Salesforce (NYSE:CRM) is gearing up to announce its third-quarter fiscal 2024 results on Nov 29.

For the fiscal third quarter, the company anticipates total revenues ranging between $8.70 billion and $8.72 billion (midpoint $8.71 billion). Non-GAAP earnings are projected between $2.05 and $2.06 per share.

The Consensus Estimate for revenues stands at $8.71 billion, reflecting an 11.1% increase from the year-ago quarter. The consensus for earnings is set at $2.06 per share, indicating a year-over-year rise of 47.1%.

Salesforce has consistently outperformed the Consensus Estimate in the past four quarters, with an average surprise of 14.2%.

Let’s examine the factors leading up to this announcement.

Factors to Consider

The growing demand for generative artificial intelligence (AI)-enabled cloud-based solutions is expected to contribute to Salesforce’s third-quarter top-line growth. The company has been integrating generative AI tools across its products to stay ahead of competitors.

In March 2023, CRM entered the generative AI space with the launch of Einstein GPT, the world’s first generative AI CRM technology. It delivers AI-created content across sales, service, marketing, commerce, and IT interaction at hyperscale, transforming customer experience.

In June 2023, Salesforce introduced its AI Cloud service, a one-stop AI-powered solution for enterprises. The suite provides real-time, open, and secure generative experiences across applications and workflows, supporting new capabilities across CRM’s products.

The robust demand environment, driven by major digital transformations among customers, is likely to have positively impacted Salesforce’s quarterly performance. The company’s focus on offering aligned products to meet customer needs and providing integrated solutions for business problems is expected to drive top-line growth.

Salesforce’s ongoing efforts to build and expand relationships with leading brands, along with growth opportunities in the public sector, may have served as tailwinds in the fiscal third quarter.

The acquisitions of Slack, Mobify, and Vlocity are also expected to contribute to CRM’s top-line growth. The growth across its cloud service offerings is anticipated to support Salesforce’s subscriptions and revenue.

Despite these positives, potential challenges include a decline in software spending by small and medium businesses amid macroeconomic uncertainty due to the pandemic and geopolitical issues. Competition from Oracle and Microsoft, along with forex headwinds, are also areas of concern.

However, Salesforce’s ongoing restructuring initiatives, including workforce trimming, are likely to boost profitability in the third quarter. In the second quarter, the non-GAAP operating margin expanded by 11.7% to 31.6%, driven by an improved gross margin and the benefits of restructuring initiatives.

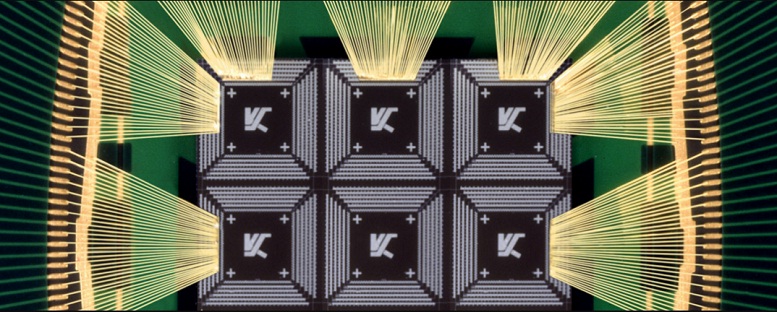

Featured Image: Freepik © pikisuperstar