Tesla

TSLA

is the leader in the electric vehicle space and has revolutionized the way we view automotive transportation. Along the way, the company has beaten the odds and silenced the nay-sayers. The stock has been one of the top performers since it came public and has done that as prolific short sellers like Michael Burry and Jim Chanos have warned investors about the company’s prospects. Furthermore, the innovators at Tesla were able to produce the first mass-market EV (Model 3), scale, and become a profitable company. As a result, investors have been rewarded handsomely, and the stock gains have propelled Elon Musk, the CEO of Tesla, to become one of the wealthiest humans on Earth.

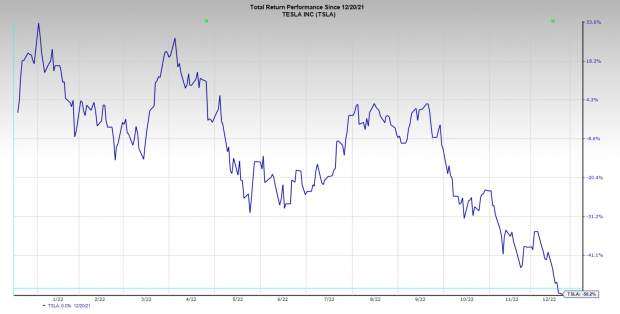

Image Source: Zacks Investment Research

Pictured: TSLA shares are down 50% in the past 6 months

However, bears have taken back control of the stock over the last six months. The macroeconomic environment and investor discomfort with Elon Musk’s acquisition and time spent at Twitter have weighed on shares. Below are five reasons Tesla can recharge its batteries and win again:

1.

Valuation is getting attractive:

Tesla’s Price to Book value is down from a high of 50 in 2021 to 11.66 today. The last time the stock’s price/book was this low was in early 2020 after the pandemic. TSLA shares went from a split-adjusted $23 to $294 over the next year.

Image Source: Zacks Investment Research

Pictured: Tesla’s price/book is at levels not seen since the pandemic.

2.

Beating the competition:

Tesla continues to produce double-digit earnings and revenue growth, while competitors such as

Nio Inc

NIO

, Rivian (RIVN),

and

Li Auto

LI

are bleeding cash and are losing money quarterly. Meanwhile, Zack’s consensus estimates expect even more growth into 2023.

Image Source: Zacks Investment Research

Pictured: Zack’s EPS Esimates for next year are on the rise.

3.

New growth drivers:

Tesla expects to begin producing three significant products in 2023, including the CyberTruck, Semi, and next-generation Roadster. These new products should help drive growth.

4.

When bad news is no news, no news is good news:

Last week, Elon Musk sold 22 million shares of TSLA worth $3.6 billion. Despite the large share dump, Tesla’s stock has had a muted reaction – even in a volatile market environment. Musk is likely selling the shares to fund his Twitter venture. Speaking of which, Musk has hinted that he may step down from CEO responsibilities at Twitter, another potential catalyst for TSLA.

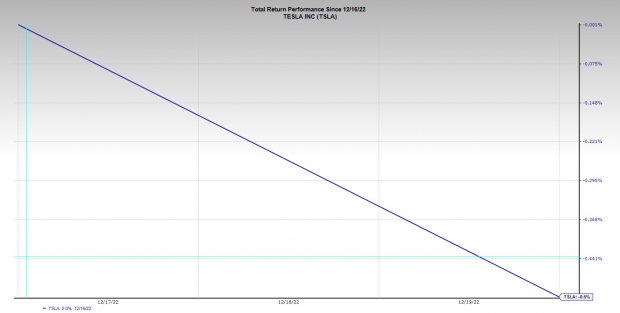

Image Source: Zacks Investment Research

Pictured: In recent days, TSLA has absorded Elon Musk’s share sale quite well despite the turbulent market backdrop.

5.

Technicals:

Teslais pulling into its 200-week moving average for the first time in years. The indicator has been a good value area to buy shares in the past. TSLA shares are also pulling into a support area dating back to when the stock broke out in 2020.

Image Source: Zacks Investment Research

Pictured: TSLA is pulling into its 200-week moving average area and its previous breakout zone.

Conclusion:

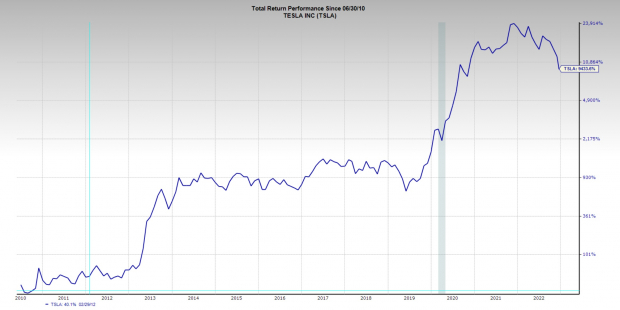

Tesla shares are attractive for long-term investors who believe in the company. Despite the recent action in the stock, the company continues to execute and reap the benefits of having a first-mover advantage. Furthermore, the pullback in shares has made the stock more intriguing from a valuation perspective, while new product launches will help to ensure future growth. When buying beaten-down stocks, time frames matter, however, as bottoms can take time. Nonetheless, if you zoom out, TSLA is still in a very powerful long-term uptrend and is up 9,433.6% since inception. The risk/reward is favorable for those who can stomach the volatility.

Image Source: Zacks Investment Research

Pictured: TSLA has been an elite performer since inception. Can it do it again?

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report