NFT Stocks Are Soaring As Digital Asset Buzz Grows

Non-fungible tokens (NFT)

are in every headline these days. And investors have been looking for NFT stocks to buy in the

stock market today

. Takung Art Co. (

NYSE: TKAT

) and Hall of Fame Resort & Entertainment (

NASDAQ: HOFV

) have started the week on a strong note as part of the speculative frenzy. Blockchain technology has made it possible for people to own unique digital items. It could be artwork, music, or video stored on the blockchain, which is the digital ledger technology that powers cryptocurrencies like

Bitcoin

. Some NFTs have sold for hundreds of thousands and even millions of dollars.

Institutional Investors’ & Celebrities’ Involvement Are Lighting The Fire For NFT Stocks

If you have been paying attention to the stock market lately, you would know that such speculative moves are not something new. But one possible reason for the renewed interest this week would be Jack Dorsey selling his first-ever tweet today for a whopping $2.9 million. Dorsey, the CEO of Twitter (

NYSE: TWTR

) and Square (

NYSE: SQ

), is a big advocate for cryptocurrencies.

Kim Forrest, chief investment officer at Bokeh Capital Partners in Pittsburgh, said the interest in companies involved in digital assets is “

largely driven by the people that think they missed bitcoin

”…“

Buying the companies offering NFT would be like buying companies that have some sort of dealings with bitcoin in the early days

”.

Of course, you could say a lot of the attention on NFT stocks is pure speculation. And that may be right. After all, many artists and celebrities appear to be getting a piece of the action. Now, both Takung Art and Hall of Fame Resort & Entertainment may not be leaders in NFTs today. But their current businesses could put them in a good position to grow into the blockchain space. Or at least, that is how the story goes. Now, as both companies continue to make strides as we start the week, which one is a better buy right now?

Read More

-

4 Top Tech Stocks To Watch Before April 2021

-

Nio (NIO) VS Xpeng (XPEV): Which Of These Electric Vehicle Stocks Is A Better Buy?

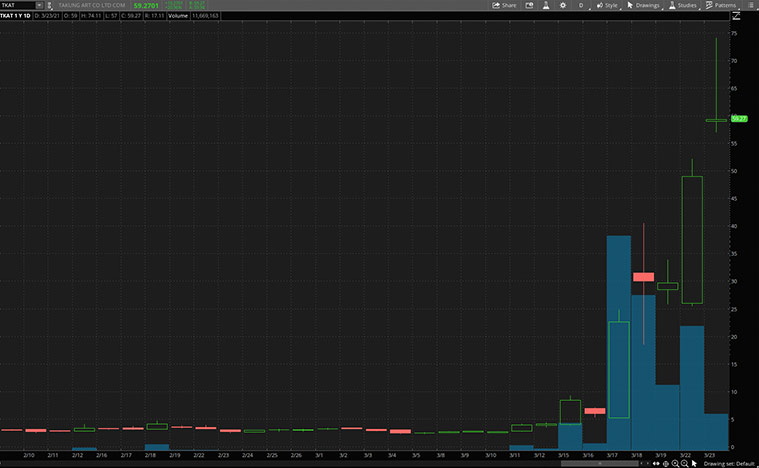

Takung Art Co. (TKAT)

Investors love Takung Art because of the company’s innovative business model. For those unfamiliar, Takung has created a marketplace for shared ownership in Asian fine art. That has made ownership of art accessible to more people. But more importantly, the company’s art business has been receiving an overwhelming response as of late due to its possible NFTs play in this trendy industry.

As you may or may not know, a digital piece of art was recently sold on the platform for $69 million. Yes, you heard that right. One digital piece of art just sold for a life-changing sum of money. That could help explain its explosive moves in the stock market. It also caught many investors by surprise that TKAT stock was only a penny stock earlier this year.

The company’s portfolio of Asia-specific art is good for its buyers. Why? That’s simply because the Chinese art industry is one of the most rapidly growing fine art industries in the world. With almost anybody able to bid on fine art, there’s a high chance that this concept could have massive interests among investors.

Why TKAT Stock Is An Interesting Speculative Play

The Takung portfolio is widely varied. From paintings, calligraphy, jewelry to precious stones, these are hot items that have constantly been in big auction houses. The momentum we saw this week is suggesting that a near-term breakout in stock price is not something impossible.

While investors are going after stocks tied to NFTs, the speculation is that Takung will launch an NFT platform. Nothing is set in stone for the future of TKAT stock. Investors have to keep in mind that there’s a risk that the company won’t officially move into the NFT space. Of course, if investors are willing to pay for these non-fungible tokens, it means they are worth something. And should Takung make an official announcement that they are diving right into the space, investors could be in for a good ride.

[Read More]

Top Cryptocurrencies To Buy Now? 4 To Watch This Week

Hall of Fame Resort & Entertainment (HOFV)

Similar to Takung Art, Hall of Fame Resort & Entertainment (HOFV) stock skyrocketed again on Monday as it continues to ride on last week’s momentum.

For those unfamiliar, HOFV stock went public in the summer of 2020 via a special purpose acquisition company (SPAC) merger with the goal of creating a Hall of Fame destination for NFL fans. It intends to build a sprawling entertainment complex around the Pro Football Hall of Fame in Ohio. Some refer to it as “

Disneyland for football fans

”.

The company’s stock price soared amid a backdrop of a weak broader market due to rising bond yields. That’s because rumor has it that HOFV could soon make a move into NFTs. Some social media sites speculated that HOFV could be managing this program for the NFL. If that is the case, it could be rewarding indeed.

NFL-themed NFTs Are Getting Investors All Excited About HOFV Stock

The company reported on March 17 that the National Football League (NFL) is working on a strategy to enter the NFT market. According to the Sports Business Journal by Ben Fischer, the league currently is engaged in ‘active discussions with potential partners to devise a strategy for digital collectibles. To add more flavor to the discussion, the NFL is also looking into blockchain technology for ticketing purposes.

With all the buzz going around cryptocurrencies, it is not surprising that many investors are speculating that the company could be the NFL’s choice in their NFT search. Should the company proceed with its intention of jumping into the NFT space, and if the NFL does choose HOFV to head up its NFT initiative, it could be a massive opportunity for the company and HOFV stockholders.

[Read More]

Making A List Of The Best Software Stocks To Buy? 4 To Consider

Bottom Line On NFT Stocks

As of today, there’s no guarantee that either company could successfully incorporate the NFT element in their operation. But the potential is certainly there. Investors also have to note that NFTs are still in their infancy. They will likely be very volatile moving forward.

With the recent run-up in TKAT stock price, it’s normal to be concerned about the company’s valuation. However, there’s no denying that fractionalizing fine art investment utilizing blockchain technology could be a massive breakthrough for the industry. Since fine arts often go up in value, incorporating NFT into its fine art business model could be a real game-changer for the company.

On the flip side, if you are into sports, you would appreciate the digital collectibles of your favorite sports team. And if HOFV could successfully strike a deal with the NFL, it would be a major boost for the company. Admittedly, the stories seem compelling with HOFV stock and TKAT stock. But investors have to note that there is a lot of speculation here. The NFT angle is by no means a sure thing. So if I were to choose one today, I would need to take a deep breath before making any decision.