TotalEnergies SE

’s

TTE

productive oil and gas assets across the globe, focus on developing clean energy assets, systematic investments to strengthen operations and presence across the LNG chain are contributing to its strong performance.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Growth Projections

The Zacks Consensus Estimate for 2021 earnings per share is pegged at $5.32, suggesting an increase of 272.03% from the year-ago reported figure. The bottom-line estimates have moved up 16.9% in the past 60 days.

The consensus mark for 2022 earnings is pegged at $5.65 per share, suggesting a 6.3% year-over-year increase. The bottom-line estimates have moved up 12.3% in the past 60 days.

Surprise History, Dividend Yield and Earnings Growth

TotalEnergies’ trailing four-quarter earnings surprise is 75.4%, on average.

Its dividend yield is currently pegged at 5.1%, which is much better than the S&P 500 group’s average of 1.39%.

Long-term (three to five years) earnings growth of the company is projected at 19.67%.

Regular Investments & Emission Reduction

After investing nearly $13 billion in 2020, it is planning a net investment of $12-$13 billion for 2021. Half of the planned expenditure is for growth purpose and the other half is to maintain TotalEnergies’ ongoing activities. Net investment in the first half of 2021 was nearly $7.2 billion. Steady capital investment is allowing the company to develop and start production from different regions across the globe.

TotalEnergies is also investing in technologies that cut emissions and strives to be a net-zero carbon emission company by 2050. TotalEnergies has renewable energy projects under construction and in development of 35 GW by 2025, with more than 20 GW already having long-term power purchase agreements. The company is gradually building a portfolio of low-carbon businesses that could account for 15-20% of sales by 2040.

Return on Equity (ROE)

ROE is a measure of a company’s financial performance and shows how it is utilizing its funds. TotalEnergies’ ROE is currently pegged at 7.97%, better than the industry average of 3.04%, which indicates that the company is utilizing its funds more efficiently than peers.

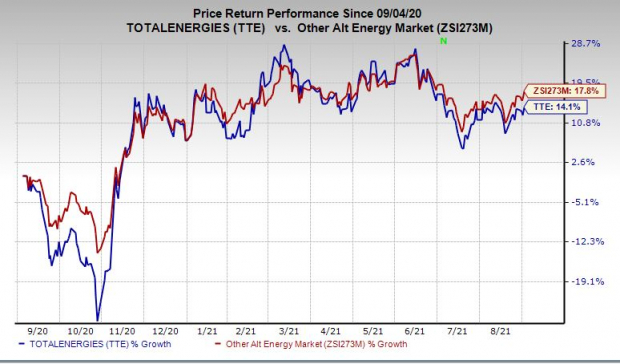

Price Performance

Over the past 12 months, the stock has returned lower than the

industry

.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include

BP Plc.

BP

,

Cabol Oil & Gas Corporation

COG

, and

Chesapeake Energy Corporation

CHK

, each currently sporting a Zacks Rank #1.

BP, Cabol Oil & Gas, and Chesapeake Energy delivered an average earnings surprise of 43.4%, 15.9% and 13.3%, respectively, in the last four quarters.

The Zacks Consensus Estimate for 2021 earnings per share of BP, Cabol Oil & Gas, and Chesapeake Energy has moved up 28.4%, 20.9% and 26.4%, respectively, in the past 60 days.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report