group (NASDAQ:CRON)

– Over

2,300%

gains on Aphria Inc (NASDAQ:APHA)

– Over

1,500%

gains on Canopy Growth (NYSE:CGC)

And the list goes on …

But the fourth compound–psilocybin–could be the next big push we’re looking at.

This is the potential treatment for a litany of global mental health issues that the world is projected to spend

$16 trillion

on.

– More than

264 million people

are suffering from depression at this very moment, according to the World Health Organization.

–

1 in 13 people

will develop PTSD at some point in their life.

– During the global pandemic… 1 in 20 women… and 1 in 50 men were newly diagnosed.

– Depression is now the

No. 1 cause of disability

in the world.

This is a massive market just waiting to be tapped ….

#2 The ‘Miracle Compound’ That Now Has Science Behind It

Rolling Stone

calls psilocybin a “

miracle

”.

US News & World Report

says it could be

better than cannabis

.

The

Wall Street Journal

calls it “fantastic”.

Forbes

says the evidence is lining up quickly.

Twice now, the FDA has designated it a “

breakthrough therapy

”.

That’s because the next big boom could be in the psilocybin market.

The science is there.

A ground-breaking Johns Hopkins study helped start it all off.

The 2016 study concluded that psilocybin eased depression and anxiety in patients with life-threatening cancer.

That opened the scientific research floodgates:

– A study in the

Journal of Psychopharmacology

demonstrated a single psilocybin dose produced an antidepressant and anxiolytic response in cancer patients, which lasted for 5 years.

– The University of South Florida found this compound to be highly effective because it binds to certain brain receptors and stimulates healing and growth.

– Another study in November 2020 found that the compound psilocybin “worked better than the usual antidepressant medications. According to Alan Davis, the author of the study and a faculty member at Johns Hopkins University and Ohio State University, psilocybin’s effect was “more than four times greater”.

Lobe Sciences (

CSE:LOBE

;

OTC:GTSIF

)

is focusing on the multi-billion-dollar PTSD, depression and anti-anxiety market.

It’s working with pioneering scientists to create the first treatment that truly resets the brain for PTSD sufferers,

before

they show PTSD symptoms… aiming to reverse the disabling march of depression worldwide.

The timing is critical.

Depression currently ranks as the #1 cause of disability in the world, and costing the global economy $1 trillion in lost production.

And current therapies are 10%-30% effective…

Lobe Sciences is hoping its psilocybin studies will achieve the 80% (or higher) success rate that we’re now seeing published in medical journals about other psilocybin studies. That’s the same rate Johns Hopkins achieved with its cancer patients.

And it’s also why it’s attracting huge names and why investors are piling in at a fast clip.

They know the next few months are critical, especially if there is a chance of having an effective treatment for depression as early as next year.

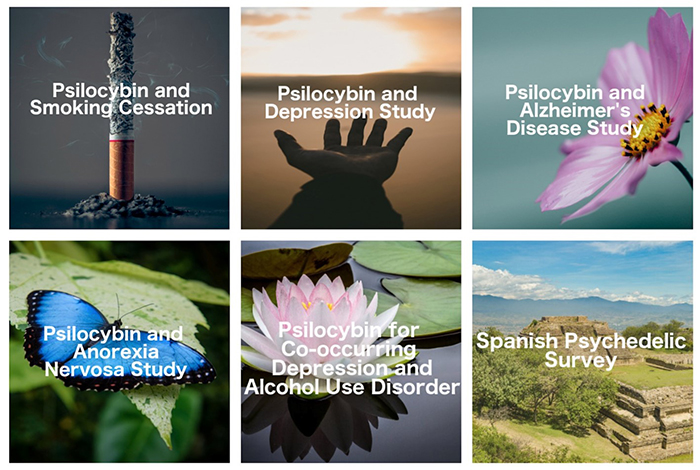

#3 Everyone’s Jumping On Board to Golden Era of Brain Science

A nod from the FDA on the power of the “functional mushroom” compound of psilocybin was enough to get everyone excited at the prospect of a revolutionary treatment for widespread depression, PTSD and anxiety.

High-profile angel investor

Tim Ferriss

has so far given $2 million to

Johns Hopkins’ psychedelic research center

, which he refers to as the “Silicon Valley of psychedelics” where they are rigorously studying psilocybin for a wide range of applications:

Source: Johns Hopkins Center for Psychedelic & Consciousness Research

In Europe,

investors are piling into

Germany’s ATAI Life Sciences, a psilocybin compound manufacturer, investing more than $40 million so far and bringing its value up to $240 million.

If the floodgates were initially opened by Johns Hopkins, they were completely removed last year when Johnson & Johnson (NYSE:JNJ) won unprecedented approval for a psychedelic-based antidepressant nasal spray,

SPRAVATO

.

That’s another area where Lobe is extremely well-positioned: In addition to coming up with a concept (that it’s working to turn into a reality) for a transformational approach to PTSD treatment, it has a provisional patent application for a nasal mist transducer device that allows for specific doses of medicines to be sprayed into the nasal cavity and rapidly enter the bloodstream. Lobe is already developing this and the next news to come out on this vertical could push the stock higher on its own.

Brad Loncar, a influential biotech investor, commented on the SPRAVATO news, calling it the “ultimate sign for investors” to jump in on psilocybin.

Then,

in November 2019

, Usona Institute received an FDA “breakthrough therapy” designation for psilocybin for the treatment of major depressive disorder.

Loncar certainly is not alone.

Among a lengthening lineup we’ve already seen multi-billionaire and PayPal co-founder

Peter Thiel

and billionaire investor

Mike Novogratz

pile in.

In the meantime, Big Pharma is still scrambling to sink its teeth into a functional mushroom market that is expected to be worth more than

$34 billion by 2024

.

The first big merger in this field–when giant AbbVie (NYSE:ABBV) scooped up Allergan PLC in May this year, demonstrated just how big the stakes are getting.

The industry has already been validated, and this space is heating up fast, with a lineup of high-profile backers, major developments and fast-paced news flow for everyone on this playing field, including:

– Theil-backed Compass Pathways (NASDAQ:CMPS), which recently won FDA “

breakthrough therapy

” designation for its psilocybin treatment for depression

– Toronto-based Field Trip Health (CSE:FTRP), which is gearing up to build 75 psychedelic treatment centers across North America

– Mind Medicine (MindMed) Inc. (OTCMKTS:MMEDF), the first publicly-traded company on this playing field, which is in the middle of multiple

Phase II

clinical trials

–

Champignon Brands

(CN:SHRM) (OTC:SHRMF), which went public earlier this year and whose acquisition hunger has netted shareholders major gains

“My prediction is that within the next five years, and certainly within the next 10 years, you’re going to see another golden era of these neuroscience products,” said

Steven Paul

, who was at Lilly when it developed the blockbuster antipsychotic Zyprexa and now serves as CEO of the neuroscience biotech Karuna Therapeutics.

Even the U.S. military is piling in. The U.S. Defense Advanced Research Projects Agency (DARPA) just announced

$26.9 million

in funding for two compounds… psilocybin and ketamine.

It’s a desperate attempt to do something about PTSD rates of up to 30%.

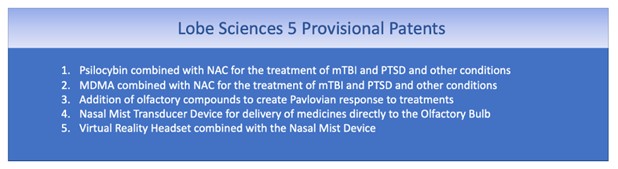

#4 Patents, Patents, Patents

Lobe Sciences (

CSE:LOBE

;

OTC:GTSIF

) is perfectly positioned to seek to take advantage of the New Year’s most transformational science trend.

As the COVID-19 pandemic rages on, significantly amplifying the global depression pandemic, this isn’t just a game of science–it’s a game of intellectual property.

It’s a race for patents.

“There is a smaller subset of investing verticals in the psychedelic space as it is more of an intellectual property race to develop drugs,” Michael Sobeck, managing partner at Ambria Capital, a San Juan, Puerto Rico-based asset manager,

told MSN in September

.

Lobe Sciences already has

5 provisional patent applications on their technology…adding some serious swagger to the IP value here.

And they have more patent applications planned in 2021.

All the patent swagger is exactly what Big Pharma will be sniffing out in the race to capture functional mushroom market share in a $16-trillion mental health cash bleed.

#5 Massive ‘Miracle Compound’ Momentum

Smart money is definitely watching closely for new entrants … They’re eyeing it as one of the biggest opportunities of 2021.

They like the science that’s finally been let loose.

They recognize the massive mental health problem.

And they’ll be looking for patents and targets for Big Pharma acquisitions.

They’ll be looking for a real treatment, where everything else has failed.

It’s the talk of every major media outlet from

The Wall Street Journal

and

Forbes

, to the

New York Times

.

Influential investor Brad Loncar loves it. It’s got the backing of everyone from PayPal cofounder Thiel to Novogratz and many others.

It’s got the backing of Big Science, with Johns Hopkins pouring a massive amount of effort and money into R&D.

It’s already got Big Pharma.

It’s even got the FDA on its side.

And Lobe’s CEO & Director, Tom Baird, has had success before. He’s led multiple tech companies in software and devices through early stage development and turnarounds delivering exceptional results for shareholders and investors.

Lobe’s Chief Science Officer, Maghsoud Dariani, also sets the stage for major advances for the company’s psilocybin pipeline. He’s obtained FDA approval before and brought key drugs to the clinical evaluation stage, including a version of the ADHD medication Ritalin, which he developed and won approval for as the Vice President of Chiral Pharmaceutical division of Celgene. Today, that drug is sold by Novartis under the Focalin trade name.

All of this helps position Lobe Sciences to potentially be one of the first stocks to benefit from the massive news flow coming out of the sector.

Just over the past year, Denver, Oakland, Santa Cruz, Ann Arbor, Oregon and Washington DC decriminalized psilocybin.

The research is about to get yet another major push with the tailwinds of legalization of magic mushrooms. Oregon and the District of Columbia were the most recent to approve ballot initiatives on November 3rd.

It’s all about brain science now. And 2021 is set to be explosively transformative.

Lobe (

CSE:LOBE

;

OTC:GTSIF

)

has 5 patents pending…

And to sweeten the deal, they’ve also got potential access to a cannabis asset—

Cowlitz County Cannabis Cultivation

—that is on track to do $20 million in revenue by year-end 2020. This is particularly important for investors: Lobe has an option to acquire 100% of that asset for only $50,000, which could be owned outright when the Washington State regulations allow it, or, the option to acquire the asset could potentially be sold, with the proceeds accruing to LOBE, who could potentially distribute to shareholders, with the possibility of some consideration being left with the Company to fund working capital for the critical patent portfolio.

Again, this is a game of patents, and Lobe has them.

And the next big news could be a major catalyst for Lobe: It’s University of Miami pre-clinical trials are coming soon…

Positive results following in the momentous wake of numerous other studies could put this stock squarely on the radar of Big Pharma.

Cannabis Companies Have Experienced The Legalization Magic First Hand

Aurora Cannabis (TSX:ACB)

is one of the biggest names in the burgeoning marijuana sector. With a market cap over $1.29 billion, Aurora has carved out its position as a leader in the industry. Over the past couple of years, Aurora has completed a number of high-profile takeovers, including the buyout of CanniMed and MedReleaf. And the company is still making moves.

Recently, Aurora closed a $173 million public offering to fund new growth opportunities in the sector, selling 23 million shares at $7.50 per unit. And the timing is perfect as a number of U.S. states have just approved new regulations surrounding medical and recreational cannabis use.

Though Aurora had a tough year in the market, seeing its share price fall 67% from $21.96 to $7.06 at the time of writing, the decline does present an opportunity for investors looking to gain exposure to the budding cannabis market as positive sentiment slowly begins to return to the sector.

Contrary to Aurora,

Canopy Growth Corporation (TSX:WEED)

has had a pretty stellar year. Though the company posted a lost in year-over-year revenue, its stock price has remained resilient thanks to its big-name partnerships. In fact, just this year, beverage giant Constellation Brands, increased its stake in the cannabis producer to 38.6%.

Bill Newlands, president and CEO of Constellation Brands explained, “While global legalization of cannabis is still in its infancy, we continue to believe the long-term opportunity in this evolving market is substantial. Canopy is the best position to win in the emerging cannabis space and we are confident in the strategic direction of the company under David Klein and his team.”

In another headline-grabbing partnership, Canopy Growth recently announced the launch of Martha Stewart CBD edibles. The collaboration includes a 60-count box featuring 15 season flavors including Passionfruit, Calamondin, and Quince. The box retails for $64.99 and is already available for purchase on Canopy’s website.

Thanks to these strategic moves, Canopy has seen its share price jump from its March low of $10.37 to today’s near-yearly high of $24.04, representing a 131% increase for investors who jumped in at the right time. And as bullish news continues to mount for the emerging industry, Canopy will likely be one of the biggest benefactors.

Following its July slump,

Cronos Group (TSX: CRON)

has seen a surge in trading volume, with a renewed investor interest which has also been reflected in its share price. Since September, the company has seen its share price jump from $5.04 to a price of $7.23 today. That’s a 43% return in just two months. Not too shabby.

The Canadian firm, though primarily an equity investor, has made some major moves in recent years, wheeling and dealing with some of the hottest names in the sector. Because of its forward-thinking attitude, it has drawn the attention of many major mainstream players, including the company behind Marlboro, Altria Group, which purchased a 45% stake in the company in 2018 for a total of $2.4 billion.

Despite the relatively tough year, new president and CEO of Cronos Group, Kurt Schmidt remained optimistic, noting in the most recent earnings call that “Our [Cronos Group] value will come from technology breakthroughs and branded sales that will help establish relationships with our consumers. There’s top-tier talent across this organization and I’m excited to lead this impressive team into the next phase of growth.”

Aphria Inc (TSX:APHA)

, currently valued at just over $1.9 billion, is a giant in the industry. The Ontario-based cannabis company has operations in more than 10 countries and distributes medical cannabis across the globe. Thanks to its big-picture approach to the industry, Aphria has been able to thrive while many of its peers have stumbled.

Recently, in anticipation of wider U.S. legalization, Aphria entered into a $300 million deal to acquire SweetWater Brewing, one of the biggest craft beer brewers in the United States. The purchase aims to help Aphria capitalize on the growing “lifestyle” market associated with both craft beer and high-end cannabis.

Aphria Chairman and CEO Irwin Simon noted, “We will establish and grow our U.S. presence through SweetWater’s robust, profitable platform of craft brewing innovation, manufacturing, marketing and distribution expertise. At the same time, we will build brand awareness for our adult-use cannabis brands, Broken Coast, Good Supply, Riff and Solei, through our participation in the growing $29 billion craft brew market in the U.S. ahead of potential future state or federal cannabis legalization.”

Auxly Cannabis Group

(TSX.V:XLY)

is an up-and-comer in the marijuana industry, with a growing presence in Eastern Canada. The company, formerly known as Cannabis Wheaton, the streaming company operates with a unique spin, focusing on its investments and partnerships within the space.

Some investors are bullish on Auxly due to its rapid rate of growth. And its recent strategic partnership with Atlantic Cultivation solidifies that stance.

By. Gail Morcombe

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT

. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Lobe Sciences to conduct investor awareness advertising and marketing. Lobe paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of sixty thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Lobe) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP

. The Publisher owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS

. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business including the legality of Psilocybin and other psychedelics, the ability of the company to exercise or sell its option to acquire shares of Cowlitz County Cannabis Cultivation or otherwise monetize its interest in Cowlitz, the degree of success with research and development of the company’s medicines and devices, the success of clinical trials, governmental approval or clearance of the company’s medicines and devices, the size and growth of the market for the companies’ products and services, the ability of management to execute its business plan, the continuity of management, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY

. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE

. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here

http://GlobalInvestmentDaily.com/Terms-of-Use

. If you do not agree to the Terms of Use

http://GlobalInvestmentDaily.com/Terms-of-Use

, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY

. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.