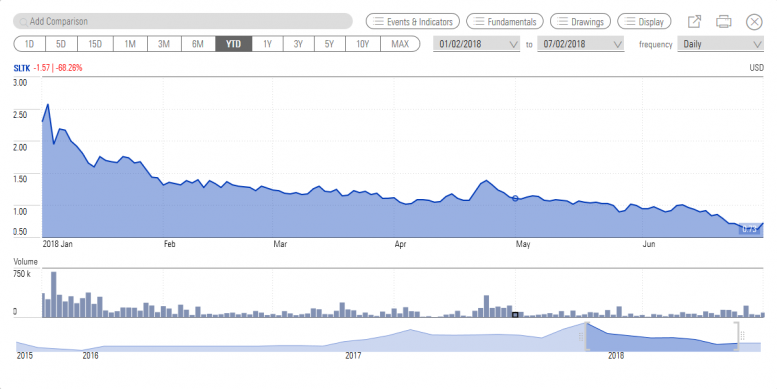

Solis Tek Inc. (OTCQB:SLTK) is one of the biggest laggard in cannabis industry this year. Its shares lost almost 70% of value since the start of the year, primarily due to lower-than-expected financial performance in the first quarter.

Its share price currently trades around $0.73, down sharply from the all-time high of $2.64 a share that it had hit at the beginning of this year. Solis Tek has a 52-week trading range of $0.57 to $2.64 a share – with the market cap of $31 million.

Solis Tek Inc. generated a negative revenue growth of 65% year over year in the first quarter. The company says its volatile business environment, lower prices, and self-rebranding were responsible for the huge drop in its revenues. The cannabis company also reported negative earnings in the first quarter.

Solis Tek Future Prospects are Improving

Soils Tek future fundamentals are strengthening despite its sluggish performance in the first quarter. The company has been working on several projects that would significantly boost its production potential in the days to come. Soil Tek is planning 50,000 square feet of cannabis cultivation and a 10,000 square feet processing facility in Arizona.

>> AZZ Shares Climb After Topping Analysts’ Expectations

The construction of the processing facility in Arizona is likely to begin in the final quarter this year – which could bring almost $500,000 in revenue per month. The company, however, believes they can generate nearly $1 million in revenues from its Arizona facility over the long-term.

Solis Tek Chief Executive Officer Alan Lien commented, “We look forward to a multi-prong strategy in increasing our business and creating long-term value through varying segments of the legalized cannabis industry in Canada and the United States.”

Solis Tek Inc.’s cash position is strong enough to support the expansion activities. The company ended the first quarter with $1.2 million in cash, and it has recently received $2.5 million from its partner to support its advancement in Arizona.

Featured Image: Depositphotos/© photographee.eu