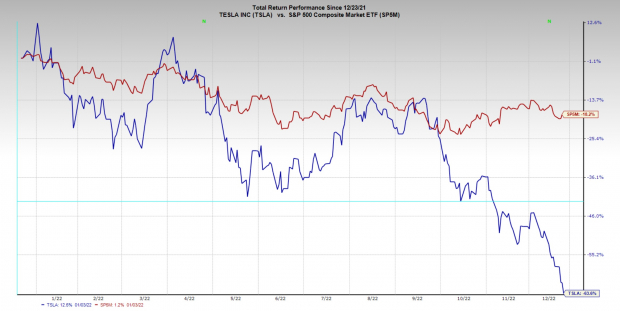

If you follow markets, it should be no secret that

Tesla

TSLA

stock rapidly declined over the past year. While the S&P 500 Index is down 18.2%, shares of Tesla are down a whopping 63.6%.

Image Source: Zacks Investment Research

What has led to the downfall?

·

Macroeconomic Conditions:

Electric vehicles are a want rather than a need. While EVs have drastically come down in price since Tesla launched the Model 3, most traditional internal combustion engine-powered automobiles are more affordable. In other words, when the consumer is crushed by inflation, debt, and higher unemployment, purchasing an EV becomes less attainable.

·

Tax Selling:

As the year ends, investors are taking inventory of the portfolio and are tax harvesting losing positions. In recent weeks, tax harvesting may have snowballed the selling behind shares in Tesla shares as many institutional investors and retail investors are stuck in underwater positions. As a result, active ETFs such as the

Arkk Innovation ETF

ARKK

may be forced to sell shares at some point.

·

Concerns Over Management:

It’s hard to argue with CEO Elon Musk’s business prowess. The controversial CEO is the mastermind behind

Paypal

PYPL

,

SpaceX, and several other successful ventures which propelled him to be one of the wealthiest humans ever to exist. Nevertheless, his actions and words in recent months have spooked investors. First, Musk acquired Twitter. In acquiring Twitter, shareholder concern about Musk’s time allocation began to increase. While Musk is known to juggle several ventures at once, the Twitter acquisition is his most immense undertaking yet. Second, Elon has been selling shares to pay for the Twitter acquisition. Insider selling is never looked at as a positive by shareholders. Lastly, the billionaire CEO has warned the public consistently about the potential for a “hard landing” caused by the Federal Reserve’s monetary policy.

What do bulls have to hang their hats on?

·

Potential Capitulation Volume:

Thursday, Tesla traded a whopping 205 million shares. The last time Tesla stock traded that many shares was in the middle of the Covid panic in March 2021.

·

Deeply Oversold Levels:

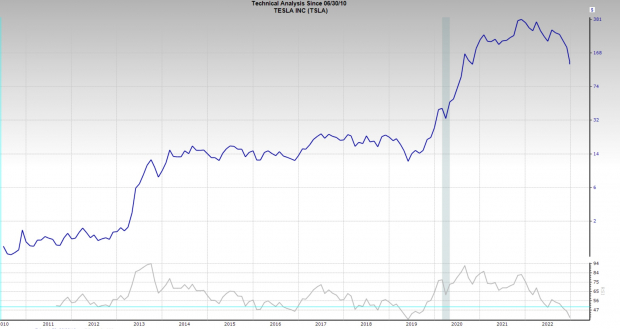

The Relative Strength Index (RSI) is a technical indicator that analysts use to measure a stock’s current and historical strength or weakness using closing prices over a recent trading period. Since its inception, TSLA has only had a more oversold reading than today in 2019. After the instance in 2019, shares multiplied twentyfold.

Image Source: Zacks Investment Research

Pictured: Max chart of TSLA. The bottom shows historical RSI overlayled on the chart.

·

Stopping the Bleeding:

Thursday, Elon Musk tried to instill investor confidence by saying that he will “not sell shares of TSLA stock until 2024 or 2025.”

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report