Wall Street has maintained its impressive northbound journey so far this year after completing an astonishing bull run in the coronavirus-ridden 2020. However, the U.S. stock market’s driver has changed.

In 2020, it was the technology sector that drove Wall Street to get rid of the pandemic-led historically shortest bear market and formed a new bull market. In 2021, the cyclical sectors like financials, industrials, energy, materials and consumer discretionary took the center stage.

The reason for this sectoral shift is primarily due to three reasons. First, as a result of its soaring performance, the technology sector became overvalued since the beginning of 2021 and investors were concerned that a major correction is in the offing.

Second, thanks to rapid deployment of nationwide COVID-19 vaccinations and a faster-than-expected reopening of the economy, the cyclical sectors, that suffered the blow of the pandemic became lucrative.

Third, a spike in general price level and growing concerns about a sustainable inflation compelled a large section of market participants to contemplate that Fed will shift from the ultra-dovish monetary policies that it implemented to tackle the pandemic. This will result in a rise in the market’s risk-free returns, which will be detrimental to growth sectors like technology.

Technology Sector Regains Pace

Yet, a close look into Wall Street’s performance of the technology sector is in fact flourishing in most parts of 2021 so far. In the past six months, the market’s benchmark – the S&P 500 Index – gained 18.7% while the Technology Select Sector SPDR (

XLK

), one of the 11 broad sectors of the benchmark, jumped 23.1%, second only to the Real Estate Select Sector SPDR (

XLRE

), which soared 32.8%.

The technology sector’s performance has been even better in the past three months. The S&P 500 Index was up 8.2% while technology surged 16%, nearly double of the benchmark itself and became the best performer within the S&P 500 stable.

Moreover, year to date, the broad-market S&P 500 Index has rallied 20.8%. The tech-heavy Nasdaq Composite is quickly catching up with a gain of 19.2% despite a slow start this year. On the other hand, the blue-chip Index – the Dow – which inclines more toward cyclical stocks – is up just 15.6%.

Technology is the Best Bet in the Long Term

The logic that the technology sector will underperform the other cyclical sectors may be true for a short period of time but in the long term, technology stocks will remain the best bets. We must not forget that the growing demand for hi-tech superior products has been a catalyst for the sector in an otherwise tough environment.

A series of breakthroughs in the 5G wireless network, cloud computing, predictive analysis, AI, self-driving vehicles, digital personal assistants and IoT, has given a boost to the overall space.

The leading emerging markets of Asia, Latin America, Africa and some European countries are still way behind in using digital technology compared with the developed world. The outbreak of coronavirus quickly changed the lifestyle and lookout of people over there.

They are now turning to digital platforms for office work (work from home), food ordering and other daily needs, including transferring money and making payments. Moreover, online schooling, video conferencing and virtual networking have now become essential.

How to Invest

At this stage, several technology stocks that look attractive are available for future growth. However, picking them on the following five criteria will make the task easy. First, select technology bigwigs (market cap > $100 billion) as these companies have a globally established business model and internationally acclaimed brand value.

Second, these stocks witnessed solid earnings estimate revisions for 2021 within the last 60 days. Third, these stocks have strong upside left reflected by a long-term (3-5 years) growth rate of more than 10%. Fourth, these companies are regular dividend payers that will act as an income stream in a market’s downturn.

Finally, each of these stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Six stocks have fulfilled our selection criteria. These are:

Apple Inc.

AAPL

,

Microsoft Corp.

MSFT

,

Applied Materials Inc.

AMAT

,

NVIDIA Corp

.

NVDA

,

QUALCOMM Inc

.

QCOM

and

Texas Instruments Inc.

TXN

.

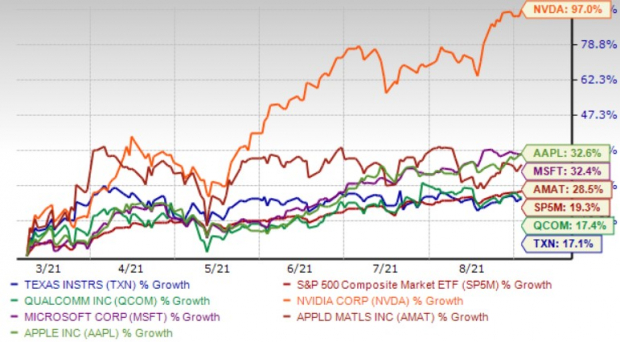

The chart below shows the price performance of above-mentioned six stocks in the past six months.

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report