Tesla Inc.

TSLA

has once again issued a new recall impacting nearly 130,000 vehicles. The recalled cars (consisting of 2021-2022 Model S and Model X, besides 2022 Model 3 and Model Y) were facing an overheating problem concerning the CPU of the center screen’s computer. The infotainment CPU may overheat during the preparation or process of fast-charging that causes the CPU to lag or restart.

The National Highway Traffic Safety Administration has stated that an official recall is required since the glitch can affect critical functions when pre-conditioning the pack on the way to a Supercharger.

However, the fix is again an over-the-air (“OTA”) software update and does not need a physical recall. The OTA software update by Tesla will improve CPU temperature management free of charge. Owners are expected to be notified by Jul 1, 2022.

Of late, Tesla has had to issue a number of recalls, majorly due to software problems, but most of them were minor issues that could be fixed by simple OTA software updates.

In January this year, the auto giant issued a massive recall of 817,000 cars in the United States over an issue with the seat belt alert, likely caused by a software error. This recall impacted vehicles belonging to the 2021-2022 Model S and Model X, the 2017-2022 Model 3, and the 2020-2022 Model Y.

Although the company has to deal with the pain that recalls entail, it points to the high level of connectivity in its vehicles and the lack of dependency on third-party dealers to service them. It is one of Tesla’s biggest advantages over the rest of the industry.

In another blow, Tesla has been forced to halt most of its production at its Shanghai Giga 3 plant due to the ongoing shortage in plants needed for its electric vehicles, per media sources.

The plant intends to bring down capacity to lower than 200 vehicles on each day, far lesser than the almost 1,200 units it had been building each day since it reopened on Apr 19 after a 22-day production hiatus.

The re-imposition of lockdown in the event of a new breakout of coronavirus in Shanghai has further made it difficult for manufacturers to operate amid hard restrictions on the movement of people and materials. Aptiv, Tesla‘s main supplier of wire harnesses, stopped shipping from a Shanghai plant after a number of its workers were found infected.

It is not yet clear as to when the current supply challenges will be mitigated and the company can move back to its initial optimistic plans to bolster capacity at the plant.

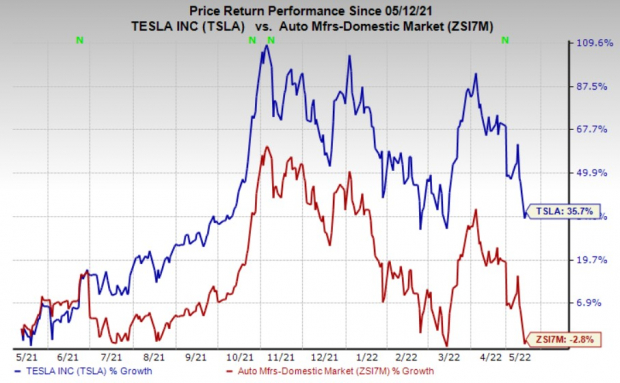

Shares of TSLA have gained 35.7% over the past year against the

industry

’s 2.8% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

TSLA currently carries a Zacks Rank #3 (Hold).

Better-ranked players in the auto space include

BRP Group, Inc.

DOOO

, sporting a Zacks Rank #1 (Strong Buy), and

Dorman Products

DORM

and

Standard Motor Products

SMP

, each carrying a Zacks Rank #2 (Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

BRP Group has an expected earnings growth rate of 9.2% for fiscal 2023. The Zacks Consensus Estimate for current-year earnings has been revised around 7.3% upward in the past 60 days.

BRP Group’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. DOOO pulled off a trailing four-quarter earnings surprise of 68%, on average. The stock has declined 8.7% over the past year.

Dorman Products has an expected earnings growth rate of 18.8% for the current year. The Zacks Consensus Estimate for current-year earnings has been marginally revised 0.7% upward in the past 60 days.

Dorman Products’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed in one. DORM pulled off a trailing four-quarter earnings surprise of 3.1%, on average. The stock has lost 2.3% over the past year.

Standard Motor has an expected earnings growth rate of 1.4% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 2% upward in the past 60 days.

Standard Motor’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. SMP pulled off a trailing four-quarter earnings surprise of 40.34%, on average. The stock has lost 13% over the past year.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report