Stock splits have gained popularity over the last several years. Generally, a company performs a stock split for a simple reason – the stock price has increased, becoming a barrier to entry for potential investors. In its simplest form, it’s a shareholder-friendly move.

A stock split doesn’t affect a company’s market capitalization, but it lowers the value of each individual share, providing ease for the stock price to multiply once again and provide investors with a multitude of gains. Additionally, volume increases with a lower share price, boosting overall share movement.

In an effort to boost stock liquidity, gaming giant Nintendo

NTDOY

announced today a 10-for-1 stock split; the split will take effect later this year, on October 1

st

. The move is very similar to recent announcements we’ve received with Amazon

AMZN

and Alphabet

GOOGL

. Both AMZN and GOOGL announced earlier this year that they would be performing a 20-for-1 split.

It’s an inspiring announcement that investors can celebrate over. After all, it is way easier to fork up the cash for shares at a fraction of their previous value.

Short-Term Share Price Impact

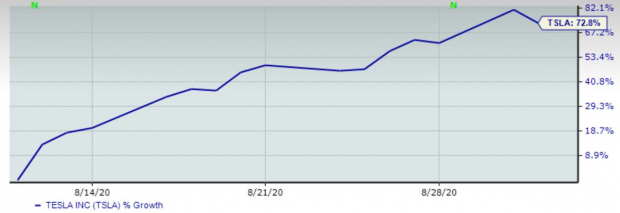

Quite possibly, the most famous example of a stock split is the all-mighty Tesla

TSLA

. Following its 5-for-1 split in August 2020, TSLA shares skyrocketed thanks to an influx of new buyers. Just look at the chart below; it illustrates the performance of shares following the split announcement on August 11

th

to September 1

st

in 2020. A high price tag on TSLA shares undoubtedly was the reason behind the split, and it handsomely paid off for the EV giant.

Tesla Share Performance 8/11/2020 – 9/1/2020

Image Source: Zacks Investment Research

The same type of bullish price action happened within AMZN and GOOGL shares following the announcements of their stock splits. On March 9

th

, when the news first broke that AMZN would be splitting, shares jumped nearly 6% the next day. AMZN’s announcement came as a bit of a surprise as it hasn’t split since 1999, but the steep share price inevitably foretold what was to come.

In Alphabet’s quarterly earnings in February, the company announced the split; shares surged 7.5% the following day. Similar to TSLA, shares of AMZN and GOOGL soared to great heights over the last several years, and the companies decided to combat the high barrier of entry issue via stock splits, opening the floodgates for buyers and a rush of volume.

Today, NTDOY shares were up as much as 7% before falling victim to the broader market’s sell-off intraday. The day isn’t over yet, although the market conditions are again looking unfavorable, potentially pushing the share price down a little more and spoiling the fun spurred by the announcement.

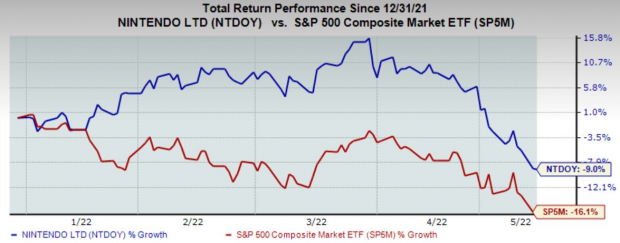

Nintendo Share Performance

With the S&P 500 declining 16% year-to-date, it’s no secret that 2022 has been rough sailing in the market. However, Nintendo shares have been a bright spot, providing a valuable blend of defense with shares declining 9% and easily outperforming the general market.

Image Source: Zacks Investment Research

The picture vividly changes when stretching out the timeframe over the last year. NTDOY shares took on a steep downtrend at the beginning of July 2021 and have drastically underperformed the general market. There was a slight sustained uptrend from November 2021 to March 2022, but that has since been broken. The stock split can breathe new life into shares, and the recent relative strength bodes well.

Image Source: Zacks Investment Research

Latest Earnings Release

The company reported quarterly results earlier this morning. The release revealed that the microchip shortage and supply-chain bottlenecks had played spoilsport for its flagship console, the Nintendo Switch. Sales for all three switch models declined 20% year-over-year.

In addition to this, the company noted that the pandemic-induced surge in gaming has significantly cooled off, further affecting sales. The company also pointed out that the highly successful release of

Animal Crossing: New Horizons

was a significant driver of hardware sales last fiscal year.

The success of

Animal Crossing: New Horizons

is vital to note, in my opinion, because NTDOY has a solid lineup of fan-favorite titles slated to release this year, such as new installments in the ever-beloved

Pokémon

series and a new

Switch Sports

videogame. The release of these highly sought-after games can potentially provide NTDOY with the same success it had last fiscal year. Additionally, annual software sales were the highest ever, increasing 1.8% year-over-year to 235 million units.

Bottom Line

Nintendo

NTDOY

is an excellent company that provides solid exposure to the rapidly growing gaming industry. In addition to videogames, the company can also produce diverse revenue streams via content merchandise in the physical world.

A chip shortage and a slowdown of the gaming boom negatively affected its latest quarterly results. However, analysts forecast the chip shortage to subside in late 2022 and continue unwinding into 2023.

The company’s flagship console, the Nintendo Switch, is increasingly becoming old relative to the next-gen Xbox Series S|X deployed by Microsoft

MSFT

and Sony’s

SONY

PS5. However, this development became much more interesting whenever Nintendo hinted earlier this year of a Nintendo Switch successor potentially coming sooner than later, but many believe this is still a few years off. Nonetheless, this is a major bullish catalyst moving forward.

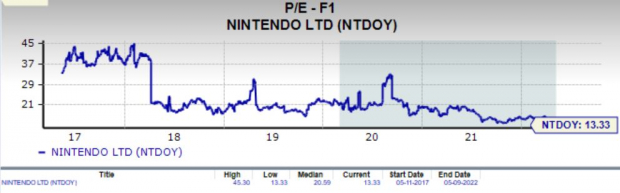

In addition to a subsiding chip shortage, a shareholder-friendly stock split, and rumors of a next-gen console, its current forward earnings multiple is sitting beautifully at 13.3X, a fraction of its 2018 45.3X high and well below its median of 20.6X over the last five years. Additionally, the value represents a 25% discount relative to the S&P 500’s forward P/E ratio of 17.9X. These are all reasons I believe NTDOY shares will find prosperity moving forward.

Image Source: Zacks Investment Research

Furthermore, the company boasts a Zacks Rank #2 (Buy) and sports a Growth Style Score of an A, which further instills a great deal of confidence in the stock moving forward. The future looks bright for this gaming giant.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report