Tesla Inc.

TSLA

is looking to expand production at its newly completed Gigafactories in Berlin and Shanghai for higher output capacities. However, the automaker might need a costly production break to upgrade the sites.

Tesla plans to significantly increase production at both plants over the next two months.

Per reports, both factories are expected to complete their expanded production lines by early August.

Tesla’s Giga Shanghai has begun its pause on most Model Y production on Jul 1 and will take around two weeks to complete. Once done, the Shanghai factory will stop the Model 3 line for about 20 days starting on Jul 18, which will be completed in early August.

The Giga Berlin will start a two-week production hiatus on Jul 11, with the company planning to double its production rate in August. Giga Berlin was on a production spree last month, building around 1,000 Model Y units in a single week while producing more vehicles globally than in any month in its history.

Despite the record production month, Tesla chief, Elon Musk, has put forth financial concerns over the past few months, citing that the automaker did not have a smooth second quarter and that the company’s new factories weigh on finances.

Needless to say that Tesla will lose out on some revenues during the production halts at Giga Shanghai and Berlin. However, since the output is expected to double in each plant, overall, it is likely to pay off in the near future.

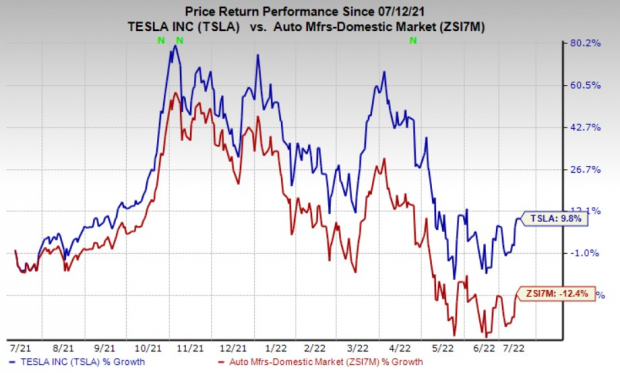

Shares of TSLA have risen 9.8% over the past year against its

industry

’s 12.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

TSLA carries a Zacks Rank #3 (Hold), currently.

Better-ranked players in the auto space include

BorgWarner

BWA

,

LKQ Corporation

LKQ

and

Standard Motor Products

SMP

, each carrying a Zacks Rank #2 (Buy), currently. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

BorgWarner has an expected earnings growth rate of 23% for 2023. The Zacks Consensus Estimate for current-year earnings has been constant in the past 30 days.

BorgWarner’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. BWA pulled off a trailing four-quarter earnings surprise of 33.1%, on average. The stock has declined 28.4% over the past year.

LKQ has an expected earnings growth rate of 6.3% for 2023. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

LKQ’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. LKQ pulled off a trailing four-quarter earnings surprise of 23.55%, on average. The stock has fallen 0.3% in the past year.

Standard Motor has an expected earnings growth rate of 5.2% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Standard Motor’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. SMP pulled off a trailing four-quarter earnings surprise of 40.34%, on average. The stock has risen 2% over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report