Are you looking for an online broker that offers low fees and portfolio-building options? If so, Capital One Investing is a full-service broker that offers investors simplicity and ease, with no account balance minimums and inactivity fees as well as a commissions rate of $6.95.

Generally speaking, most beginner investors are drawn to Capital One Investing because of their self and adviser guided plans, their low costs for persisting investments, the potential to gather partial shares and their free reinvestment program. That said, frequent and advanced traders tend to be thrown off by Capital One Investings lack of a trading platform and comprehensiveness.

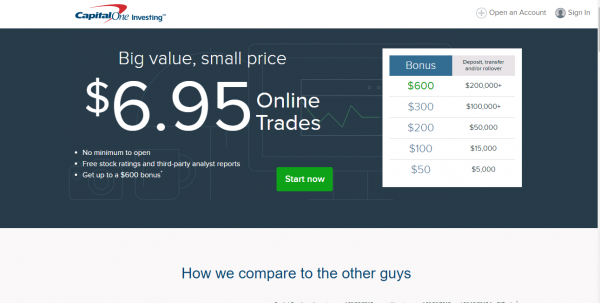

Capital One: Did You Know?

- The commission rate is $6.95

- The account minimum balance is $0

- Promotion: Depending on the balance, an individual can receive up to $600 for new accounts.

When Is The Right Time To Use Capital One Investing?

- Capital One Investing is best if you’re a Capital One banking customer, a beginner investor, or an investor who is looking to build their portfolio and automatic investing options.

Areas in Which Capital One Investing Excels

Automatic investing: If you are a beginner investor, Capital One offers a ShareBuilder Plan which helps to make the process of putting money aside for investing that much easier. Choosing from more than 7,000 stocks and ETF’s, investors are able to schedule investments on a weekly, biweekly, or monthly basis. These investments can be of any amount. When deciding how much money you should put aside, keep in mind that with each order processed, there will be a fee of $3.95. That said, you can turn the plan off at any time.

Building your portfolio: Not everyone wants to invest in a portfolio of exchange-traded funds, therefore Capital One Investings portfolio building tool simplifies this process. With this tool, an individual can select their investing style, the amount that they plan to invest based on a regular schedule and a fund family. As Capital One Investing builds a portfolio of up to six to eight ETFs, customers can expect to be charged a $18.95 flat fee for each processed order. If you are a part of the automatic investing plan, you have the opportunity to buy partial shares. This is because you are investing a dollar amount rather than buying a set number of shares.

Low fees and no minimum deposit on brokerage accounts

Mentioned previously, Capital One Investing is best suited for beginner investors as they require a no minimum deposit on an account. If you are looking for a cheaper commission rate, try checking out a discount broker like TradeKing and OptionsHouse. That said if you want a full-service broker, most of the commission rates with being on par with Capital One’s rate of $6.95.

Additionally, Capital One offers low fees in comparison to other online brokers. They will not charge inactivity fees, they only charge a rate of $19.95 for broker-assisted trades, and they offer more than 450 no-transaction-fee mutual funds.

Research archives and tools: Despite not having a trading platform, Capital One offers an array of tools. For instance, an individual is able to use Capital One’s investment screener to sort through ETFs, stocks and mutual funds. The investment screener will sort it out based on predetermined criteria, such as fund strategy and 90-day average volume. If you are looking to analyze and compare funds, you have the option to use Morningstar ratings. Capital One Investing also offers a “What-If” tool which shows you how much a stock would be worth if you had invested a certain amount. Additionally, the Capital One Investing site offers customers tracking alerts, watchlists and tools that pinpoint performance across different investments.

Disadvantages of Capital One Investing

There isn’t a trading platform: Frequent and advanced traders will be disappointed by this. Due to Capital One Investing not having a desktop or web-based trading platform, customers have to make trades via the Capital One Investing website. That said, this isn’t all bad as the website is fairly organized, easy to navigate, and has a corresponding mobile app that you can use. If you are a beginner investor, chances are you won’t be affected by the lack of a trading platform.

Doesn’t offer commission-free ETFs: Capital One Investing can give its customers access to ETFs at a lower commission cost, but they will not offer any commission-free exchange traded funds.

Investment selection is limited: Since Capital One Investing has less than 500 no-transaction-fee mutual funds, clients can only trade stocks, mutual funds, exchange-traded funds, and options. Unfortunately, you will not be able to trade forex, futures, or individual bonds.

What It Comes Down To

As Capital One Investing is tailored to beginner investors, they have removed any barriers a beginner might find intimidating. They now offer a no account balance minimum and low commissions rates ($6.95).

Capital One Investing offers a variety of tools that help new investors build a foundation of knowledge as well as tools which encourage a regular investing routine. If you are an existing Capital One banking customer, these tools are much more accessible to you and you have the ease of handling all of your accounts under the same roof.

Just keep in mind that advanced and frequent traders will be turned off by the following: lack of selection, no trading platform, and commission-free offerings.

Featured Image: thestreet.com